Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 05, 2023

By Anushil Anand Roy, Kallol Saha, and Manisha Mishra

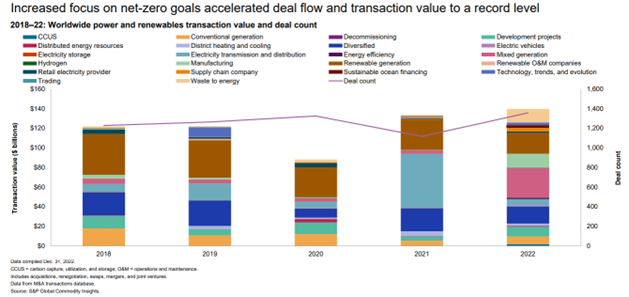

The transition to low-carbon energy has gained momentum, especially after recent events like Russia's invasion of Ukraine in early 2022, resulting in an increase in low-carbon M&A activity over the last year. This trend culminated in a record number of deals and partnership agreements in 2022. The increase can be attributed to various factors, including the ambitious climate goals set by many countries to reduce greenhouse gas emissions and shift to cleaner renewable energy sources.

Several countries and regions, including the United States, Europe, China, India, and Australia, are investing heavily in green technologies and infrastructure to meet these objectives. These investments are creating opportunities for mergers, acquisitions, and partnerships in the renewable energy sector, leading to a rise in deal count and transaction value, which saw a 20% increase year-over-year.

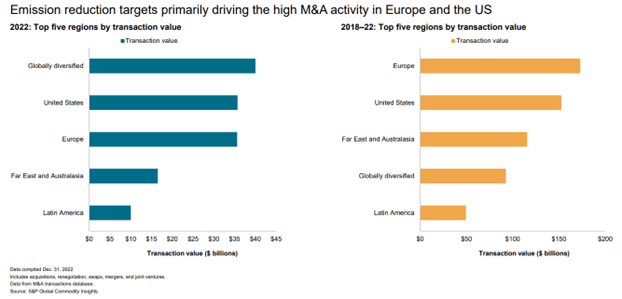

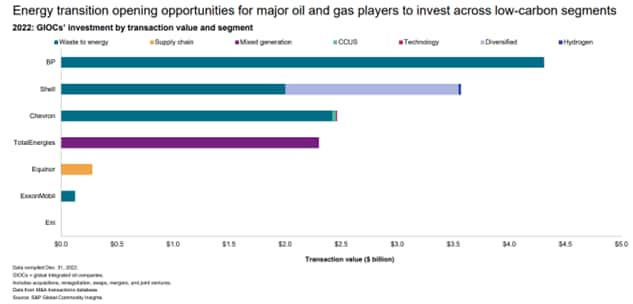

In 2022, about 600 corporate low-carbon deals were announced globally. Europe and the United States were the leading contributors, accounting for over 50% of the transaction value and 65% of the deal count. In addition, major oil and gas companies such as BP, Shell, and Chevron dedicated a considerable amount of their low-carbon M&A spending toward the waste-to-energy segment.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.