Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 21, 2024

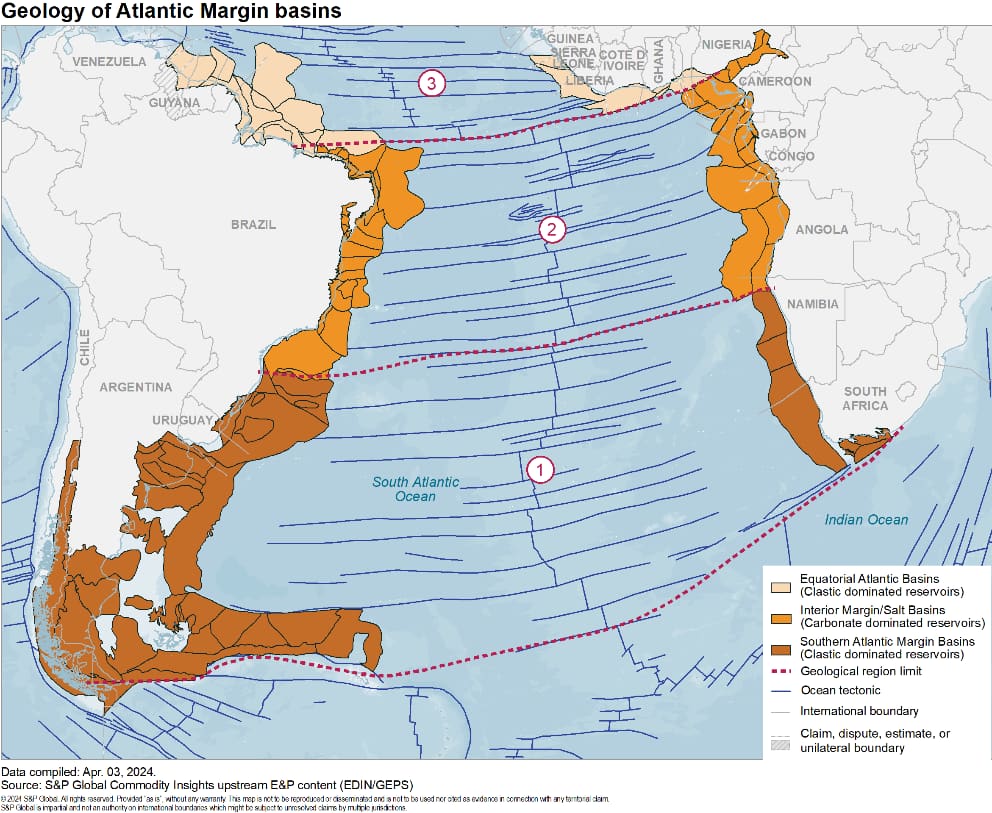

The Atlantic Margin play — focused on the coastal basins of western Africa and eastern South America — is drawing increasing strategic focus and exploration and production (E&P) spend from upstream investors due to rising prospectivity. Recent discoveries by international oil companies (IOCs) in Guyana and Namibia have ignited exploration activity across frontiers (e.g., São Tomé and Príncipe, Uruguay) and producers (e.g., Angola, Brazil), making the margin one of the most active areas for E&P globally.

Discoveries in the Atlantic Margin basins account for 40% of oil and gas volumes discovered globally since 2020 and more than half of the top-20 discoveries by volume. Liquids represent two-thirds of recoverable volumes located offshore in Atlantic Margin basins, increasing the likelihood that resource monetization can be expedited. By 2050, about half of the expected global oil supply will come from fields or projects that are not in production today, creating a favorable global oil demand picture for Atlantic Margin discoveries.

The Atlantic Margin's openness to foreign investors sets it apart from other prolific basins globally, and the margin's E&P hotspots boast the large reserve bases, lighter crude grades and favorable fiscal terms that will secure IOC interest and activity and make the region a key source of future supply. In 2024, twenty of the 39 global high-impact wells targeting prospects of at least 250 million barrels of oil equivalent are located on the margin.

However, above-ground risks will determine whether host countries can maximize their below-ground potential. Atlantic Margin countries range from frontiers to declining producers, with each phase bringing new policy pressures as host governments seek to balance investor incentives with revenue maximization. As countries move from discovery to production, governments generally increase fiscal take to generate income and set local content regulations to support economic development. Conversely, production declines can compel governments to relax E&P terms, as has occurred in Angola.

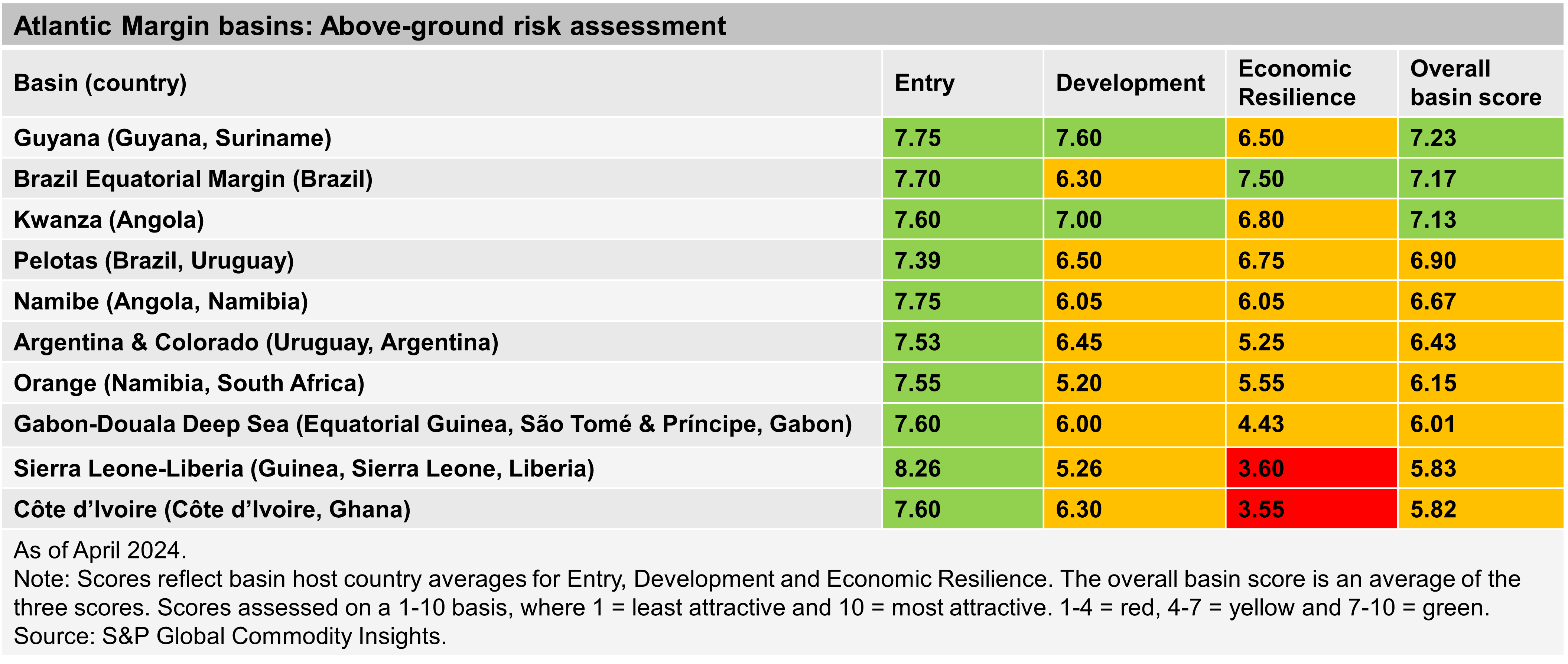

Considering geological potential, investor interest and upcoming entry opportunities, we selected promising Atlantic Margin basins and assessed them using our Entry, Development, and Economic Resilience risk aggregates to determine which countries offer a conducive investment environment for long-term upstream projects. South American basins generally scored higher (indicating lower risk) than basins in Africa, mainly due to higher host country scores for Development and Economic Resilience (see table below). The basin performance assessments were based on detailed analysis of the corresponding host countries.

The selected basins score relatively well for Entry, as expected for a group mostly comprising frontiers and producers seeking investment. However, Atlantic Margin countries score lower on Development due to a lack of established infrastructure and rising civil society risks in frontiers, and poor contract sanctity and high policy volatility in declining producers. Limited Economic Resilience is a key watchpoint for Atlantic Margin countries. African countries in particular are expected to face difficulties weathering economic crises without introducing distortionary economic policies with the potential to negatively affect upstream investments.

From an above-ground perspective, the Guyana Basin and Brazil's Equatorial Margin Basins are the most attractive in the Atlantic Margin, with the Côte d'Ivoire Basin and Sierra Leone-Liberia Basin posing the highest risks. In the next five years, Namibia (Orange Sub-basin) and Suriname (Guyana Basin) are well positioned to join Guyana as important sources of new production volumes, with their respective governments following Guyana's lead in taking steps to avoid many of the pitfalls that have historically plagued petrostates around the globe.

This article is an excerpt from the Oil and Gas Risk Quarterly Report, Margin calls: Risk and opportunity in Atlantic Margin conjugate basins. To access the report via subscription, click here. To learn about the product, click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.