Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 23, 2024

By Abhyuday Tewari and Qingyang Liu

This Scheduled Update provides a brief overview of selected reports in the Global Power and Renewables service. To learn more about our Global Power and Renewables Service and the reports featured in this post, click here.

In January 2024, regional research teams came out with the key trends expected to play out in respective power and renewables markets in 2024. Alongside future trends in regional power and renewable markets, S&P Global Energy has also analysed the future of various power generation and transition technologies.

Five trends in 2024 for global power and renewables markets prognosticates that low power prices and high development costs will challenge renewable projects' economics, but clean energy technologies will nevertheless have a record year in terms of generation and capacity additions. Many regions are observing market prices well below the highs of 2022 — particularly for solar energy. Supply chains for solar, and to a lesser extent onshore wind, are oversupplied and this competition will reduce costs; whereas those for offshore wind face constraints. Additionally, increasing clean energy demand from corporates, the push to electrify transportation, heating and industrials processes and the adoption of newer technologies like green hydrogen will change the mix of supply and demand resources used to foster energy transition. Battery storage is becoming crucial, but mineral shortages pose a challenge. The complex financial environment, marked by higher interest rates and lower project valuations, calls for strategic caution. Global contrasts in economic growth, policies, and capital access will lead to varied power market trajectories in their energy transition.

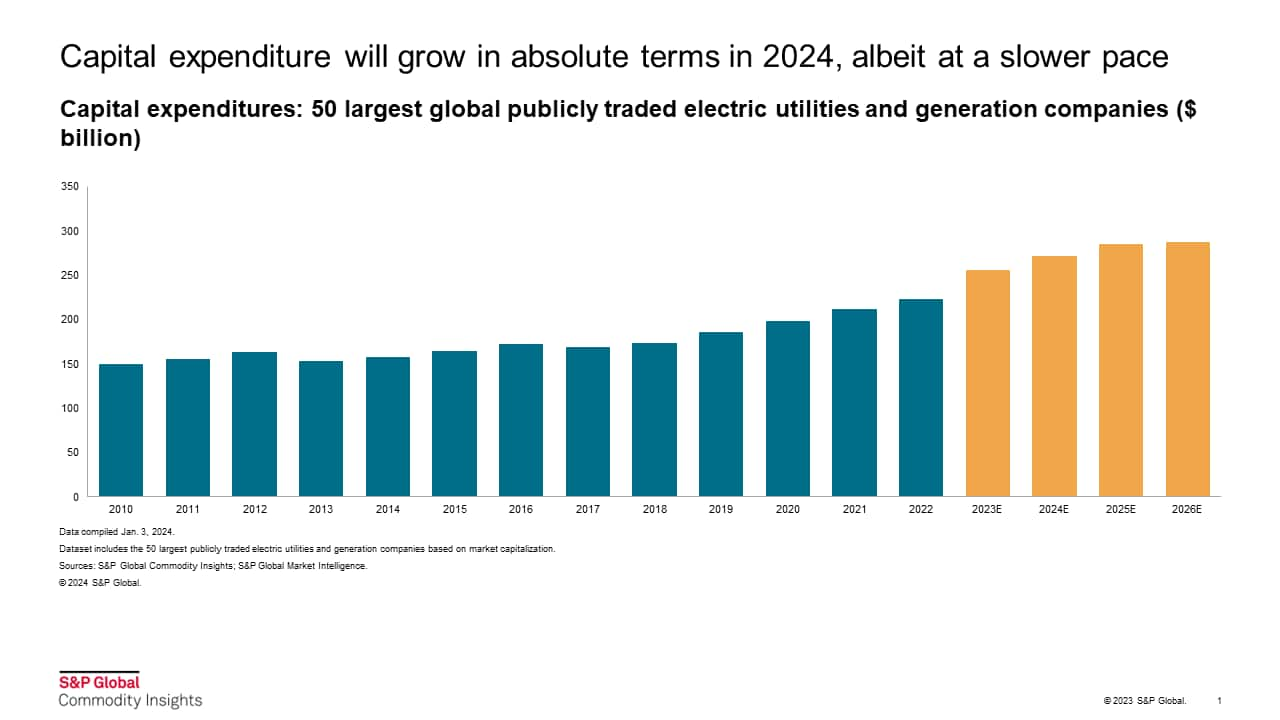

Correspondingly, Global power and renewables companies and strategies: 5 anticipated trends for 2024, explains that due to challenges in the power and finance sectors, expansion plans are expected to be moderated. Factors such as high borrowing costs, increased debt, and low equity market values will compel businesses to seek different financing options. To minimize risk, companies will focus more on their main markets, technologies, and business sectors, while gradually or completely selling off assets that are not central to their operations. They will also invest in innovative low-carbon power technologies, which will represent a small, but increasing portion of their capital investments.

Top 10 questions facing North American gas and power markets in 2024 discusses the areas of interest for North America's power markets in 2024. These include among others, offshore wind, where challenges include equipment costs, high interest rates, and inadequate labor force; coal retirements, which have been held up; extreme weather conditions, which bring into question how outages can be mitigated, particularly during storms and winter; new technologies such as hydrogen and carbon capture, the adoption and effectiveness of which will be subject to costs and efficiencies.

The Five big questions for OECD Asia gas and power market in 2024 puts forth key areas of discussion considering the Conference of Parties (COP28) and ongoing geopolitical tensions. Some of the key questions pointed out were: Will power demand recover in 2024, and which technology will prevail? Can nuclear capacity be tripled by 2050? How will the offshore wind market progress in 2024?

China faced multiple macroeconomic and weather related shocks in 2023. Keeping those in mind, some of the 10 big questions for China's gas and power market in 2024 are as follows: Will China take advantage of its weary economic recovery to effectively control carbon emissions? How will power market pricing mechanisms evolve to drive the low-carbon transformation? How will leading Chinese power companies adjust their portfolio and financing strategies to better cope with energy transition targets? How will weather events impact gas and power demand and supply balance in 2024?

Top trends in 2024 for India's power and renewables markets points out that following a successful hosting of the G20 Summit in 2023, India positioned itself as an attractive destination for energy transition-related investments. Clean energy technologies are advancing in India, but reliance on coal will continue, with capacity additions planned as well. Improving domestic fuel supply will remain a top priority to respond to rapidly growing demand. India expanded its financial assistance to promote green hydrogen/green ammonia ecosystem and laid the groundwork for its domestic carbon markets. On green hydrogen and green ammonia, the focus would shift to local demand creation. Renewables will stay at the center of India's climate policy as 2024 is expected to register the highest renewable capacity addition supported by falling module costs globally. 2024 is also expected to be the year that will define the "nuts and bolts" of India's domestic carbon strategy.

Four big questions for global coal markets in 2024 interrogates the future of the global seaborne thermal coal market in 2024. The questions posited for 2024 were with regards to global coal demand; Chinese coal imports; Indian coal production; and US coal market balance. These are of relevance considering the recent supply shocks in seaborne trade routes; and the phasing down of coal generated power in some countries juxtaposed with the ramping up of the same in others.

Executive briefing: Mounting costs hammer US offshore wind endeavors discusses the challenges and future pathways for the proliferation of offshore wind in the United States. The offshore wind sector has been facing high commodity prices, high interest rates and a constrained global supply chain. As a result, nominal levelized cost of energy (LCOE) for East Coast projects rose substantially from 2021 levels. Despite new tax credits, mounting project costs have led to project delays, cancellations, and a reduced capacity outlook for 2030. However, the long-term US outlook remains strong due to policy commitments and decarbonization efforts, with annual capacity additions expected to double after 2030. The briefing can be read here.

Going 100% green: Optimal strategies to procure 24/7 renewable energy in India highlights the challenges and strategies for consumers opting for 100% renewable energy. To achieve this objective, corporations are often faced with the challenge to optimally design and size the project and mitigate the market, regulatory and operational risks. The up-front capital expenditure investment requirement is extremely high while designing a hybrid system to meet 100% electricity requirement through a renewable energy system. Long-duration batteries solutions remain the lowest-cost option for round-the-clock (RTC) supply. The full report can be accessed here. Further, understanding the sensitivity to the capacity factor and battery requirements can minimize the operational risks. To simulate various scenarios of renewable capacity and utilization, clients can use the Optimal project sizing model for round the clock renewables supply.

Long-duration energy storage is essential in a low-carbon electricity system explains the role of battery storage in ensuring round-the-clock renewable energy supply and the challenges in adopting the same. Long-duration energy storage (LDES) of more than 8 hours can accelerate the integration of renewables and reduce curtailments, but most of the benefits of energy storage are captured with durations below 8 hours. The existing market mechanisms are insufficient to support LDES, and new supportive mechanisms will be challenging to implement. Therefore, LDES deployment is expected to grow slowly, being mostly supported by direct procurement programs such as those recently seen from New South Wales, in Australia, and California, in the US. Newer technologies focused on LDES are not cost competitive yet. Pumped hydro still accounts for most of the capacity in the pipeline.

The recent global trends mentioned above show how rapidly the perspectives on the global power sector's future can evolve. Energy continuously updates its power demand, supply, and price outlooks. In January, regional power teams updated their outlooks for several markets and metrics:

To learn more about our Global Power and Renewables Service and the reports featured in this post, click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.