Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 17, 2023

By Emma Xie He and Sam Huntington

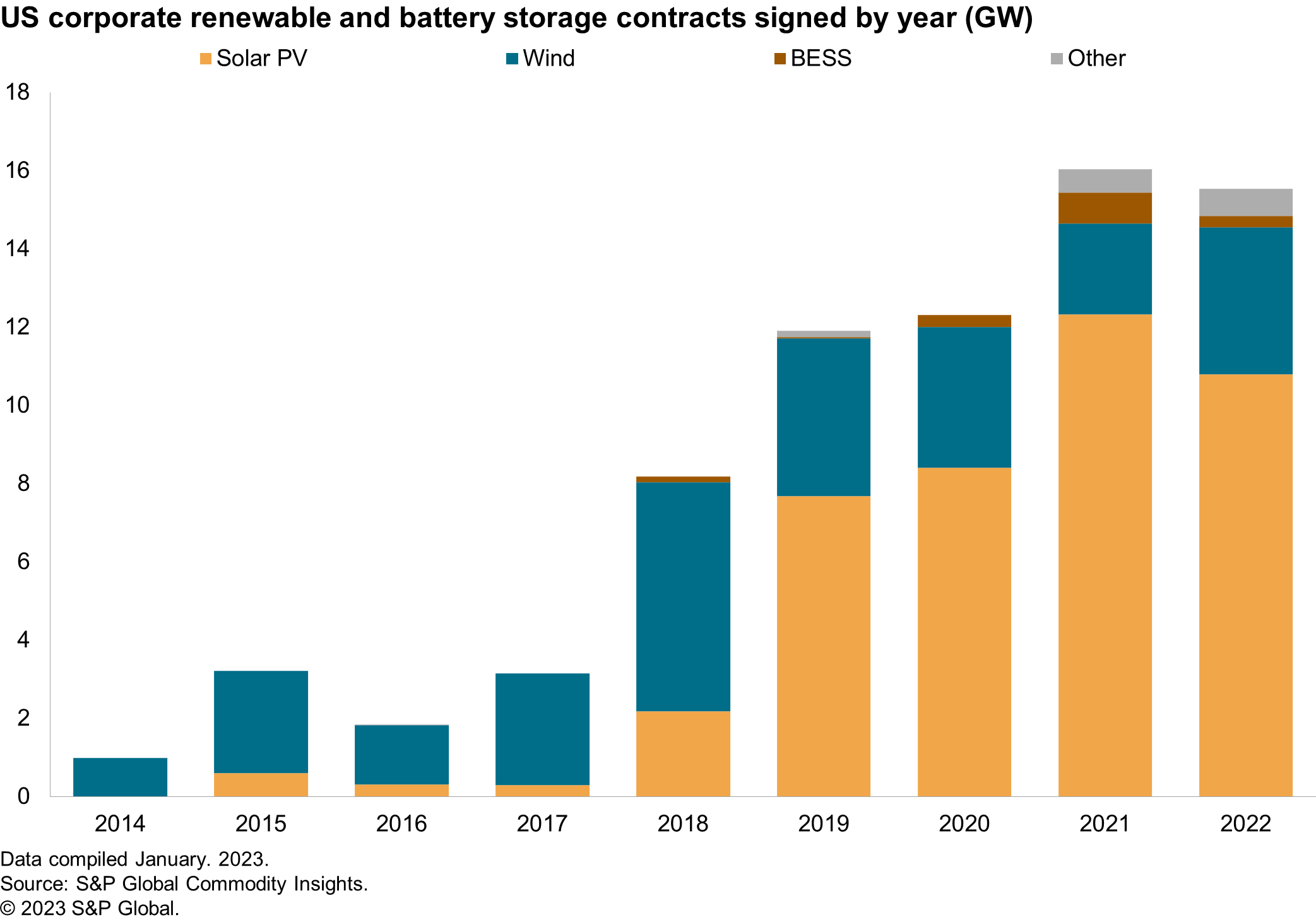

Procurement of renewable energy by corporations continues to expand in the US. Corporates have procured more than 70 GW of project specific renewable capacity since 2014 (including direct PPAs, virtual PPAs, and green tariffs). The past decade of corporate procurement has been fueled by a surging number of corporations committing to climate targets, the falling cost of renewables (prior to the current uptick), and the expansion of procurement channels across the country.

In 2022, the market share of renewable capacity contracted by the corporate sector surpassed 50% of the total PPA market. Technology giants have played a significant role in renewable procurement since early 2010s, accounting for over half of contracted capacity to date. The pool of buyers also continues to diversify, with manufacturing, retail, and energy sectors accounting for an increasing share of contracts signed since 2018. In terms of resource types, solar has led all technologies since 2018 when it overtook wind.

S&P Global's most recent outlook foresees continued expansion of corporate demand for clean energy through the end of the decade. Our analysis is based on a database of over 1400 companies operating in the United States that have exhibited climate ambition, either by setting procurement targets or disclosing their emissions. The outlook is driven by several factors:

Analysis of existing procurement trends, company targets, progress toward targets, power consumption patterns, state policies, green tariff programs, solar and wind economics, and timelines for transitioning from contracting to installation provide insight into S&P Global's recently released outlook for corporate procurement,

In this planning case outlook, solar continues to be the most contracted resource of the total corporate renewable market, owing to its low cost and the widespread availability of projects. In terms of regional distribution, ERCOT renewable corporate demand will make up a notable portion of the increase in the next few years before slowing down as development grows in regulated markets at the end of the decade. In the high case outlook, we expect expanded ambition among companies, escalating procurement strategies and accelerated renewable demand.

To learn more about our corporate renewable procurement research, visit our Clean Energy Procurement page.

For more North America research, visit our North America Regional Integrated Service page.

Emma Xie He, senior research analyst with the Gas, Power & Climate Solutions team at S&P Global Energy, focuses on corporate renewable procurement and power market fundamentals.

Sam Huntington, director with the Gas, Power, and Climate Solutions team at S&P Global Energy, focuses on energy storage and power market fundamentals.

Posted 17 February 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.