Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 02, 2024

By Abhyuday Tewari and Ankita Chauhan

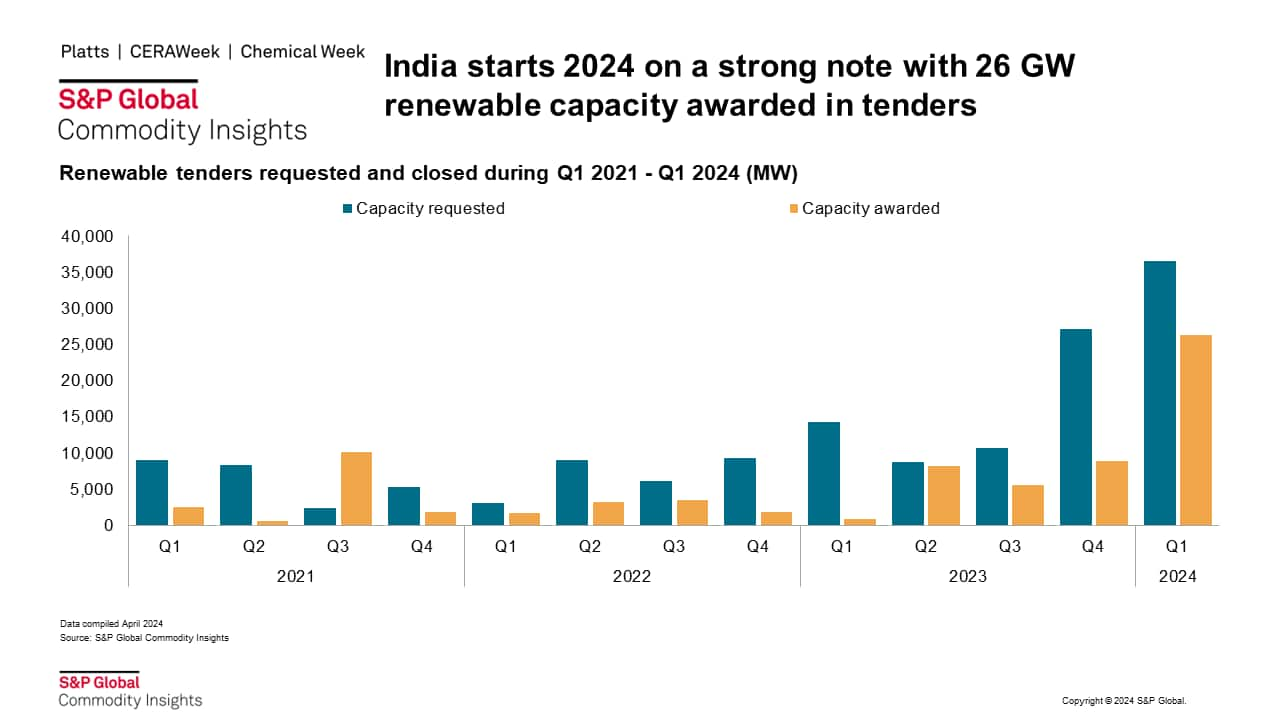

India started the first quarter of 2024 on a strong note with more than 26 GW of renewable projects awarded in competitive tenders. Energy recorded about 49 GW of renewable capacity awarded by India fiscal year 2024 (FY starting 1st April 2023 till 31st March 2024), a touch under the 50 GW annual target for allocating renewable projects to meet its target of 500 GW by 2030. As of March 2024, the total renewable capacity has reach 143 GW along with a massive pipeline of about 100 GW projects in different stages of development.

The renewable capacity requested in Q1 2024 alone represented about 40% of the total 80 GW tenders requested during FY 2024. Majority 55% of the capacity awarded in the FY2024 was from federal agencies including Solar Energy Corporation of India (SECI), NTPC Limited, SJVN Limited and NHPC Limited. About 38% of the capacity awarded was by state level agencies to meet their renewable purchase obligation as well as under for installations under programs for distributed PV.

This includes 26 GW of tenders requested in the first quarter of 2024 and remaining 18 GW open tenders delayed from previous 2 quarters. Majority 52% of the open tenders are for solar PV projects, followed by 27% of hybrid renewables with or without storage and 15% of onshore wind projects. About 5% of the open tenders are for stand alone energy storage. These tenders are expected to close during the next 1-2 quarters.

Avaada Energy won the largest 5.8 GW capacity in this period followed by ReNew with 4.4 GW and SJVN Limited with 4.0 GW renewable projects awarded. The 5 largest awardees also including NTPC Limited and ACME Solar have won almost 40% of the total awarded capacity during the last fiscal year. Among the largest winners are largely domestic renewable independent power producers and diversified utilities, whereas only about 6% of the capacity awarded was won by international companies.

Average solar tariffs for projects awarded in Q1 2024 was roughly $31.4/MWh, up from about $30.5/MWh in Q1 2023 driven by an expected increase in costs once regulatory restrictions on imports come into force from April 2024 onwards. Onshore wind tariffs see a higher increase to $41.6/MWh in Q1 2024 from about $36.3/MWh in Q1 2023 driven by project sites moving from high resource to medium to low resource locations.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.