Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Aug 02, 2023

By Diego Ortiz

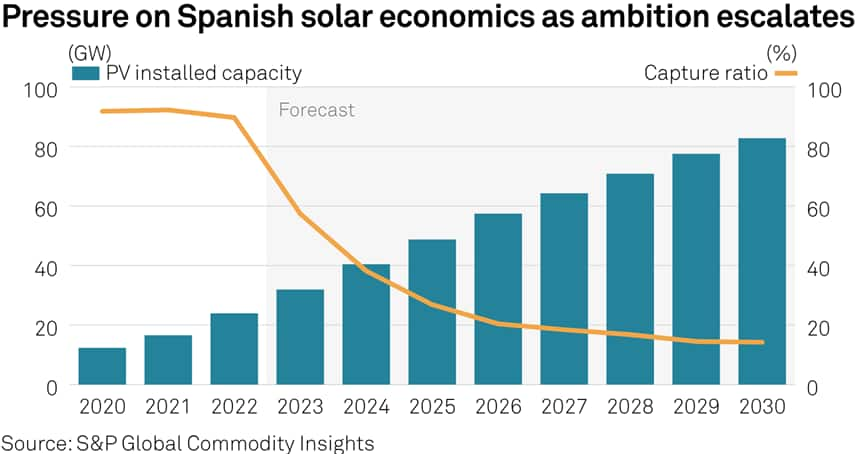

Higher renewable ambition risk oversupply and project economics. Spain's draft National Energy and Climate Plan (NECP) outlines an ambitious increase in renewable energy targets, aiming to raise the share of renewables in the power sector from 74% to 81% by 2030. The plan hinges on significant expansion of solar photovoltaic (PV) capacity, which needs to grow by nearly 50 GW by 2030, surpassing the expected 32 GW growth in wind capacity. This translates to annual additions of 6.3 GW and 4.3 GW for solar and wind, respectively.

However, the current power demand has not fully recovered from the energy crisis and lags 7% below the five-year average as of 2023. A modest rise of only 3.5% in final power demand is anticipated by 2030. Electrification is expected to become evident only post-2030.

The option for self-consumption has been met with high success in the Spanish market, growth in this sector will continue but will also reduce demand in the grid. Today we estimate the transmission connected (TC) demand loss from 2022 to 2023 to date at 55% owing to self-consumed solar, with the impact logically concentrated on daytime hours. While overnight demand has seen a drop of 5% in January-June 2023, daytime demand (between 8:00 a.m. and 6:00 p.m.) has fallen 7% on working days compared to 2022. By 2030, S&P Global Energy expects the self-consumption generation to account for 23 TWh, 20% of the total PV generation. The NECP set a target of 19GW of self-consumption generating assets installed by 2030.

The rapid increase in solar PV installations is already exerting visible effects on both demand and electricity prices during daylight hours. Currently, over 55 GW have secured grid access and must be built before the end of 2025 to maintain its access; the potential for oversupply looms.

In April of 2023, solar PV generation achieved 22% share in total demand in peninsular Spain, its highest share of 2023. However, during that month, given the generation profile of solar PV assets, captured revenues from the wholesale market accounted for only 63%, a metric known as the capture ratio. Looking ahead, the NECP anticipates solar PV to account for 34% of total generation and 40% of demand (after accounting for exports).

Renewables revenue cannibalization is a major risk until the 2030s. For solar PV, annual capture rates will fall from 90% harvested in 2022, 80% so far in 2023 to below 20% after 2026, rising above 25% only after 2040. Wholesale market prices will hit their lowest point in 2034 at €37/MWh and recover to €46/MWh by 2040 with increasing electrification and higher carbon prices.

Full details can be found here for S&P Global Energy subscribers.

For more information about European renewable power coverage, visit our European regional integrated energy or clean energy procurement service pages.

Diego Ortiz Garcia, a senior research analyst with the Gas, Power, and Climate Solutions team at S&P Global Energy, is currently dedicated to the analysis of the European renewable power sector.

Posted 2 August 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.