Published February 2023

Lime, or calcium oxide (CaO), is derived through the decarbonation of limestone. The primary product of limestone decarbonation is called quicklime; it can be hydrated to form hydrated lime or calcium hydroxide (Ca[OH]2). Quicklime is used primarily in metallurgy (steel) and flue gas desulfurization, while hydrated lime (also known as slaked lime) is used in construction (soil stabilization) and water treatment. Limestone, a sedimentary rock composed mainly of calcium carbonate (CaCO3), is the precursor in the manufacture of lime and precipitated calcium carbonate, and is an important raw material with a wide range of applications; its primary use is in the construction industry, where it is the principal source of crushed rock aggregate. It is also an essential raw material for cement manufacture, and a source of building stone.

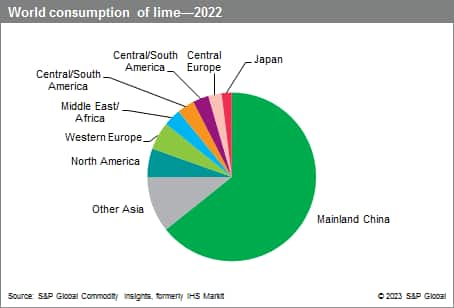

The following pie chart shows world consumption of lime:

The production of lime increased steadily during 2016–19 but declined in 2020 in most regions apart from mainland China. In 2021, the production of lime reached a high point, with strong demand recovery in all sectors following the pandemic shutdowns in 2020. However, lime production in mainland China declined in 2022, as the zero-COVID-19 policies and lockdowns continued throughout 2022, leading to reduced demand for lime in the metallurgy and construction sectors. Even so, mainland China continues to lead the production and consumption of lime and will remain one of the fastest-growing markets during the forecast period. In developed regions, such as North America, Western Europe, and Japan, the production of lime is a mature industry characterized by consolidation among regional producers, each servicing its regional markets; however, this consolidation has slowed since 2018.

The major use for lime is in metallurgy, primarily in steel production as a flux to remove phosphorus, sulfur, silica, and manganese from the molten steel. Lime is also used in aluminum and magnesium metal production and in the processing of other metal ores (copper, gold, nickel, zinc, cobalt, and lead). Soil stabilization is the primary use for lime in construction; other construction markets include asphalt, mason’s lime used in mortars and concrete, and finishing lime for plasters. Environmental uses, including flue gas desulfurization, potable water treatment, and wastewater treatment, are expected to be some of the fastest-growing applications through the forecast period. The majority of the remaining consumption is for various chemical and industrial uses, such as production of precipitated calcium carbonate (PCC), aluminum oxide, calcium carbide, and soda ash; use in sugar refining, glassmaking, and leather tanning; and direct use in agriculture to neutralize acid soils and provide essential nutrients.

There is relatively very little trade worldwide, primarily because lime is readily available in all parts of the world, and transportation costs can account for a significant portion of the product value. The two largest producers of lime with a worldwide presence are the Lhoist Group and the Carmeuse Group, both headquartered in Belgium. However, there are also local producers with large capacities serving the local markets in metallurgy, construction, chemicals, and agriculture. Some large consumers in these industries have substantial capacities to cover their internal needs.

Overall consumption is forecast to grow at 2.0% annually during 2022–27, led by the largest market, mainland China. The highest growth will be seen in Other Asia, particularly Malaysia and Vietnam, where new steel plants and construction projects will increase the demand for lime by 3–4% per year on average over the forecast period. The fastest-growing markets are expected to be chemical and industrial applications, followed by metallurgy, driven by increasing steel production.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook - Lime and Limestone is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook - Lime and Limestone has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with IHS Markit’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability