Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 12, 2023

By Parag Goyal

With the start-up of the Dhirubhai 55 (D 55) MJ field in the KG-DWN-98/3 asset located in the Krishna-Godavari Basin (KG), the Reliance-bp joint venture (JV) achieved a significant milestone in securing the energy supplies for India. The field started commercial production on 30 June 2023. In a press release, Reliance stated that the field would peak at around 424 million standard cubic feet per day (MMcf/d) of gas and 25,000 barrels per day (bbl/d) of condensate from eight wells. Previously, the JV started production from the R-series and the Satellite cluster projects in 2020 and 2021, respectively; the current gas production from these two projects is around 670 MMcf/d. The JV plans to achieve 1 billion cubic feet per day (Bcf/d) of gas production from these three projects.

The development of the D 55 field does not come without challenges. The field is producing from the Lower Cretaceous reservoir, similar to ONGC's Deen Dayal field, located 20 km north of D55, where the target peak production dropped significantly due to the reservoir's complexity. Also, the operator will be cautious as it will try to avoid the difficulties it had to face in producing from the Dhirubhai 1 & 3 (D 1 & 3) field. The D 1 & 3 fields suffered a sharp decline two years from the first oil in 2009. Likewise, the high pressure-high temperature (HP HT) condition of the D 55 reservoir may also impose a challenge.

Another project, Cluster 2 development of ONGC's KG-DWN-98/2 asset, located adjacent to KG-DWN-98/3, is producing around 60 MMcf/d of gas and is expected to ramp up gas production to 270 MMcf/d by 2024. Success in these fields will likely open opportunities and encourage further exploration in the KG basin.

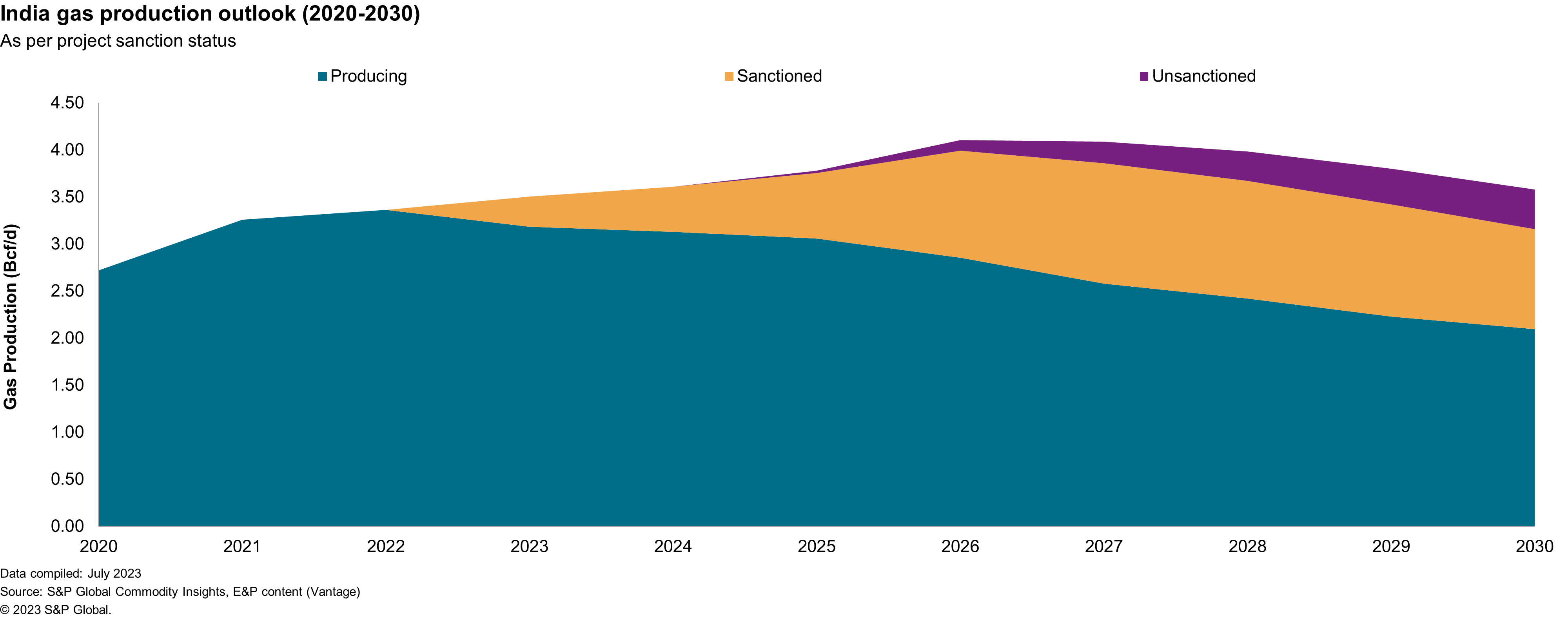

Other sanctioned project, such as ONGC's Daman Upside Development in the Bombay basin, could also help India in becoming a gas-based economy. The increased gas production from these fields will reduce India's gas imports in the short term; from 42% in 2023 to 40% in 2025. However, the long-term uncertainty remains.

Investment in exploration is required to reduce this uncertainty. The Reliance-bp JV has plans to drill one exploration well in its KG-UDWHP-2018/1 block, adjacent to the already producing R-series field. It has also submitted a bid for the KG-UDWHP-2022/1 block on offer under OALP 8 bid round. To help stimulate investment in the Indian E&P sector, the Indian Government has made various enhancements in policies to help ramp up domestic production. The 2016 ceiling gas price policy for deepwater/difficult fields is one of them. In the recent e-auction, the gas from the D 55 field was sold at a price linked to the Japan Korea Marker (JKM) price marker subject to the cap as per the 2016 ceiling price policy. The 2023 amendments to the domestic administrative gas pricing formula will cater to increasing production from old mature fields of ONGC and Oil India. The government also has a view to giving complete pricing freedom to deepwater/HP HT fields in the near future.

Learn more about S&P Global Energy, Vantage

Parag Goyal is Senior Research Analyst at S&P Global Energy, covering Indian Sub Continent upstream markets and focused on market intelligence, supply outlook and commercial analysis.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.