Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Nov 14, 2023

By Terence Khoo

On Oct. 20, 2023, Navigator CO2 Ventures LLC announced the cancellation of its Heartland Greenway pipeline project - a proposed 2,092-km CO2 pipeline that would have spanned five US states - citing the unpredictable nature of regulatory processes and requirements governing the project.

The cancellation of the CO2 pipeline and storage project represents a setback for the Biden administration, which is counting on carbon capture, utilization and storage (CCUS) to play a significant role in reducing emissions in the US. The cancellation also illustrates limitations with the Inflation Reduction Act (IRA), which incentivized certain decarbonization investments financially but did not directly address potential permitting or regulatory bottlenecks. Those permitting and regulatory issues are likely to affect other CO2 pipeline projects - particularly those that span more than one state - slowing progress on CCUS capacity and emissions reduction targets, at least in the short term.

Regulatory and permitting challenges prove too much to overcome

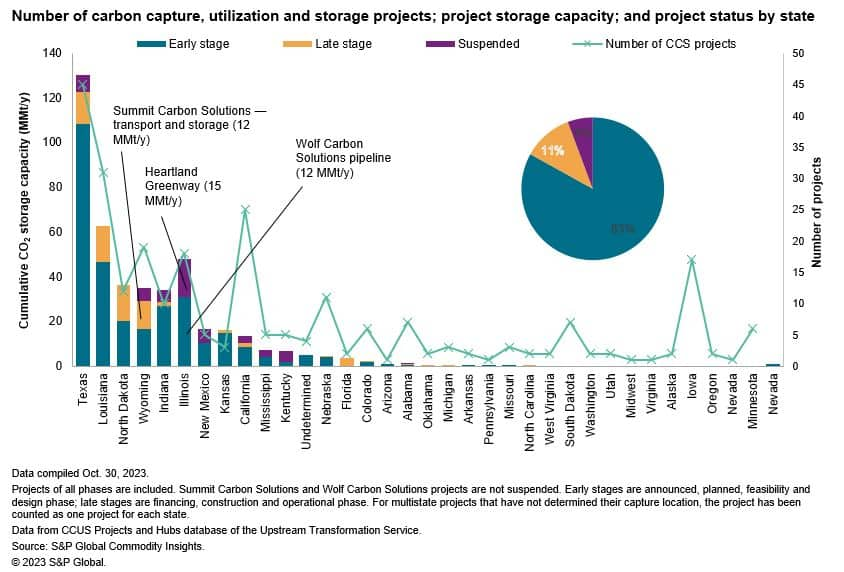

The Heartland Greenway project was first announced on March 16, 2021, with projections that the pipeline network would transport up to 15 million metric tons of CO2 (MMtCO2) annually from ethanol and other agricultural manufacturers from South Dakota, Nebraska, Minnesota and Iowa (where more than 60% of the planned pipelines were located) to be stored in Illinois.

The project was met with heavy resistance from local communities due to a perceived lack of consideration of local land rights and environmental concerns, which led to pressure on state-level officials. Permits for the project were rejected in Illinois and South Dakota in February and September 2023, respectively, before the project was canceled in October. In its statement announcing the project's cancellation, Navigator cited the unpredictable regulatory situation in South Dakota and Iowa.

A similar multistate project by Summit Carbon Solutions LLC has also encountered state-level permit challenges in North Dakota, South Dakota and Iowa and has delayed its original startup timeline from 2024 to 2026 as a result. Another large CO2 pipeline project by Wolf Carbon Solutions US LLC has encountered relatively less resistance as it spans just two states, but opponents - emboldened by Navigator's canceled project - have indicated they will soon ramp up the pressure.

The US carbon capture, utilization and storage context

The Bipartisan Infrastructure Law (2021) and the IRA (2022) have played an important role in spurring development of CCUS projects in the US. Notably, many of the recently announced projects are economically feasible thanks to the financial incentives within those laws.

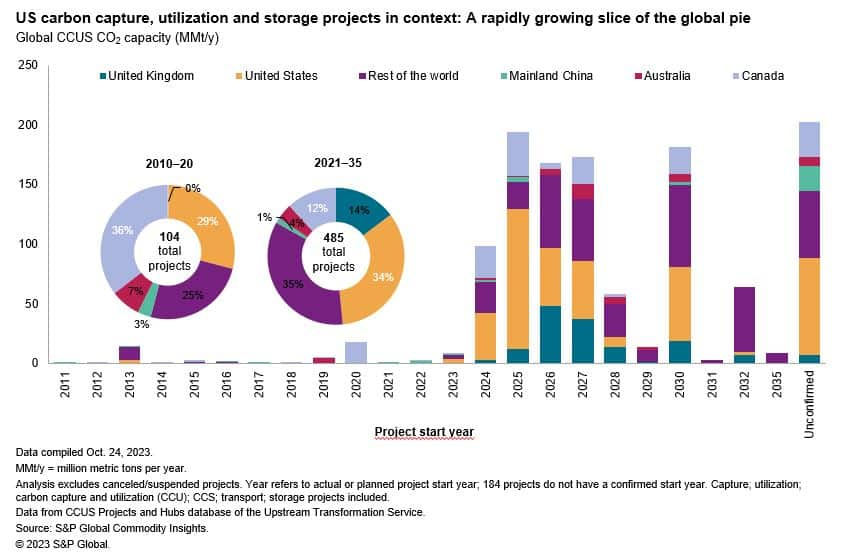

As a result, the US accounts for 29% of global carbon capture and storage (CCS)/CCUS projects (operational, planned and announced) from 2021 onward, rising from its previous share of 19% prior to the laws' passage and experiencing an average growth of nine projects per year between 2021 and 2035.

Incentives and regulatory mismatch

While federal legislation has proven successful at financially incentivizing decarbonization developments, the nascent and decentralized framework of permitting processes and regulations for associated pipeline development is proving to be a hindrance.

Efforts to broaden or even streamline authority to regulate CO2 pipelines (and other energy-related projects) at the federal level have been stalled legislatively, leaving companies to navigate a patchwork of state regulatory regimes — with a disproportionate impact on projects that span multiple states.

At the state level, social license to operate could become a growing problem. In rejecting or delaying permits, state-level authorities have cited concerns over the safety of CO2 pipelines, environmental impact, eminent domain, setbacks and cultural issues — showing that existing legislation falls short in laying out processes and guidelines to balance CCUS development against these issues.

Timely rollout of carbon capture, utilization and storage projects at stake

Prior to its cancellation, the Navigator project represented 3% of total planned capture capacity in the US, and other planned multistate Midwest projects are equally critical to near-term CCUS plans.

In addition, the canceled Heartland Greenway project accounted for 5% of total planned onshore CO2 storage capacity in the US. If other projects that face similar resistance are canceled or delayed, nearly 25% of onshore storage capacity could be affected, with significant repercussions for the short-term US emissions reduction outlook.

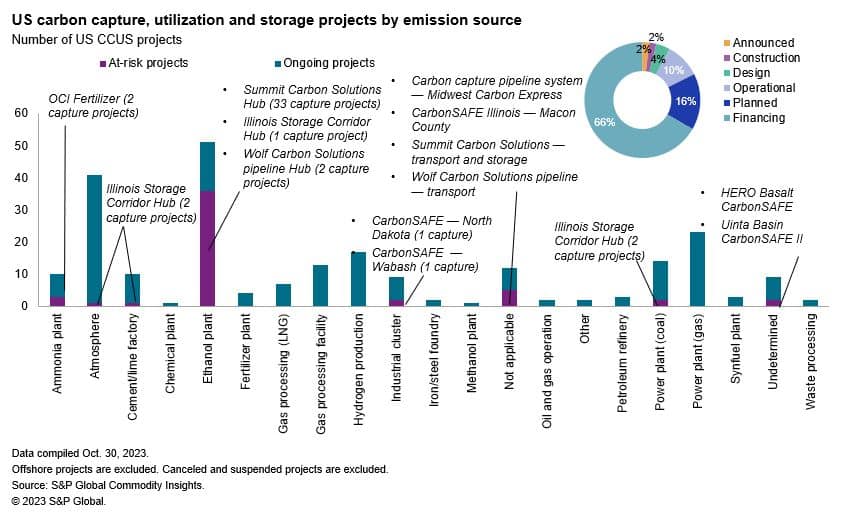

CCUS had been viewed by ethanol producers as a means of reducing carbon intensity of their biofuel, qualifying their products for California's (and other West Coast states') low-carbon fuel standard markets. The Midwest ethanol producers that had planned to use the Heartland Greenway pipeline to enable CO2 transport and sequestration will now have to change course; carbon emissions can still be captured from the plants, but any captured CO2 is likely to be stored or transported in ways less economic than interstate pipelines. Thus, while US ethanol producers will likely continue to pursue CCUS, the rollout of onshore CCUS projects is likely to be delayed by opposition to multistate CO2 pipeline projects, hindering realization of the country's biofuel goals.

Regulatory challenges to persist near term

In the near term, challenges to the development of CO2 pipelines across multiple states are likely to persist, causing additional project delays and/or cancellations. Recent federal efforts are unlikely to resolve the regulatory bottlenecks: Legislative proposals have focused on carbon storage and CO2 pipeline safety, which could assuage the concerns of some local populations but still would not resolve environmental and land rights concerns or issues of federal-state authority. Moreover, a dozen Democratic representatives in the House have asked the Biden administration to pause federal CO2 permitting pending finalization of federal safety regulations, signaling some level of resistance at the federal level and within the president's own party.

Several federal bodies have indicated their reluctance to extend their authority to regulate CO2 pipeline development. In October 2023, the Federal Energy Regulatory Commission (FERC) allowed a natural gas pipeline to be converted into a multistate CO2 transport network but based on very specific considerations. Further, FERC has declined to broaden its mandate to include CO2 pipeline transportation or its economics, basing its authority to a very precise interpretation of its empowering legislation and Supreme Court rulings to avoid criticisms of regulatory overreach.

That said, the Utilizing Significant Emissions with Innovative Technologies (USE IT) Act (enacted in 2020), which created two new task forces to help inform responsible development of CCUS, promises to bring some clarity and uniformity to CO2 pipeline permitting. The task forces' remit is to provide recommendations to the federal government on efficient CCUS permitting by reflecting inputs from a wide range of stakeholders. Both task forces are assigned to develop, among other things, common models for state-level CO2 pipeline regulation and oversight guidelines for the Outer Continental Shelf and nonfederal lands. These initiatives could provide some clarity between federal-state authority, but they are slow moving and no recommendations have emerged thus far.

Prolonged delays and/or cancellations of CO2 pipeline projects could also begin to have a financial impact, potentially preventing project developers from enjoying the full tax incentives from the IRA, many of which are time-bound (ending in 2033). This could also affect companies intending to utilize their CCUS projects to produce biofuel to qualify for California's (and wider West Coast states') low-carbon fuel standard credits.

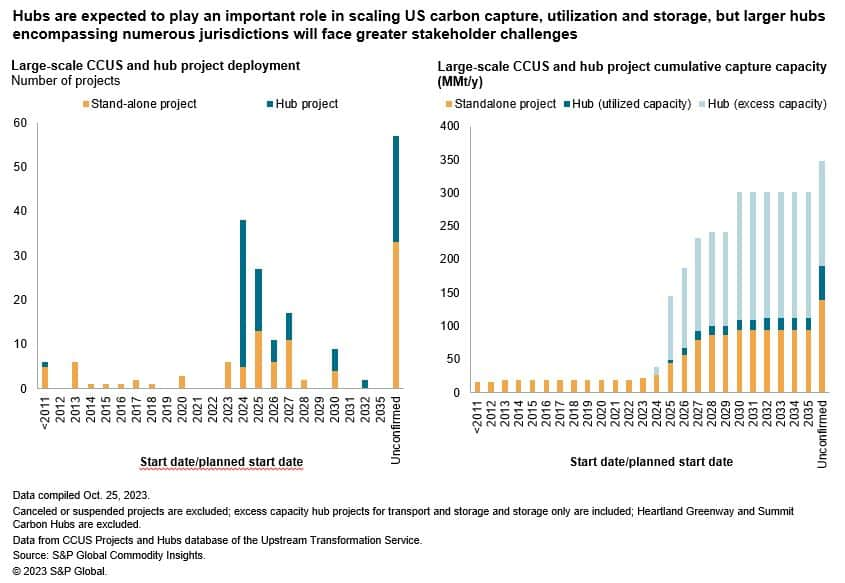

In the absence of action to streamline permitting and regulatory processes for such projects, CCUS project developers may pivot to point source rather than hub models (although most capture facility locations lack the appropriate geological storage). Alternatively, developers might eye areas where there are existing CO2 pipelines with unutilized capacity for carbon capture hubs, or where existing pipeline rights-of-way could be repurposed for CO2 transport. This could drive the concentration of carbon capture projects in a few regions only, potentially stranding large-emitting assets in areas lacking CO2 transport and storage infrastructure.

Already a subscriber to our Upstream Transformation service? Check out our new low-carbon incentives dashboard.

*******

Terence Khoo, Research Specialist, terence.khoo@spglobal.com

Cedric Lee, Research Specialist, cedric.lee@spglobal.com

Syazana Shamsuddin, Research Analyst, syazana.shamsuddin@spglobal.com

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.