Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 01, 2024

By Chad Barnes

PTT Exploration and Production Public Company Limited (PTTEP) has announced its agreement to acquire a 10% stake in the Ghasha Concession from Wintershall Dea in Abu Dhabi. The transaction follows Wintershall's broader divestment program, which included the sale of most of its E&P business to Harbour Energy. The 10% participating interest in the Ghasha concession represents Wintershall's only asset in the Middle East region, which was awarded in November 2018 on a 40-year concession along with other partners including Abu Dhabi National Oil Company (ADNOC) (55%), Eni (25%), OMV (5%), and Lukoil (5%).

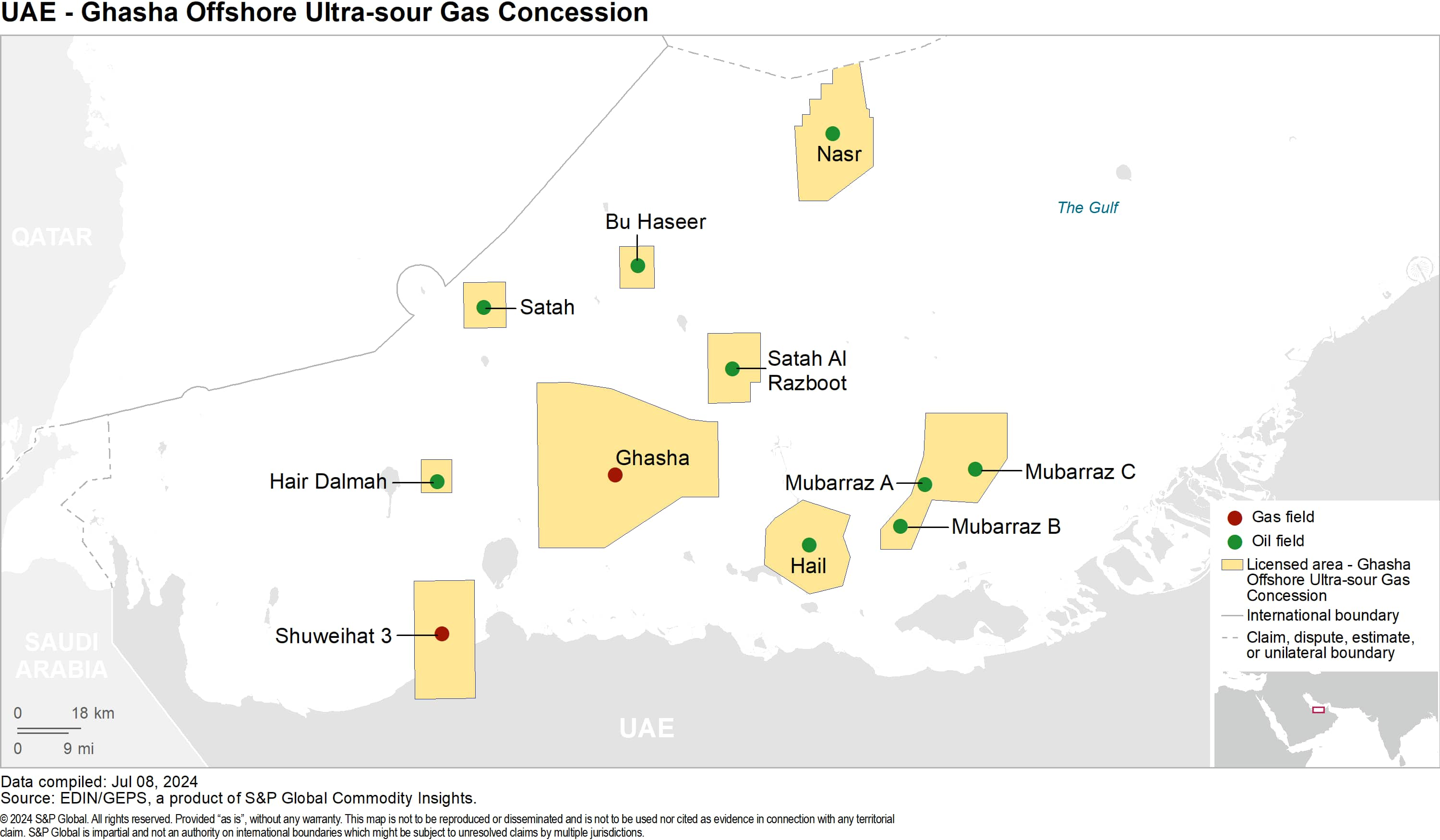

The Ghasha Offshore Ultra-Sour Gas Concession comprises nine large non-associated gas fields with a combined gas reserve of over 16 trillion cubic feet (Tcf). The reservoirs are in shallow water, approximately 60-130 km west of Abu Dhabi. The reservoirs were discovered between the 1960s and 1980s but remained undeveloped given the challenges presented by the environmentally sensitive location of the fields and the high H2S and CO2 content found in the gas. Despite these complications, the demand for gas has recently increased, and the Ghasha concession is a core development to help Abu Dhabi become gas self-sufficient by 2030. The concession will be developed in phases, starting with the Dalma sour gas development, which is expected to begin gas production in early 2025. The major Hail & Ghasha project will follow, after reaching a final investment decision (FID) in October 2023, with the award of both the onshore and offshore EPC contracts for a total value of $17 billion.

The concession is expected to have a raw sour gas production capacity of 1,500 million cubic feet per day (MMcf/d). However, following the removal of the significant non-hydrocarbon gas content, the remaining sales gas is expected to be around 800 MMcf/d. Boosting the financial feasibility of the project is the high liquid content within the fields. Liquids make up a significant portion of the total modeled revenue, with the Hail & Ghasha project estimated to produce more than 120,000 barrels of high-value oil and condensates per day. Likewise, NGLs and sulfur will be separated and sold as extra income streams.

The first project as part of the concession is the Dalma sour gas development. The project includes the development of three fields (Hair Dalma, Bu Haseer, and Satah) with first gas expected during the first quarter of 2025. The fields will be developed by platforms tied back to Arzanah Island. The gas will then be processed before being transported 80 km to Habshan via a tie-in to the 42" IGD-E gas export pipeline, and the condensate is exported via a 53 km pipeline to Zirku Island.

The Hail & Ghasha project will follow, which is expected to be one of the most challenging and complex gas developments planned in Abu Dhabi. The development is planned to operate with net-zero carbon CO2 emissions. This will include the capture and storage of 1.5 million metric tons a year (t/y) of CO2, as well as leveraging clean power from nuclear and renewable sources from the grid. Both fields contain significant amounts of carbon dioxide and hydrogen sulfide, with over 40% present in the major Ghasha field alone. The fields are being developed with ten artificial islands in shallow waters that will enable new wells to reach the full extent of the reservoirs. The products will then be gathered at the main Al Chananiz Island and sent to shore for processing near the Ruwais complex. The Satah Al Razboot project will likely be developed next and is understood to be in the FEED stage. The other fields have been assumed to backfill the main Hail & Ghasha project in the mid to late 2030s.

PTTEP growing Middle East presence

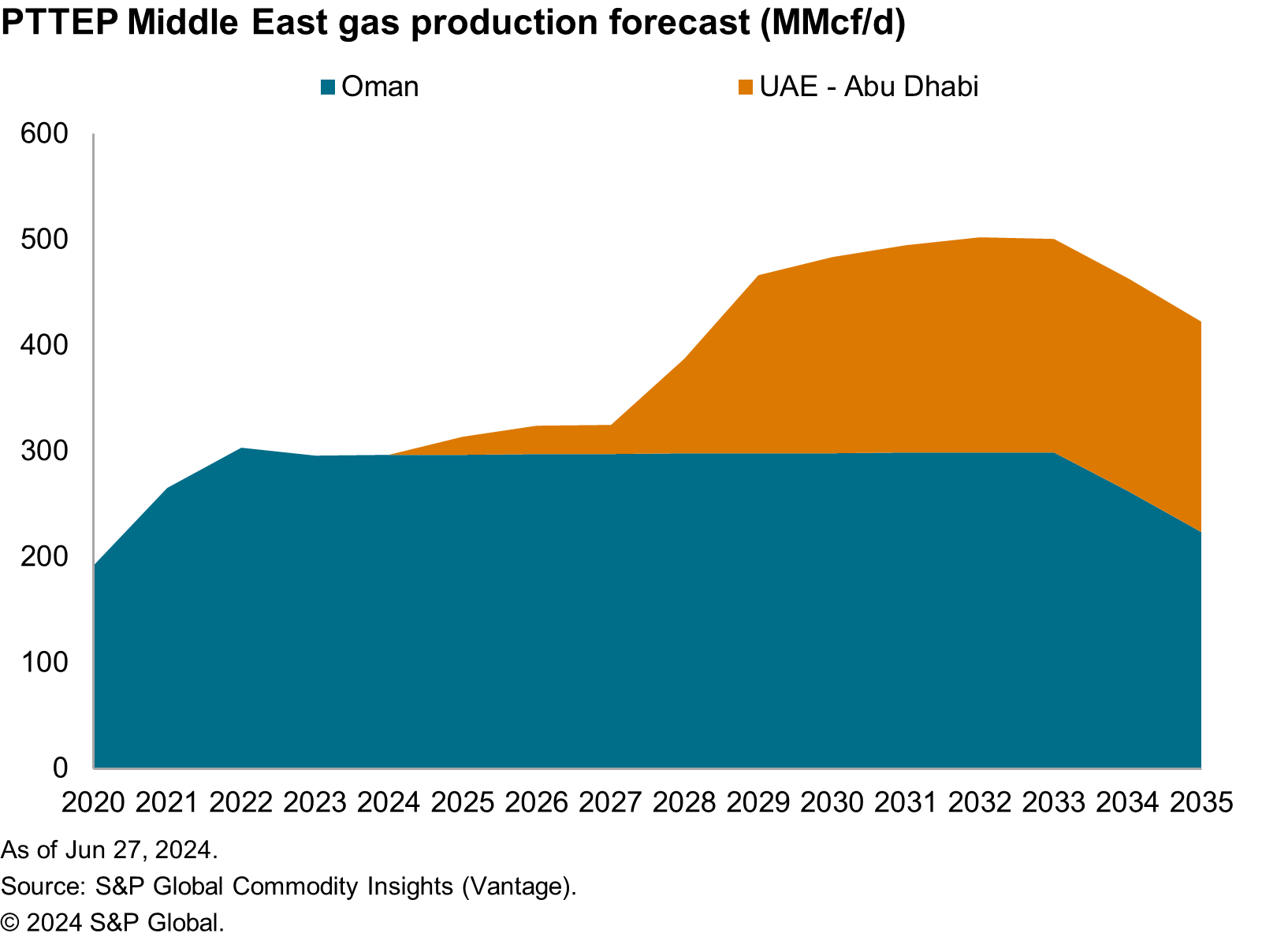

Within the Middle East, PTTEP currently holds assets in the UAE and Oman. However, the National Oil Company (NOC) has historically held exploration acreage in Bahrain and Iran and has shown interest in license rounds in Iraq and Lebanon. Following a series of investments over the last five years, PTTEP has built a growing portfolio of production, near-term developments, and exploration upside.

PTTEP significantly expanded its regional presence through the $622 million acquisition of Partex Holding in June 2019. Partex had a long history in the Middle East and held interests in Abu Dhabi and Oman, as well as some minor interests in Kazakhstan, Brazil, and Angola. The main asset acquired was the 2% interest in Petroleum Development Oman (PDO), which owns the largest producing asset in Oman (Block 6). Also, a 1% interest in Block 53 (Mukhaizna) was gained, which was producing around 120,000 b/d of heavy oil at the time. Likewise, the acquisition gave exposure to midstream gas assets, with a 2% holding of Oman LNG (OLNG) and 2% in ADNOC Gas Processing (AGP) in Abu Dhabi.

Following the Partex acquisition, PTTEP acquired 20% from BP in the major gas producing Block 61 (Khazzan-Makarem) in February 2021. This was PTTEP's largest single upstream acquisition in the past decade - costing $2.6 billion. The tight gas field in the block achieved a production rate of nearly 1,500 MMcf/d in 2023 and has been a game-changer for Oman, enabling the country to reverse earlier plans to phase out LNG exports by 2025. PTTEP is also a partner of TotalEnergies in Oman, holding a 20% share in the exploration Block 12.

The NOC entered the Emirates following successful bid rounds in Abu Dhabi and Sharjah in 2018 and 2019. PTTEP was awarded a 25% interest in both the Sharjah Onshore Area A and Area C concessions, as well as a 30% interest in each of Abu Dhabi's Offshore 1, 2, and 3 blocks. All the blocks are in the exploration and appraisal stage and are in partnership and operated by Eni SpA. The blocks include developed hydrocarbon discoveries, along with a range of undrilled leads, prospects, and untested plays.

In Sharjah, Onshore Area C is in the early G&G phase, the partners conducted a 3D seismic survey in 2022. Onshore Area A already contained producing fields; however, the Sharjah National Oil Company (SNOC) retains development rights and operatorship of pre-existing fields. A discovery was announced in May 2024 called Al Hadaiba, which has yet to be tested but reportedly yielded "promising quantities" of gas. Likewise, the partners suspended a deep gas exploration well at Sajaa in early 2024 - the results of which have not yet been disclosed.

In Abu Dhabi, there are historical discoveries in Offshore Block 1 and Block 2 that have yet to be developed. However, a major gas discovery was made in Block 2 with Eni and PTTEP's first exploration well. The XF-002 was discovered in 2022 and tested gas in multiple good quality reservoirs. The partners announced total gas in place of 2.5 -3.5 Tcf, with plans for a fast-track development. An initial phase of development is aiming to produce 300 MMcf/d by the second half of 2025, with further phases assumed to follow. The Ghasha concession overlaps PTTEP's existing acreage, allowing for collaboration and potential shared use of facilities in future developments. Likewise, PTTEP will benefit from its 2% ownership of ADNOC Gas Processing, the sole buyer of any gas production in Abu Dhabi.

PTTEP's investments in the Middle East demonstrate a clear and focused gas strategy, with the acquisition of interests in some of the biggest gas fields in Oman and UAE, as well as stakes in key midstream infrastructure. While the majority of the NOC's existing gas production is concentrated in Southeast Asia, the Middle East is expected to account for around 20% of its global portfolio in the next decade, making the region a significant growth area for the company. Continuing the trend of the past few years, additional investments in the region should not come as a surprise.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.