Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jul 12, 2024

By Logan Reese

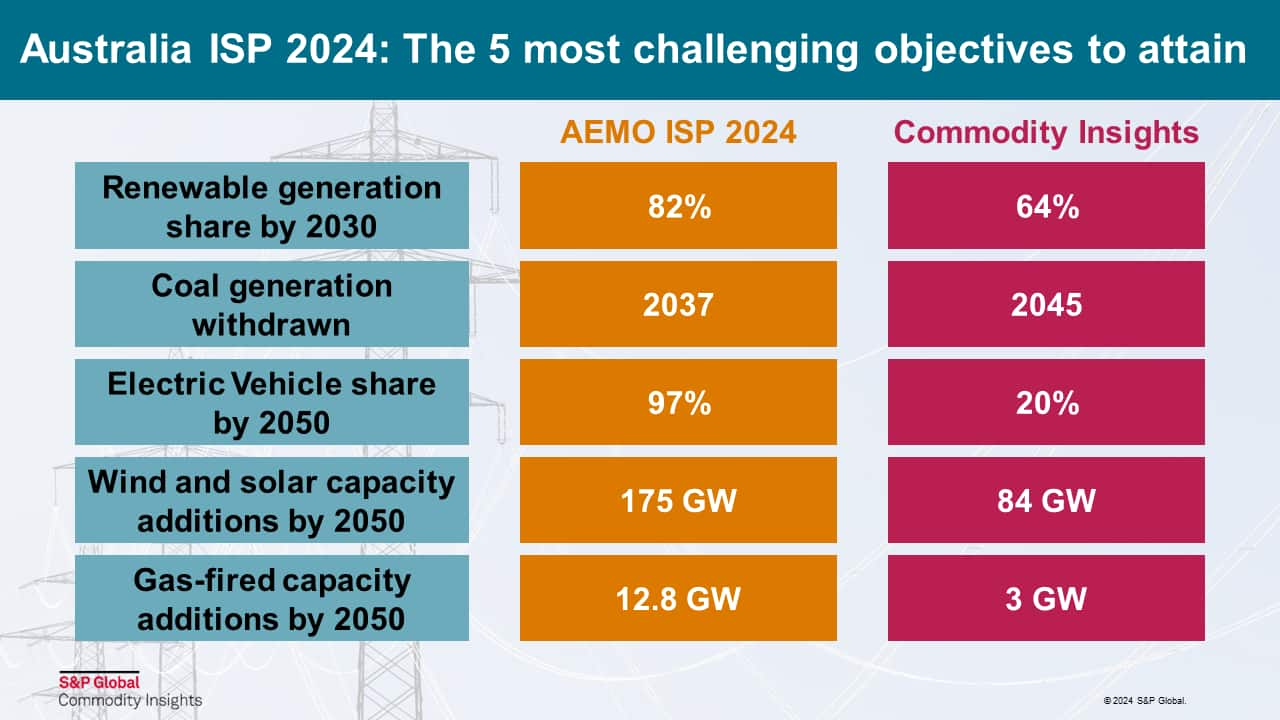

On June 26, the Australian Energy Market Operator (AEMO) released the Integrated System Plan (ISP) 2024 — a development path to transition the National Electricity Market (NEM) to net-zero by 2050. The ISP suggests that renewable energy connected with new transmission and upgraded distribution, firmed with storage and backed by gas-fired generation, is the lowest-cost, most resilient, pragmatic path to achieving the government's targets. S&P Global Energy latest long-term outlook for the NEM is in general agreement with the primary findings of the ISP, but differences emerge within the timeline and the development pathway.

Fundamentally, the ISP is not a projection. Rather, it is the least cost scenario to serve as a blueprint to achieve government ambitions with current state and federal energy policy and targets as direct inputs into the modeling constraints. Moreover, the results of the ISP are used to inform governments about the required investment — and the timing of that investment — to realize policy goals and targets. By contrast, Energy latest outlook is a projection of the development path of the NEM, which does not directly enforce targets when forecasting the power system. Nevertheless, like the ISP, Energy is anticipating a high level of renewable penetration of over 90% in the NEM by the 2040s but by way of a slower growth rate of renewable generation.

Coal Phaseout

The recent government policy changes have accelerated the energy transition in the ISP 2024 over the prior ISP outlooks, including phasing out coal six years earlier than the ISP 2022. Retirement dates have been announced by all but one coal-fired power station, with roughly half of the installed capacity scheduled to retire by 2035 and a full phaseout by 2051. AEMO's ISP 2024 anticipates a rapid acceleration of the retirement schedule with 90% of the NEM's coal-fired capacity to retire before 2035 and the entire fleet by 2037. Energy expects the retirement schedule to accelerate but assumes a slower paced exit is needed to ensure system security (a risk identified by AEMO) with 65% retired by 2035 and a full phaseout by 2045 — eight years later than the ISP.

Power demand

Fuel switching from natural gas to renewables-based electricity is a key component of the government's strategy to decarbonize low-energy-intensive applications such as home and commercial use. Electrification is under way with the current slow pace of early adoption expected to be stimulated by financial incentives, low interest loans, and more importantly, the recent bans on new gas connections in Victoria and the Australian Capital Territory. However, high upfront costs and consumer behavior are likely to limit electrification rates in the near term, accelerated in the long term by the end of life of existing gas-based applications. Although, efficiency gains from new appliances combined with improvements in building energy efficiency will slow demand growth in these sectors.

The ISP 2024 calls for stronger growth in demand compared to the ISP 2022, with the latest report showing a near doubling of electricity demand by 2050 (including efficiency gains) — driven by an uptake in EVs, hydrogen production and electrification. Energy forecasts a much slower adoption of EVs, alternative location for hydrogen production, a delay in electrification of gas-based end uses and slower efficiency gains — resulting in an estimated 37% increase in on-grid power demand by 2050.

Renewable capacity additions

To help meet the supply gap of the ISP's coal retirement schedule and the expected growth in demand while achieving the 82% renewable generation target — AEMO envisages a total 29 GW of onshore wind, 7 GW of utility scale solar and 19 GW of distributed solar capacity additions by 2030. However, renewable capacity additions are becoming constrained by the availability of high-capacity transmission, which has been compounded by increased financial risk in the wholesale market with declining captured prices that incentivize battery colocation. Moreover, the slower growth expected in Energy demand outlook compared to the ISP requires fewer wind and solar capacity additions. Consequently, Energy latest forecasts call for 6 GW of onshore wind, 0.6 GW of offshore wind, 8 GW of utility scale solar and 15 GW of distributed solar capacity additions by 2030 — reaching the ISP's 82% renewable generation in 2036, six years beyond the government target.

Firming Capacity

New firming capacity will be required to back variable wind and solar generation in the wake of the phaseout of coal-fired generation. AEMO and Energy expect energy storage — primarily in the form of pumped hydro and battery energy storage systems — backed by gas-fired generation to provide the required firming capacity to support a variable generation-based power system. However, the ISP places a heavy reliance on coordinated energy resources such as rooftop solar, home batteries, and virtual power plants — an assumption that requires participation by reluctant consumers. Conversely, Energy assumes the transition of the power system will largely remain in the hands of developers with a stronger uptake of utility scale capacity and less coordination of behind-the-meter generation and storage. Furthermore, Energy outlook calls for lower gas-fired capacity and stronger uptake in energy storage (relative to installed wind and solar capacity) compared to the ISP thanks to rising gas prices and gas supply availability together with declining battery storage costs and technology advancements.

Conclusion

Energy latest outlook views AEMO's rate of change in the energy transition as too ambitious and there are several signposts to watch out for as an indication of the influence of the ISP on stakeholders as well as shifts in future ISP outlooks, including early coal retirements, development plans for renewable energy zones, advancement of new regional interconnectors and the federal elections expected in 2025.

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.