Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Nov 08, 2023

This update provides a brief overview of selected reports in the Global Power and Renewables service. Learn more about our Global Power and Renewables Service and the reports featured in this post.

There has been net growth recently in the global move toward renewables, but this has not come without hurdles. Corporate renewable contracts and clean energy certificates have demonstrated considerable uptake. At the same time, some regions have increased their reliance on gas, at least for the short term, and power companies have divested out of some renewable assets.

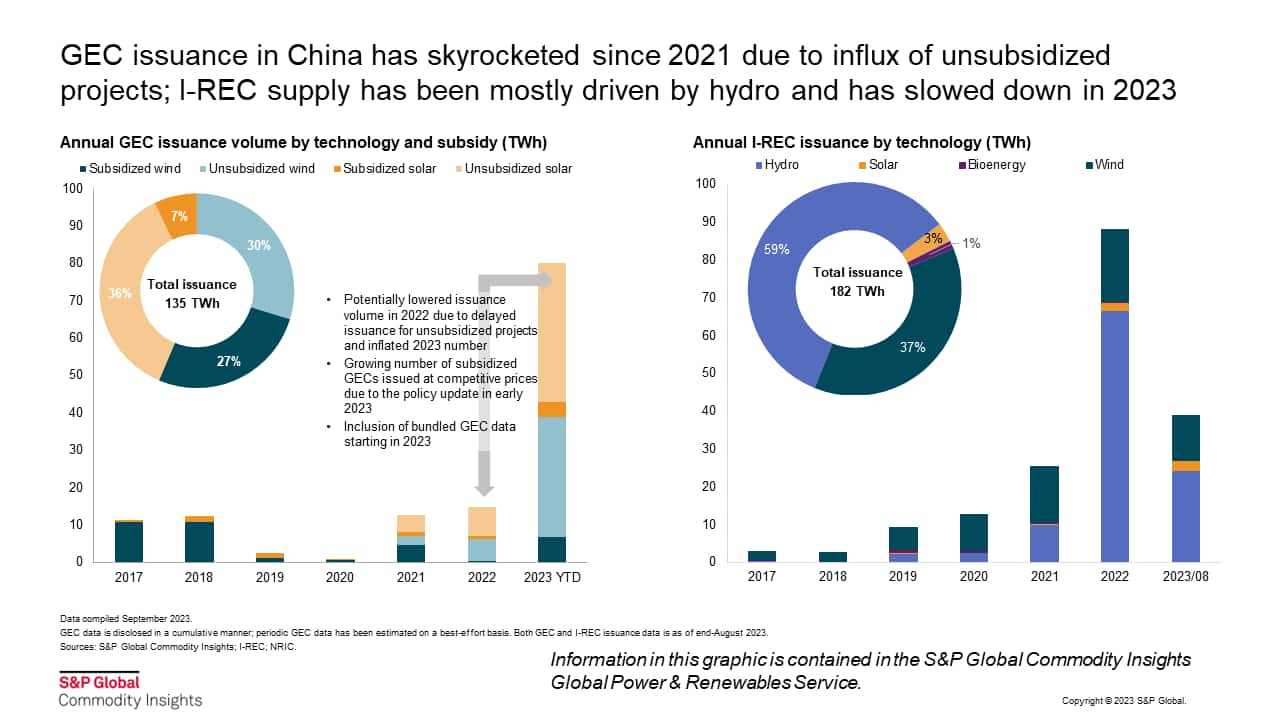

Corporate green attribute procurement has received a major boost, primarily due to policy changes. Mainland China has, since 2019, observed significant growth in trading of Green Energy Certificates (GECs) and International Renewable Energy Certificates (I-RECs). Annual demand for I-RECs grew from 2 TWh in 2019 to 22 TWh in the first half of 2023 — cumulatively, hydro accounted for 53% of total redemption, followed by 44% from wind. GECs have grown much faster than I-RECs in 2022-23. This comes on the back of a policy shift in mainland China, as explained by the S&P Global Energy research Evolving green electricity certificate and I-REC market in China: GEC supply will boom amid price uncertainties. (Customers can read the full report here.) As per the updated policy, the scope of GEC issuance has been expanded to cover all types of renewable energy projects in mainland China, and GECs are readily transitioning to become a tracking tool for domestic green power consumption. GEC supply is expected to grow exponentially upon the latest policy rollout. However, with the liberalization of the types of projects that may be included under the purview of GECs, demand may not be able to match the increased supply, leading to a fall in GEC prices.

Corporate green energy procurement has observed a marked uptrend. This comes on the back of voluntary sustainability targets, policy compliance requirements and improved cost competitiveness of renewables.

As per the Energy Asia Pacific renewable corporate power purchase agreement — Q2 2023, there was a 74% increase in renewable corporate power purchase agreements (CPPAs) in the second quarter of 2023 over the first quarter of 2023. Mainland China and India were the top markets in terms of contracted renewable capacity. Most of the growth came from increases in contracted capacity rather than an increase in the number of deals.

Similarly, the Energy PPA market grows in 2023 — Continued success: European PPA market experiences strong growth in H1 2023 shows that there have been 160 deals between January and August 2023, whereas there were 180 deals in all of 2022. Spain and the UK account for half of the power delivered under renewable power purchase agreements (PPAs) in Europe.

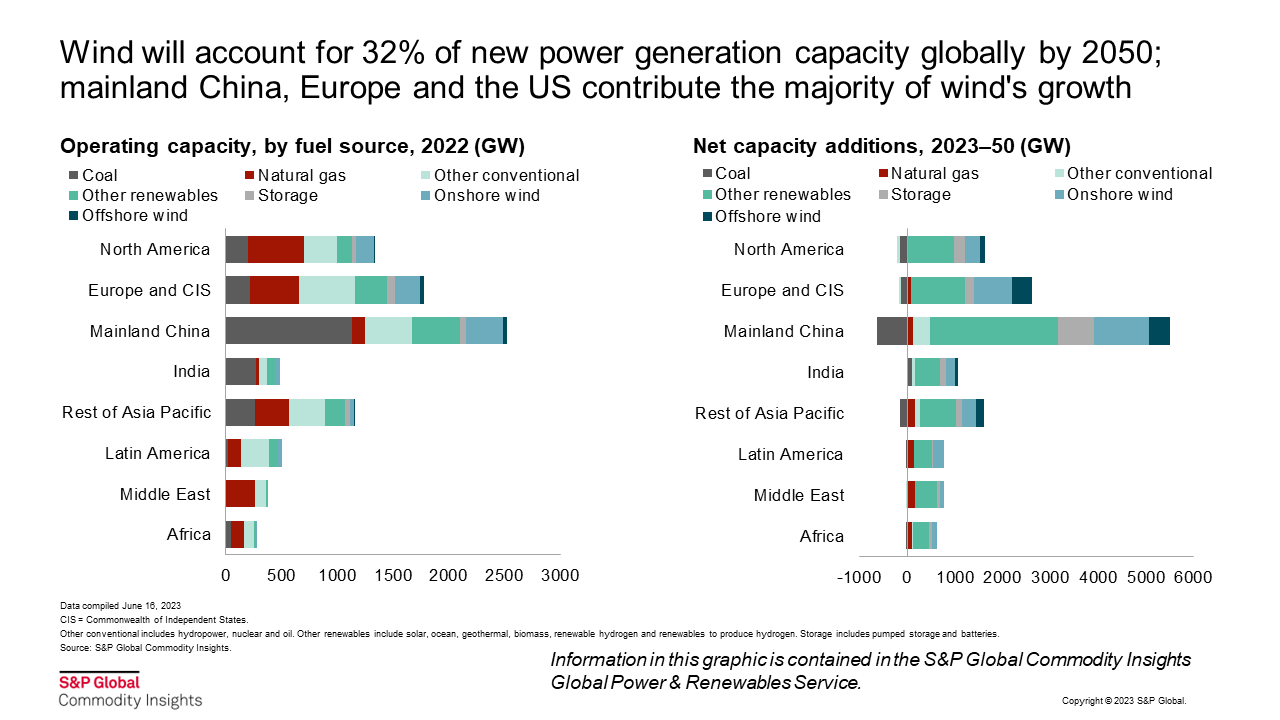

There was an upswing of global wind projects in 2022, when countries increased focus on diversification and transition toward renewables in the wake of the oil and gas supply crunch, worsened by the Russia-Ukraine conflict. Global onshore wind installed capacity is expected to grow 2.7 TW over 2023-50. Global installed capacity of offshore wind is expected to grow 1.2 TW from 2023 to 2050. As per the Energy Global Wind Market Outlook, wind will account for half of net incremental power generated to 2050, making it second to none, with offshore wind making up a sizable share of the pipeline capacity. Europe will be the leader in increasing the cost effectiveness of offshore wind. (Customers can read the full report here.)

While the above trends are a bright spot, European offshore wind project costs have not fallen in tandem with countries' expectations. The prices are expected to peak around 2025, and the technology is not likely to be a cheap source of renewable energy at least until 2030, according to the Energy Offshore wind in Europe: Harder than it looked. While the challenge of high costs persists, European offshore wind pipeline capacities will likely not be curtailed by more than 10% of their ambitious 2030 targets.

Offshore wind projects entail large investments and have a long gestation period. Considering this, further cost increases in the development of offshore wind plants in other regions can pose a challenge to achieving targets.

There has been an interim resurgence of gas across some geographies. This may be attributed to increased temperatures and increased power demand owing to El Niño and coal shortages.

The Energy South Korea's power sector used more gas during a hot August explains that gas-fired power generation has increased to meet the additional demand and should average close to 20 average GW (aGW), which is a year-on-year increase of 2 aGW. The higher-than-normal power demand has largely been met with an increase in gas-fired power generation, while coal-fired power generation is unchanged year on year.

As explained in the Energy article India's power sector could see higher use of gas in Q4 2023 coal shortages on account of higher power demand in the preceding months, relatively low hydro power generation and a potential coal union strike led to higher gas use in the country. There has been a fresh tender for 4 aGW of electricity from gas-fired power plants to meet high power demand between Sept. 30 and Nov. 30.

According to the Energy article Is space heat electrification taking off in the US?, since 2019, annual shipments of air-source heat pumps in the US have risen 40%, from 3.1 million units per year to 4.3 million units per year. However, the rise in heat pump adoption has not yet coincided with a noticeable fall in fossil-based space heating. In the past 15 years, the number of housing units relying on any fossil-based heating has changed little, even though the types of fuel may have changed (from more expensive fuel gas and propane to less expensive natural gas).

Italy exhibits the peculiarity wherein its renewables' share of demand is still the lowest in the EU5 (France, Germany, Great Britain, Italy and Spain). According to Slow pace of renewables growth in Italy expected to maintain power price premium, low renewables deployment has kept Italy reliant on gas generation, which met 30% of demand in 2023 year to date. Italian solar capacity deployment has rapidly increased since 2022, but overall renewables growth has not offset the smaller Italian thermal fleet, creating a less resilient power system. Reduction in thermal capacity exceeds growth in wind and solar, decreasing total capacity from a high in 2013.

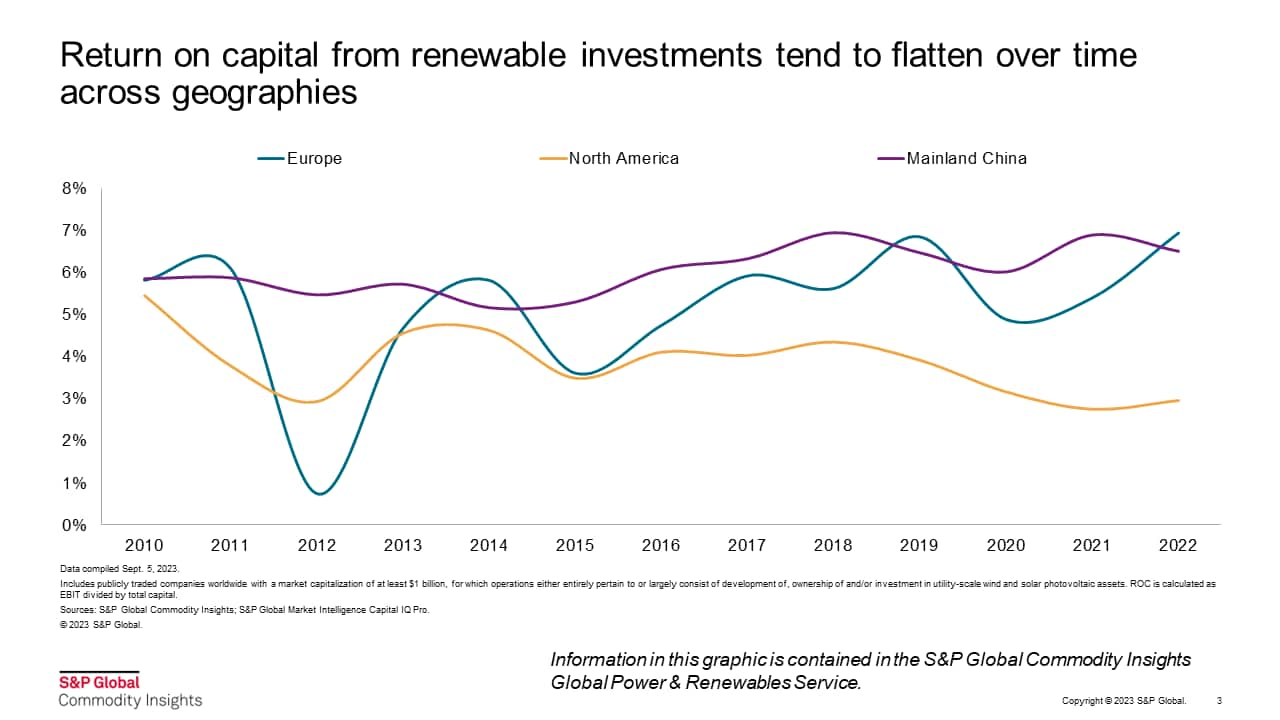

From the purview of corporates, there has been a mix of headwinds and tailwinds when it comes to renewable investment and profits from renewables. As explained by the Energy Renewable energy company returns remain stable amid market volatility — but investors seek further upside, recent favorable factors such as higher electricity prices, clean energy-focused policies and private sector demand for clean energy procurement have helped boost revenues. At the same time, challenges such as input and labor cost inflation, supply chain constraints, permitting challenges, interconnection delays, higher interest rates and growing competition contract profitability. In contrast with conditions at the start of the current decade, when sustainability and the energy transition were key drivers of capital flows, a relatively reduced prominence for these themes amid the current market landscape has led to a decline in renewable company valuations from the peak reached in 2020. While sustainability is likely to remain a core objective for investors, current market fundamentals have elevated the importance for these companies to deliver on their return objectives. It is observed that returns from investments in renewable projects have plateaued over time.

The recent global trends mentioned above show how rapidly the perspectives on the global power sector's future can evolve. Energy continuously updates its power demand, supply, and price outlooks. In September, regional power teams updated their outlooks for several markets and metrics. Customers can read the full reports below:

Learn more about our Global Power and Renewables Service.

Abhyuday Tewari is a research analyst with the Asia-Pacific Power and Renewables team at S&P Global Energy, focusing on South Asia.

Posted on 8 November 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.