Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 14, 2023

By Weixiao Qin

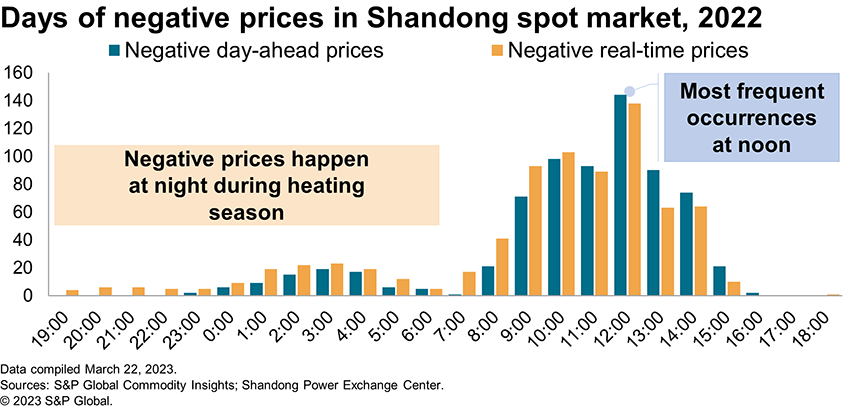

As one of the first eight pilots to trial spot power trading in China, Shandong is no stranger to negative prices with the first instance in December 2019 during the heating season. More frequent occurrences were observed in the continuous trial operations since December 2021. With high renewables penetration in Shandong, the most frequent occurrences were from 12 p.m. to 1 p.m. where nearly 40% of days in 2022 reported negative prices. However, nighttime was not spared as well—negative prices occasionally happened at night during the heating season.

Shandong has the country's largest CHP capacity to serve its strong demand for industrial heating, and residential and commercial building heating. About 60% of the province's power demand in 2022 was met by coal-fired CHP.

In Shandong's spot market, must-run quantities of a CHP are determined by its scheduled heat output level, which is particularly high in the winter. During market clearing, such sizeable must-run quantities are guaranteed dispatch and led to occasional negative prices in winter nights when solar is at rest. Even at midday when solar is the most abundant, CHP output is estimated to be more than double of the solar PV generation, making it the top reason behind the frequent negative spot prices in Shandong.

Not only CHP fleets, but Shandong also has the largest solar PV capacity among provinces in China. With 42.7 GW of solar PV and 23 GW of wind power installed by the end of 2022, renewables served about 12% of the province's power demand in 2022 and will continue to expand robustly.

A majority 70% of Shandong's solar PV capacity are distributed PV which does not participate in power market trading but has rather significant influence on spot prices indirectly—its offsetting effect on system demand has created a "duck curve"[1]. On the other hand, utility-scale PV that has contracted in mid- to long-term market in Shandong is required to offer in spot market with 10% of its estimated output taking part in price setting.

Nonetheless, compared to CHP's must-run, robust growth of Shandong's solar PV only makes it an increasingly important compounding factor in daytime spot market clearing.

S&P Global Energy expect less than 5% of Shandong's wholesale power trading being settled at spot prices. Furthermore, in the retail power market, contracts between power users and retailers are typically priced at a negotiated fixed rate. As such, negative spot prices only impact limited volume of power trading.

However, frequent occurrences of negative spot prices give an illusion of over-supplied power system and raise concerns about investment risks and returns. To mitigate the long-term risks, retrofitting of CHPs and deployment of energy storage systems (ESSs) will become increasingly important in Shandong's power system. Decoupling of CHP's heat and power generation could unleash more flexible power to support system peak shaving, while ESS evens out the intermittency of renewables generation.

Learn more about our Asia-Pacific energy research.

Weixiao Qin, a senior research analyst in Greater China power and renewables research for the Gas, Power, and Climate Solutions team, primarily focuses on the China power and renewable market analysis, including power market reforms, power prices and renewable power policies.

Posted on 14 June 2023

-------------------

[1] Note: System demand refers to total power demand less demand served by captive generation, including distributed solar PV output, that is not subject to central dispatch of system operators; "duck curve" refers to the shape of the load profile in power systems where abundant renewable generation during the day results in a high peak load in mid- to late evening. The term was coined by the California Independent System Operator in 2012 to describe the resemblance of its load curve to a duck.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.