Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 25, 2023

As Turkey looks to address its growing gas demand, we assess the implications and challenges posed by the country's prized Sakarya development.

Turkey's reliance on natural gas imports to meet its energy demands has been a long-standing challenge for the country. Over 98% of the country's annual gas consumption was imported in 2022, making natural gas the primary energy source for electricity generation. As per recent estimates, Turkey's annual gas consumption amounts to around 1.9 Tcf per year, with the majority being piped from neighbouring Russia or imported as Liquified Natural Gas (LNG) from the USA and Qatar. The Sakarya development offers the potential to address this issue. With an expected production capacity of 350 MMcfg/d in phase one, the project is projected to meet roughly 7% of Turkey's domestic electricity demand, and this contribution is expected to rise to around 27% with the introduction of phase two. However, as Turkey's energy consumption continues to escalate, achieving gas independence has become an increasingly complex task.

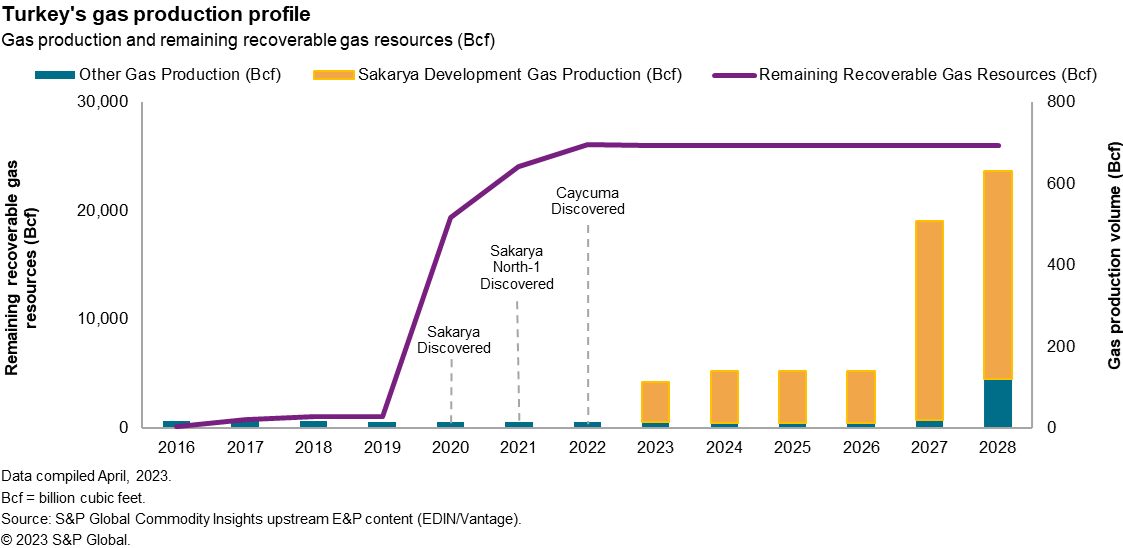

Figure 1: Graph showing Turkey's annual recoverable gas resources and production, including forecasted values based on S&P Vantage data.

In recent years, Turkey has made substantial investments in advanced gas infrastructure, which is administered by the state-owned BOTAŞ Petroleum Pipeline Corporation (BOTAS). Alongside an extensive national pipeline network, the country has the capacity to store around 205 billion cubic feet (Bcf) of natural gas, with future plans to expand its underground storage capacity to 353 Bcf. Despite this, limited onshore discoveries and low recoverable gas resources have resulted in domestic production being unable to match the nation's infrastructural capacity. Figure 1 highlights this issue, depicting Turkey's persistently low annual gas production from 2016 through to 2023, at which point the Sakarya development comes onstream.

Sakarya, previously known as Tuna, was discovered in August 2020 and is the largest discovery in the Black Sea, with an estimated 18 trillion cubic feet (Tcf) of proved and probable (2P) gas resources. The North Sakarya-1 field, located approximately 45 km northeast of Sakarya, was discovered shortly after in May 2021 and has estimated 2P resources of around 4.5 Tcf. These discoveries have increased the country's recoverable gas resources twenty-fold in just four years and are expected to be developed as part of a two-phase Sakarya development program, as projected by S&P Vantage.

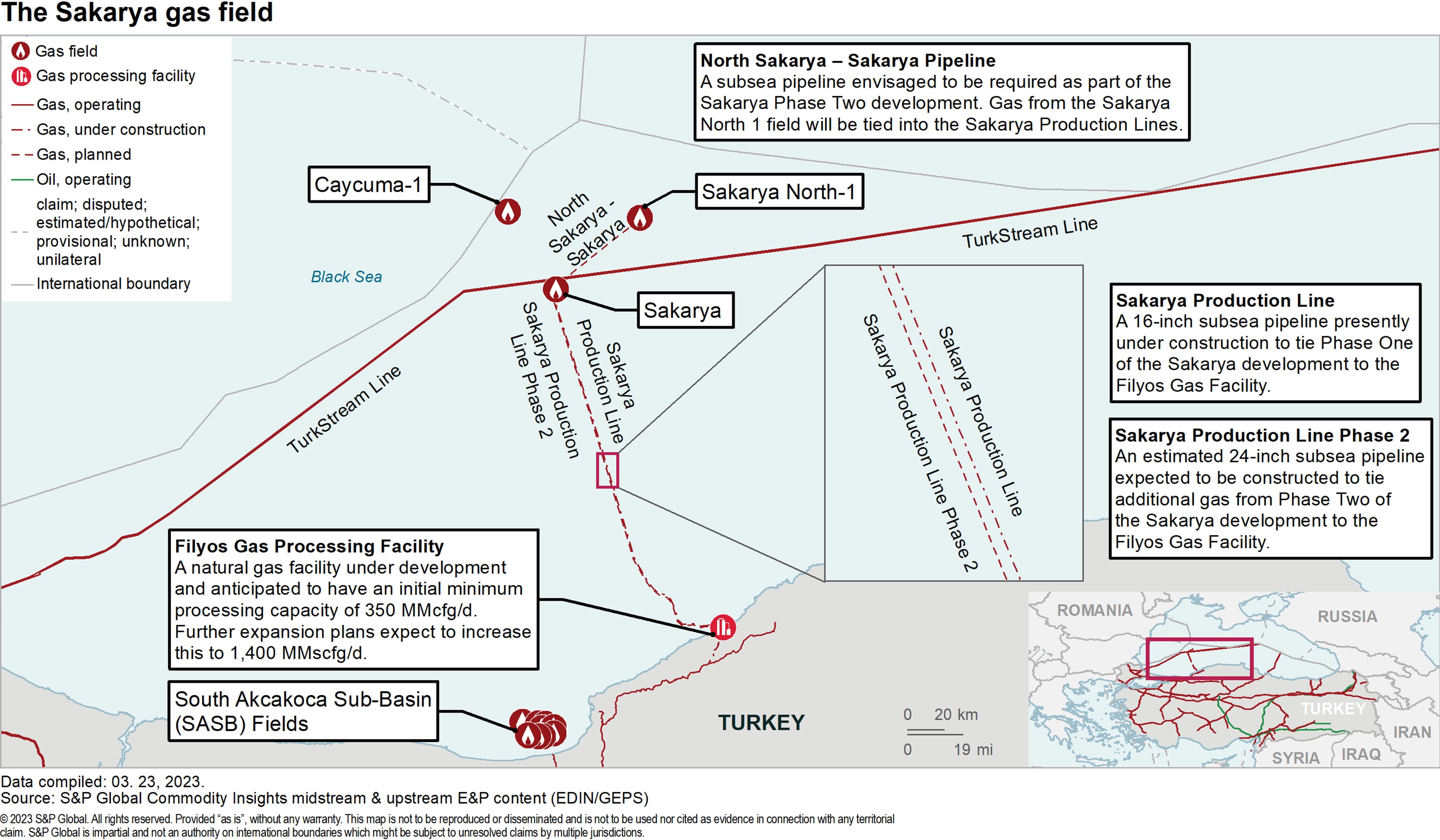

Figure 2: Map illustrating the proposed outlook for the Sakarya field development, including potential midstream facilities and infrastructure for further expansion.

Sakarya will become the country's first ultradeep water (>2,000 m) development. Türkiye Petrolleri Anonim Ortaklığı (TPAO), Turkey's state-owned oil and gas company, holds a 100% working interest in the asset and serves as the field's operator. Initial reports suggested that TPAO was considering an operating partnership to develop the field; however, it subsequently decided to adopt an independent development plan. A potential benefit of this approach is the option to sell the produced gas at near-breakeven prices to BOTAS, to then be utilised domestically. Nonetheless, the project presents a significant challenge regarding the substantial upfront capital cost and expertise required for an ultradeep water development, especially given this is the TPAO's first endeavour of its kind. In this regard, Schlumberger and Subsea 7 were awarded an engineering, procurement, construction, and installation (EPCI) contract in October 2021 for phase one of the project.

The asset lies around 155 km north of the Port of Filyos, in the Caycuma district of the Zonguldak Province, Turkey. Phase one consists of a multi-well program, comprising the drilling of ten new production wells, and solely targets the Sakarya field. A 16-inch, 165 km subsea pipeline has been installed to tie the dry gas to a newly constructed onshore processing facility, as illustrated in Figure 2. The facility lies within Turkey's Filyos development zone and has a maximum capacity of around 350 million cubic feet of gas per day (MMcfg/d).

Plans for phase two are less defined, but based on S&P Vantage modelling assumptions, are expected to involve an expansive drilling campaign for the Sakarya field and include the development of North Sakarya-1. Thirty production wells are expected to be drilled as part of this phase. Two new pipelines have been assumed to be required. The North Sakarya - Sakarya subsea pipeline will tie gas into Sakarya. A new 24-inch pipeline will also be constructed in parallel to the existing phase one Sakarya pipeline. Gas from both fields will be tied into the same Filyos production center, whereby additional processing trains will be installed to accommodate for the additional capacity required.

Figure 3: Graph showing the gas production profile for the Sakarya development, forecasted to 2050.

The production profile in Figure 3 illustrates that phase one of the Sakarya development will reach a plateau rate of 350 MMcfg/d by 2024, with the expected number of wells already drilled on site. Phase two is envisioned to come online in 2027 and is forecasted to reach a peak production rate of 1,050 MMcfg/d by 2028. Therefore, the total peak production for the asset will be 1,400 MMcfg/d. Once processed, the gas from the Filyos facility is expected to be transported approximately 80 km to the existing Erdemir thermal power plant for domestic electricity generation.

In December 2022, a third major gas discovery, Çaycuma-1, was announced in the Black Sea with 2P resources of 2 Tcf. This represents the third Tcf-sized gas discovery made in the last three years, demonstrating the promising potential for further discoveries in the region. If additional gas discoveries of similar size are made, the percentage contribution towards meeting Turkey's domestic demand will rise significantly. These discoveries have opened up a new play in the Black Sea, and TPAO has already deployed three drill ships working continuously in the area, indicating that extensive drilling work is expected in 2023/24. However, future development strategies will be based on the success rate of the Sakarya development and may require partnerships with international oil companies, depending on the level of capital risk TPAO is willing to accept.

In conclusion, the Sakarya development has the potential to contribute around a quarter of Turkey's future energy demand. Although Sakarya is not expected to completely resolve Turkey's gas import dependency, it represents a pivotal initial step for future developments. If TPAO's first ultradeep water project proves successful, it is likely to act as a catalyst in accelerating exploration efforts in the region to help Turkey achieve gas dependency in the long term.

***

For further insight, kindly refer to the article in the upcoming July 2023 issue of the PESGB titled 'Turkey's Energy Future'.

Want to access more upstream content? Visit S&P EDIN & Vantage.

Posted 25 April 2023

by Kishore Thamilselvan, Senior Technical Research Analyst, S&P Global Energy

and Ana Saez Fuentes, Senior Technical Research Analyst II, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.