Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 14, 2023

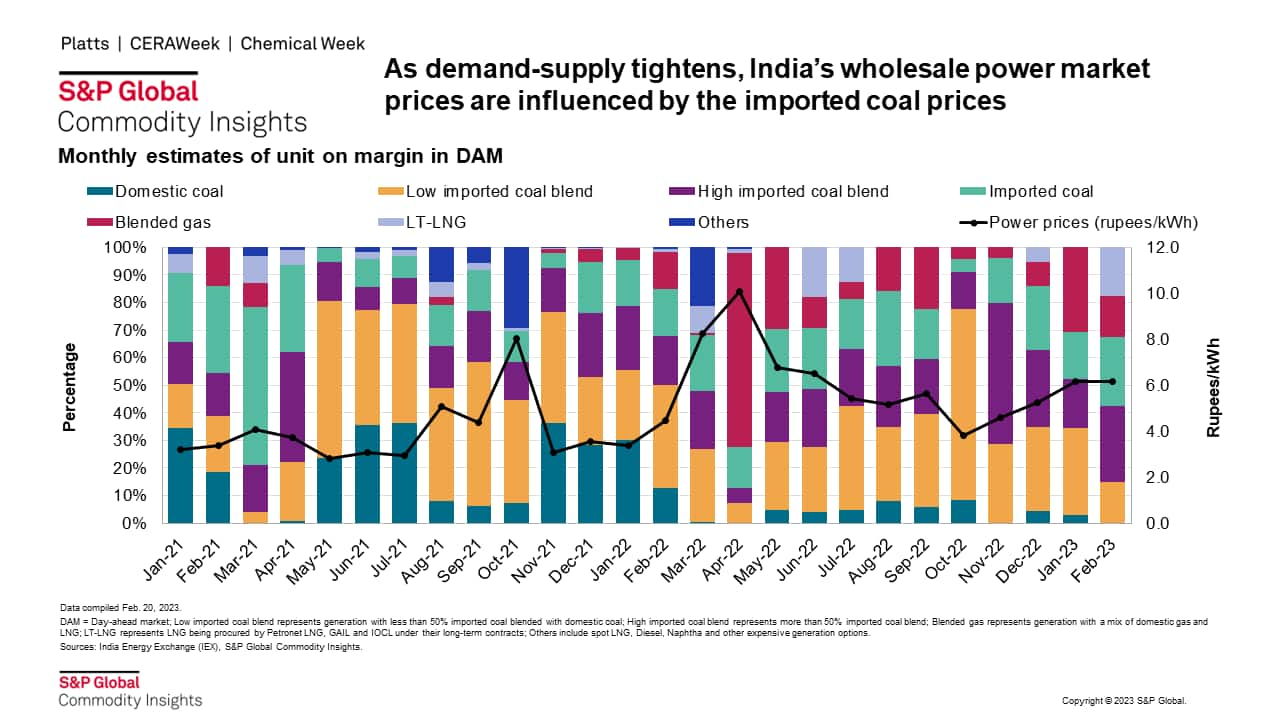

The spot market is one of the key indicators of the state of India's power sector. During the months of January and February 2023, the prices of electricity in the spot market remained high with an average price of 6.18 rupees per kilowatt-hour. This marks a 58% increase compared to the same period last year.

This rise in prices is attributed to tightening of demand-supply in the country, along with high prices of coal in international market. The historical trend indicates that there is a strong correlation between price spikes and the difference between buy and sell volumes on the power exchange. Whenever there is a supply constraint in the spot market, the power prices are pushed up as marginal fuel changes from domestic coal to imported coal (or LNG).

As seen in graph below, prices in February 2023 were higher as imported coal and LNG were on the margin about 40% of the time. Compared with February 2022, these fuels were on margin for only 15% of the time.

High demand growth expected for March to June period

In January and February 2023, increased commercial and industrial activity in northern and western regions led to high growth in electricity demand. Against an all-India average of 10% growth in demand, the northern region grew by 12.5% and western region grew by about 15%.

An unusual rise in temperature in the month of February 2023 is raising the alarm for an upcoming heat wave. Based on projections from the World Meteorological Organization (WMO), 2023 will be a "triple-dip La Niña" year, with the potential for widespread warmer-than-average sea surface temperatures during spring and summer. For March to June period, all-India electricity demand is expected to grow between 8.5-11.5% driven by signs of improved economic activity and unusual rise in temperature.

Peak demand is also expected to grow at 9-12% during the first half of 2023, reaching 235-240 GW and surpass the coincidental peak demand of216 GW in April 2022 (registering a year-on-year growth of 6.3%).

Expecting high demand in the upcoming months of March to May, the government has initiated various steps

In anticipation of high demand, the government has initiated various actions:

During H1 2023, power prices are expected to remain high, and consumption of imported coal expected to increase

The projected increase of 70-84 TWh in electricity demand (in H1 2023, compared to H1 of 2022), is expected to be met primarily by increase in coal generation (of 48 to 60 TWh). Key factors contributing to demand supply situation during March to June period include:

Customers of our Asia-Pacific Regional Integrated service can click here to read about our detailed analysis on demand-supply balance and power price projections for H1 2023 on our Connect platform. For non-clients, for more information on the service, pleasse click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.