Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 27, 2022

By Cecillia Zheng and Choon Gek Khoo

IHS Markit (now a part of S&P Global Energy) published the Southeast Asia (SEA) power and renewable market briefing for the second quarter of 2022 (Q2-2022). The report discussed the power demand, supply, pricing, and major market events in the quarter, as well as the latest proposed or enacted policies and regulations. The report is now accessible to customers via our Connect platform.

Power demand recovery momentum continues in the second quarter of 2022, with most SEA countries' power demand surpassing the pre-pandemic levels (2019). However, the region is facing headwinds from global fuel price hikes.

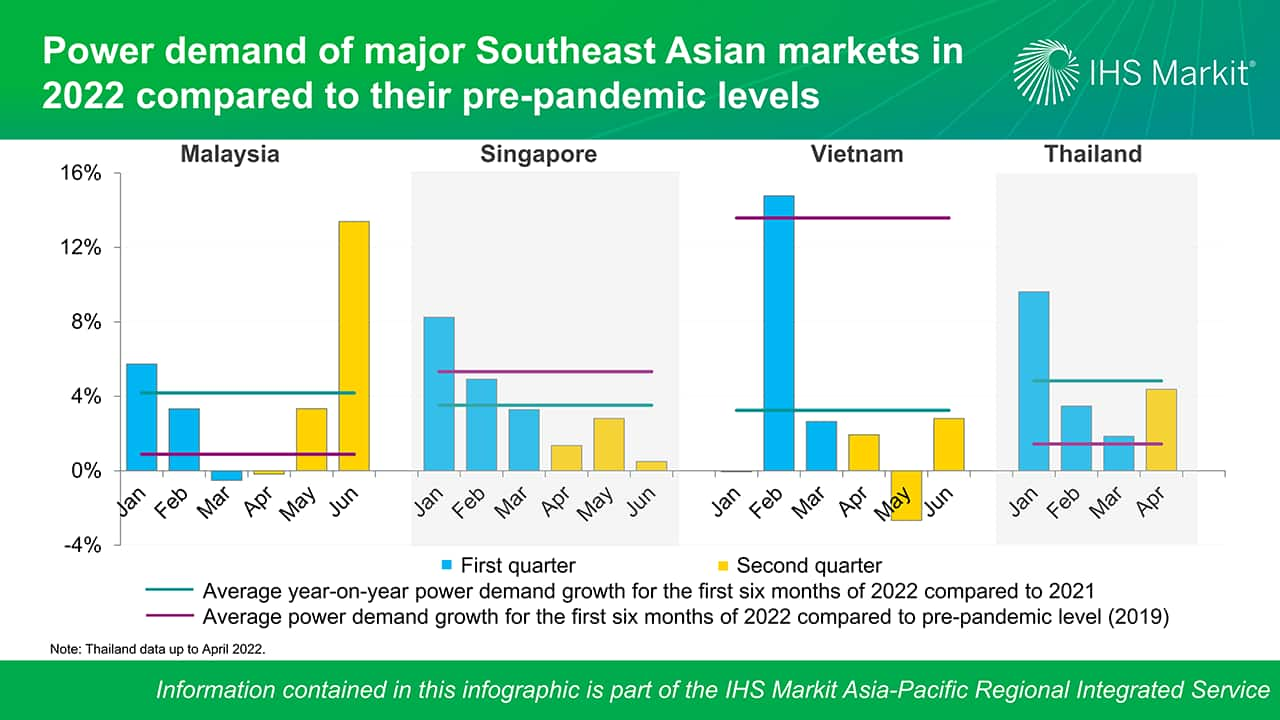

According to published power market statistics, power demand growth in Vietnam, Singapore, and Thailand slowed down significantly in Q2 compared to the previous quarter. The figure below illustrates the power demand growth rates in 2022 versus 2021, which range from -2.7% y/y to 13.4% y/y for Q2. Furthermore, regional power prices remained high in this quarter due to persistently high fuel prices.

Malaysia has experienced the most significant monthly demand growth (up to 14% y/y by June 2022), with average 2021-22 power demand in Q2 increasing by 5.5 % y/y, compared to 2.8% y/y in Q1. Because of the reopening of economic activities and international borders for tourism, market recovery performance remained consistent with the previous quarter. However, Malaysia has the lowest recovery rate relative to its pre-pandemic level across all markets (when comparing performance in the first six months of 2022 and 2019 (H1-2022/2019)). With a 0.9% surplus in power demand for H1-2022/2019, the country's power demand recovery prospects remained uncertain.

Singapore is still on track for positive power demand growth in Q2, albeit at a slower pace. Monthly demand growth in 2022 slowed compared to 2021, averaging 1.6% y/y in Q2 versus 5.5% y/y in Q1. This is because the high commodities prices, including power prices, resulting from high inflation, have caused a slowdown in power consumption. Nonetheless, the average power demand in H1-2022/2019 exceeded the pre-pandemic level (2019) by 5.3%. This was supported by the lower severity of the pandemic and high vaccination rates, allowing economies to be more open than in previous waves of COVID-19.

Vietnam led the monthly power demand contracts in Q2-2022, with a contraction as low as 2.7% y/y in May 2022, resulting in a downward trend of average growth of 0.7% y/y in Q2 compared to 5.8% y/y in Q1. The power demand fluctuated in Q2 due to external economic shocks that slowed export-driven economic recovery. Despite poor monthly demand performance in Q2, the overall power demand in H1-2022/2019 surpassed the pre-pandemic level (2019) by a whopping 13.6% across all markets. The remarkable growth in power demand is being driven by the country's strong economic growth, and Vietnam was deemed to be the top-performing Asian economy in 2020—without a single quarter of economic contraction.

Power demand in Thailand increased by 4.4% y/y in April, with a slight decrease from the average of 5.0% y/y in Q1. Power demand is gradually recovering as a result of the recovery of business activities and the opening of international borders for tourism activity from January 2022. Thailand's demand from January to April 2022 has been suppressed by the high cost of imported fuels, but still surpassed the pre-pandemic level (2019) with a slight growth of 1.4%.

Overall, the region's power demand growth has moderated in Q2. Although uncertainties lay ahead, the regional power demand growth will be boosted by a robust economic recovery.

The major power utilities in SEA countries announced electricity tariff hikes in this quarter after more than two years of price hike moratoriums to battle against the COVID-19 pandemic.

The unprecedented rise in global energy prices is putting pressure on governments' budgets for power subsidies. Power generation becomes more costly as high fuel costs in the midst of a global energy crunch have been exacerbated by the prolonged Russia-Ukraine conflict, and countries with limited domestic gas supply, such as the Philippines and Thailand, had to increase the use of expensive imported fuels for power generation. These factors, combined, posed an upward pressure on electricity tariff adjustments to bolster the state-owned utilities.

Learn more about Asia Pacific energy research.

Choon Gek Khoo is a research analyst with the Gas, Power, and Climate Solutions team at S&P Global Energy.

Cecillia Zheng is an associate director on the Gas, Power, and Climate Solutions and leads Southeast Asian power market research and consulting at S&P Global Energy.

Posted on 27 July 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.