Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jun 30, 2023

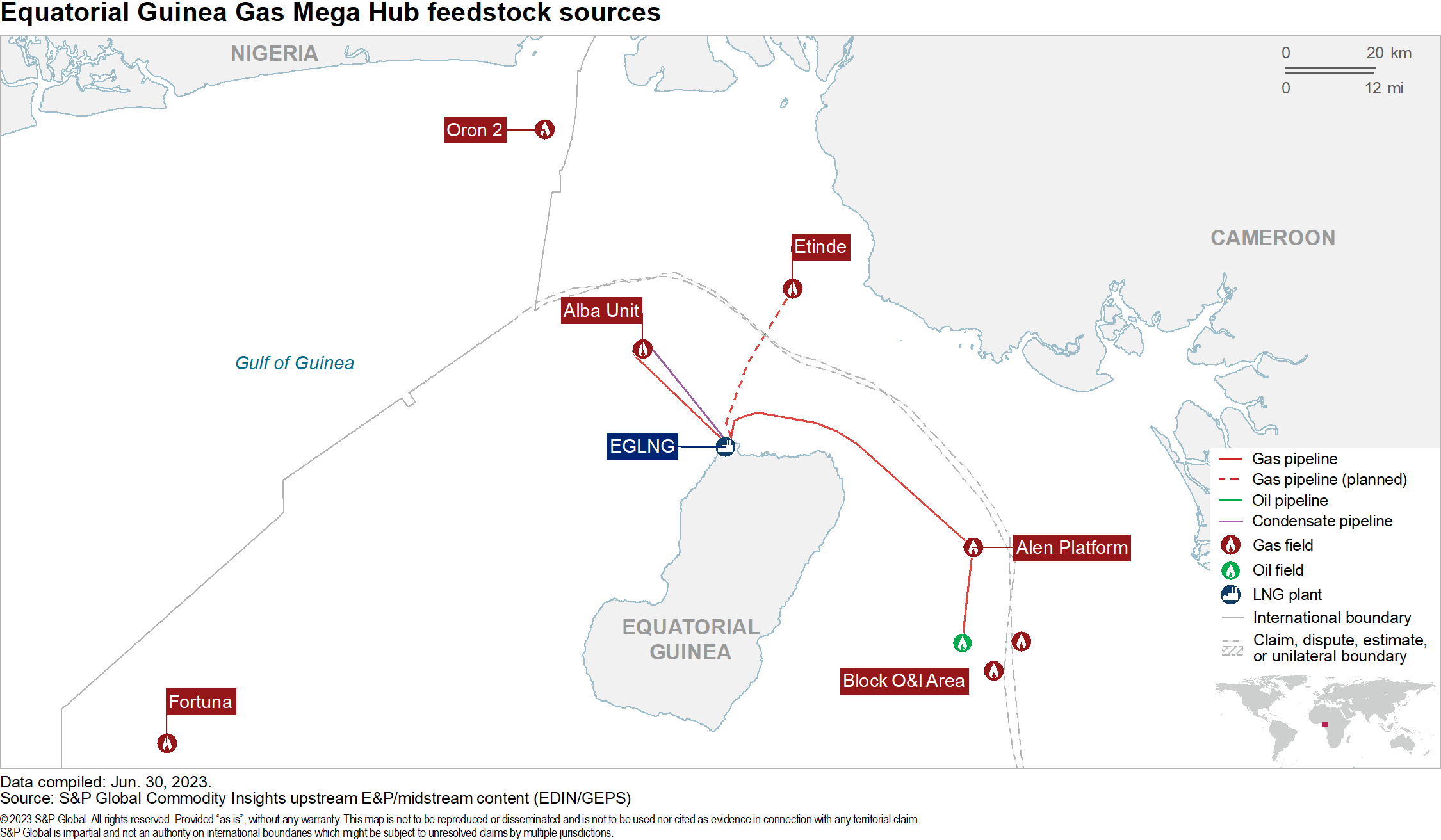

Equatorial Guinea could be a major hotspot for LNG within West Africa following the recent agreement between the Equatorial Guinea government, Marathon Oil Corporation (Marathon Oil) and Chevron's Noble Energy E.G. Ltd to move ahead with the development of the Gas Mega Hub (GMH). The Heads of Agreement (HOA) aims to extend and maximize gas feedstock for the terminal through the development of more fields in the region and within the neighboring countries.

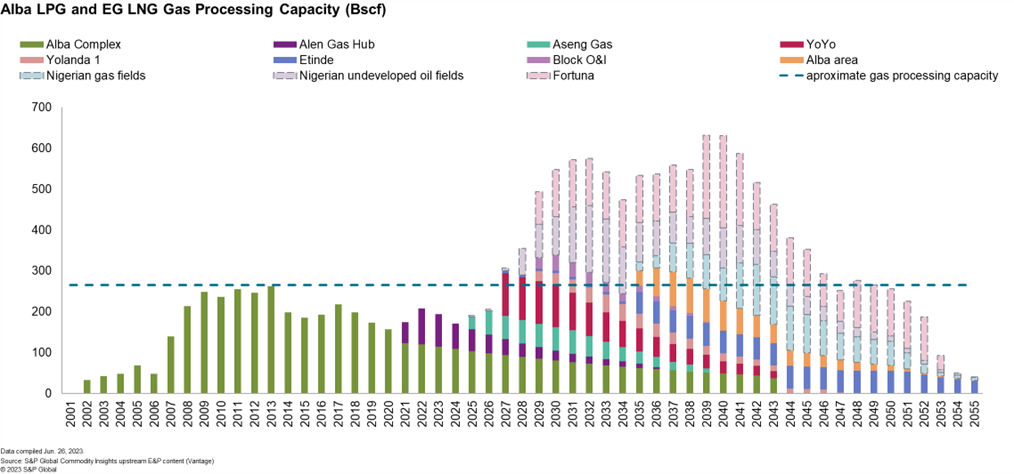

Phase I of this project was successfully completed in February 2021 with the start-up of the Alen gas monetization project, which aimed to send gas from the Alen field to the Punta Europa facility via a newly built 70km-long pipeline with a capacity of 950 million cubic feet of natural gas per day (MMcf/d). The Alen field had been producing condensate since 2013, while gas was reinjected to maintain reservoir pressure. Currently, gas is processed through the existing Punta Europa facilities, from where it is further sold to the European and global LNG markets. The Alen gas monetization project has been a key step forward in maximizing development of existing and future regional gas resources and can facilitate the commercialization of further gas resources in proximity to the Alen facility.

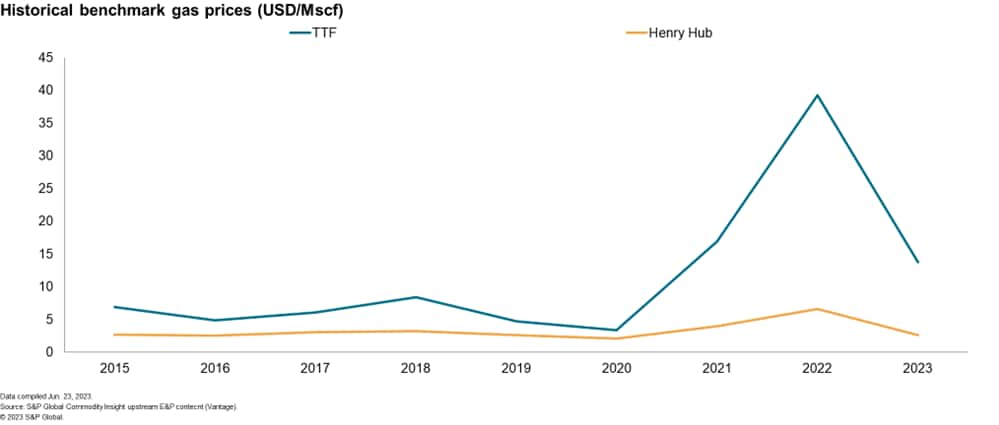

Phase II consists of a change of contractual terms for the Alba gas field, which has been the main source of feedstock gas to Punta Europe since 1991. Currently the Alba LNG is sold under contractual terms linked primarily to the Henry Hub index. However, following the expiry of this contract at the end of 2023, Alba gas volumes will be processed under new contractual terms linked to the TTF index. Marathon expects the new contract to improve the company's earnings and cash flow, because of the recent and expected higher gas prices (graph 1) due to the sanctions imposed by the European Union to Russian gas imports and the consequent increased LNG demand. The improved cashflow will provide Marathon Oil the funding to further develop the Gas Mega Hub (GMH). Moreover, the company is also evaluating at least two infill drilling opportunities to improve and maintain the Alba production performance, that has been declining on average at a rate between 8% and 10% year on year.

Phase III of GMH will focus on the commercialization of gas from the Aseng field, which has been producing oil since 2011 with gas injection for pressure maintenance. It is estimated that there will still be spare processing capacity at the Punta Europa facility to accommodate production coming from the Aseng field, which is expected to be connected to the EG LNG via a tie-back to the Alen production platform.

A recently signed bilateral treaty on cross-border oil and gas developments between Equatorial Guinea and Cameroon opens up an opportunity to further expand the possibilities for gas commercialization within the region and further extend the life of the terminal. This bilateral agreement aims to accelerate the development of Chevron's Yoyo-Yolanda project, situated on the border between Equatorial Guinea and Cameroon. The joint development would involve a subsea tieback to the Alen platform from where gas will be exported to the EG LNG via the existing pipeline.

The Etinde gas field offshore Cameroon could be another candidate to supply feedstock gas to the EG LNG plant. The field was discovered in 2019 but has since remained undeveloped partly due to the complex geological structures and high-pressure reservoirs, as well as due to the commercial and regulatory issues impacted by COVID-19 and recently, due to the sanctions that were imposed on Russian Lukoil. Should the Etinde gas field be included in the bilateral treaty, the partners might finally go ahead with a Final Investment Decision (FID) via the EG LNG plant which gives potentially lower development risks, lower initial investment cost and potentially a shorter timetable compared to the initial development plan that included a Floating Liquified Natural Gas (FLNG) facility. Operatorship change from New Age to Perenco is still pending, but once completed, it is expected to accelerate development planning activities.

Apart from the plans to import gas from Cameroon, Nigeria can also provide gas feedstock to the GMH. A memorandum of understanding (MOU) signed between Nigeria and Equatorial Guinea in early 2022, could allow the commercialization of Nigerian untapped resources located in the proximity of the border via an offshore gas pipeline to the EG Alba facilities, which will provide access to the Punta Europa LNG terminal. The signature of this MOU could accelerate the development of unexploited gas fields such as Oron 2 (discovered in 1975), as well as open the possibility to commercialize gas from other oil fields located at a tie-back distance from Alba. Combined, the gas reserves of these fields are estimated to be in the range of at least 3 Tscf.

Finally, the Fortuna gas field which is estimated to hold up to 2 Tscf of natural gas, located in Block EG-27, has remained stranded for almost 10 years. Ophir Energy and Lukoil, the two past operators, haven't managed to finalize a development plan. The previous FDP included an FLNG, however the government leaned towards a scenario of a 150 km long tieback to the Punta Europa facility, which could cause both technical and financial challenges due to the distant field location. According to the authorities, negotiations for a new operator are ongoing.

Other sources of potential gas supply for the EG LNG plant could be the fields located in the blocks, adjacent to the Alba unit. Combined, these fields are estimated to hold around 700 Bscf of gas resources, which could be developed simultaneously as a tie-back to the existing Alba facilities provided the projects are technically and economically viable.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.