Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 14, 2024

By Jessica Jin

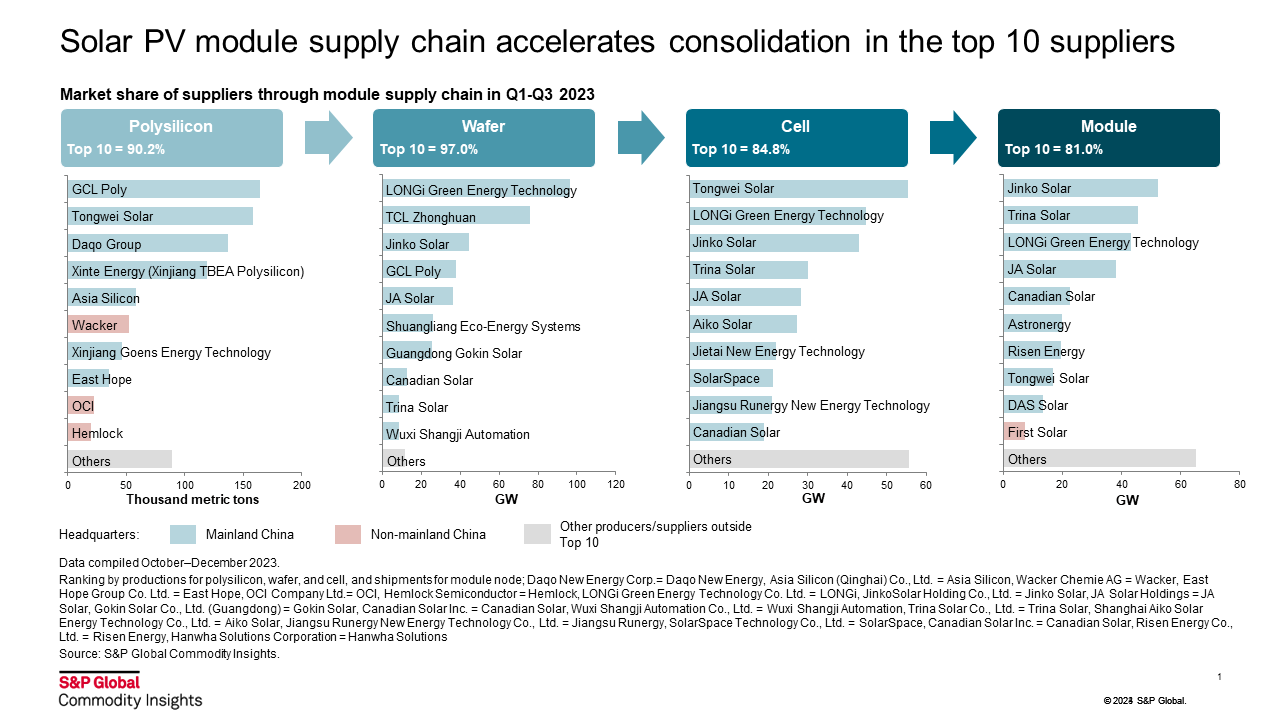

The market share of top 10 companies through the module supply chain achieved over 80% in the first three quarters of 2023. Only four companies included in the top 10 rankings are headquartered outside mainland China, showing the dominance of mainland China companies over the module supply chain.

Polysilicon. The top four polysilicon producers are Chinese and had a combined market share of 64% in the first three quarters of 2023. The Uyghur Forced Labor Prevention Act (UFLPA) regulation in the United States, allowed non-Chinese polysilicon producers with higher production cost to be competitive and consolidate market share in the United States. Polysilicon price is forecast to drop below tier-2's cost, most-likely resulting in idled capacity, cancelation of manufacturing plans from new entrants, and increasing production concentration in leading companies. However, no shortage is expected: tier 1 producers' total capacity will be enough to supply global demand in the next four years (even for the upside potential scenario).

Wafers. LONGi Green Energy Technology Co. Ltd and TCL Zhonghuan Renewable Energy Technology Co., Ltd continued dominating global wafer production with a combined market share of 45% in the first three quarters of 2023. A significant development in the wafer market has been the emergence of rectangular wafers. This is still an emerging technology, but it seems to be equally adopted by the two leaders and applied to both M10 and G12 wafer producers due to its higher efficiency but lower weight.

Cells. Half of the top 10 cell producers were vertically integrated companies and the other half pure cell manufacturers selling to the merchant market. In 2023, leading vertical integrated manufacturers increased wafer and cell capacities to align with their larger module capacities for better cost control of manufacturing costs during the cell technology transition period from P-type to N-type technologies. TOPCon will become the mainstream technology leader among N-type technologies for the next 4-5 years. PERC retirement will start from 2024 and accelerate from 2025.

Modules. Module manufacturing has the lowest barriers to entry and still has the largest number of active manufacturers in the market. Yet, the top four module suppliers managed to maintain a combined market share of over 50% in the first three quarters of 2023. The rest of the top 10 suppliers faced fierce competition and encountered strong challenge from tier 2 suppliers. The leading polysilicon and cell producer, Tongwei, expanded its business to module the node and entered the top 10 module suppliers in 2023 with significant commercial success in China mainland market.

Learn more about our top 10 cleantech trends for 2024.

Jessica Jin is a principal research analyst within the Clean Energy Technology research team at S&P Global Energy, specifically responsible for the company's research of the global PV module supply chain, including polysilicon and wafer, cell and module, market supply and demand analysis, and technology development. She also covers downstream research for Taiwan's PV market.

Posted on 13 February 2024

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.