Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 08, 2022

Following two offshore discoveries that have uncovered billions of barrels of hydrocarbon resources, Namibia's government is focusing on value addition from the hydrocarbon sector to solve domestic economic challenges. As a result, upstream E&P investors are likely to face a shifting political, regulatory, and fiscal risk matrix as Namibia accelerates from frontier to emerging producer.

Shell's Graff and TotalEnergies's Venus discoveries - announced in February and March this year, respectively - may have unlocked upwards of four billion barrels of oil and gas resources, giving Namibia the potential to become one of Sub-Saharan Africa's largest hydrocarbon producers by 2030, with significant exploration upside.

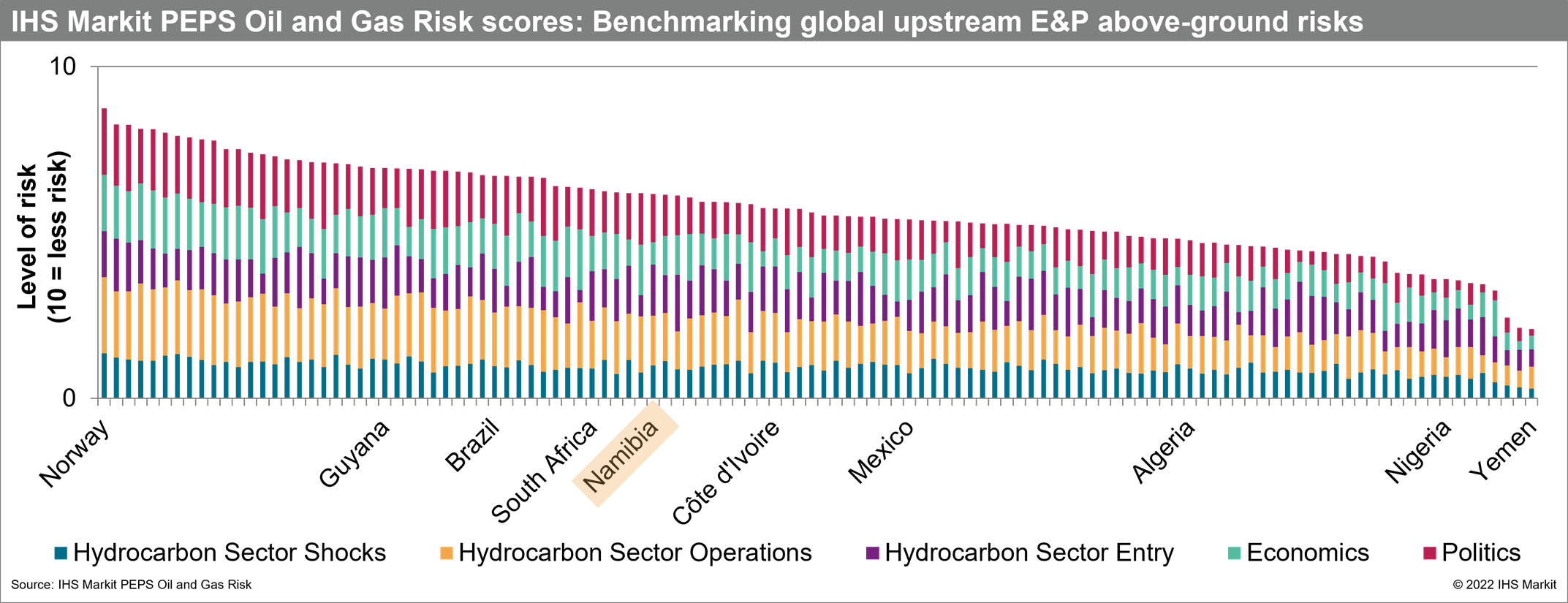

Namibia's hydrocarbon boom presents President Hage Geingob and his ruling South West Africa People's Organisation (SWAPO) party - in power since Namibia's independence in 1990 - with both a potentially vast economic windfall (adding to the country's existing mineral wealth) and a significant policymaking challenge. The country's middle-income status, political stability, and relatively generous E&P terms make it one of Sub-Saharan Africa's most attractive upstream investment destinations (see chart). However, that status is now likely to come under pressure.

Geingob is focusing most immediately on job creation and domestic processing and industrialisation opportunities to shore up public support for his administration in the face of a drought-and-pandemic-hit economy and high levels of unemployment among well-educated young people, which he acknowledges as a "time bomb" threatening stability.

More detailed and onerous local content requirements than those currently detailed in the 1991 Petroleum Act have long been considered. Namibia has been drafting an affirmative action framework, the National Equitable Economic Empowerment Framework (NEEEF) for around 15 years, aiming to address race-related economic inequalities and increase the role of previously disadvantaged citizens in key sectors. A bill to introduce the framework has yet to be passed, and in 2018, Geingob's government revised the bill to remove challenging ownership provisions that may have constrained foreign investment.

For now, it appears the government will probably pursue a moderate, investor-friendly attitude to local content. However, if the NEEEF is not finalised and implemented before the 2024 election, at which Geingob will step down, then SWAPO's approach could harden, particularly if the party's more left-leaning internal factions gain sway.

Mindful of a narrowing investment window to fully exploit the country's resource endowment amid global energy transition, Namibia's government will probably move to update and clarify other elements of petroleum legislation, with a focus on increasing state participation and revising currently generous fiscal terms for new contracts.

Namibia's authorities and upstream investors will also face increasing domestic and international civil society action, demanding transparency around government revenues and distribution. Environmental advocacy groups will likely seek to disrupt an E&P expansion via both direct action and legal challenges, as is occurring in neighbouring South Africa.

Namibia's accelerated resource boom could therefore strain the state's policy and decision-making capacity, as it attempts to balance domestic political and economic imperatives with international upstream competitiveness and IOCs' commercial considerations. Senegal and Tanzania provide cautionary examples of countries that overreached with legislation and terms once resources were proven.

***

Learn more about our coverage of African E&P risks and opportunities through Petroleum Economics and Policy Solutions (PEPS).

***

Try free access to the Upstream Oil & Gas Hub to explore similar energy research, analysis, and insights, in one integrated platform.

Posted 08 June 2022 by Roderick Bruce, Research and Analysis Associate Director, E&P Terms and Above-Ground Risk, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.