Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 08, 2022

By Benjamin Levitt, Etienne Gabel, and Rama Zakaria

In 2021, the world economy rebounded amid the continued stresses of the COVID-19 pandemic, global supply chain disruptions, several extreme weather events, and a global energy supply crunch marked by surging fuel and power prices.

As 2022 begins, our Global Power and Renewables team considers six key trends that we believe will define global power and renewable markets.

1) Electricity demand growth shifts closer to pre-pandemic levels.

Global power consumption slumped in the first year of the pandemic then rebounded in the second as the global economy transitioned from recovery to expansion. Chinese demand for electricity, which accounts for over 30% of global demand, roared ahead in 2021 driven by strong economic growth. Outside of China, global electricity demand in 2021 is likely to have recovered to right around the 2019 pre-pandemic level. By the end of 2021, electricity demand in half of the largest electricity consuming nations is anticipated to have reached or exceeded pre-pandemic levels.

Looking ahead, lock-down measures will continue to ease even as economies adapt to the new, highly contagious, though milder COVID-19 variant. In 2022, global economic expansion moderates as growth in real GDP and electricity demand is expected to shift closer to pre-pandemic levels.

2) The ongoing global energy supply crunch means another year of high and volatile power prices.

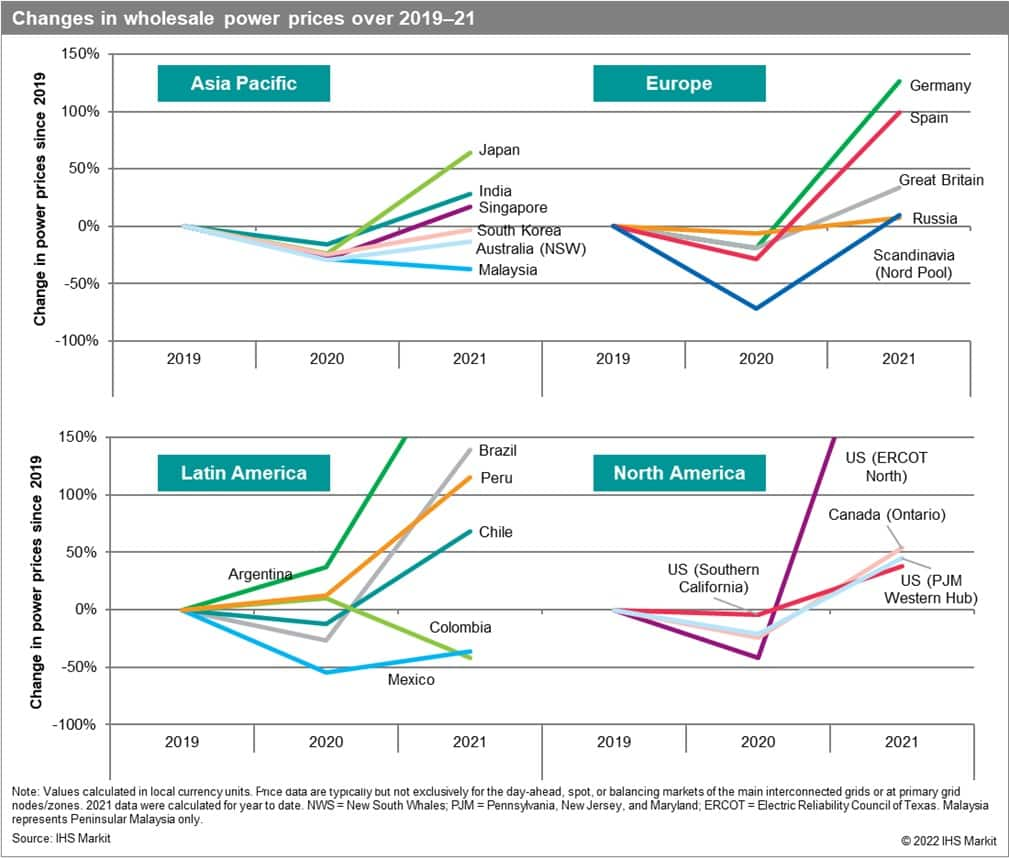

In 2021, the growth in global energy demand outpaced supply, leading to an energy supply crunch and soaring prices for globally traded fuels. Gas and coal prices traded at record levels with extreme volatility and European carbon prices hit record highs. Elevated gas, coal, and carbon prices fed directly into wholesale electricity prices (see figure below). In the third quarter of 2021, wholesale power prices averaged €97/MWh in Germany and France and €118/MWh in Spain, shattering all-time records, while a severe coal deficit in China contributed to one of the most widespread power shortages in recent history.

The dynamics that led to the 2021 energy supply crunch are not expected to moderate in 2022. Slowing economic and electricity demand growth in China, the US, and other large economies will reduce pressure on the demand-side but will not be enough to ease the energy supply crunch. In 2021, LNG liquefaction facilities operated at or near full capacity. Additional supply from newly constructed projects or facilities brought back online after maintenance or unexpected disruptions will struggle to keep pace with the rising demand in Asia and Latin America. The blowback against Russia following its invasion of Ukraine will exacerbate existing challenges. As of 2 March 2022, there are no direct sanctions on the trading of Russian energy commodities. However, sanctions on Russian banks and physical disruptions related to the conflict have impacted coal exports from Russia. And while no disruptions in gas flows from Russia to Europe have been registered, the conflict has elevated the risk of interruption and sent prices higher. Consequently, global power prices in 2022 will continue to reflect the ongoing tightness and volatility of the global market for gas and coal.

3) Supply chains are putting pressure on renewable costs.

Also in 2021, prices for key raw materials for wind and solar photovoltaics (PV) technologies increased up to three times, owing to pandemic-related supply chain disruptions, putting pressure on renewable costs. With prices for many raw materials expected to remain 20-30% above 2019 levels through 2023, wind and solar original equipment manufacturers are looking for ways to trim their supply chains to maximize growth while minimizing costs. At the same time, sustained high prices for raw materials will likely increase capital costs and levelized costs of electricity (LCOE) for solar PV and wind, at least through 2023. In India, an additional premium of 40% on imported solar modules - expected to be implemented in April 2022 - will further increase solar project costs while in Europe, supply chain risks are expected to continue in the long term especially for offshore wind. In the longer term, end consumer sensitivity to sustainability will impact supply choices and stimulate alternative supply chains that will increasingly focus on circularity and recyclable materials.

4) Renewables are expected to grow despite supply chain issues.

Despite supply chain bottlenecks and raw material price increases, renewables buildout worldwide is expected to continue strongly in 2022. Indeed, renewables often remain cheaper than thermal alternatives (on an energy-basis, at least), climate and renewable policies are proliferating, power market reforms are in some regions opening new doors, and the push by many corporations to procure clean energy creates new opportunities to get renewables to market.

Among these many drivers, the activity of corporate power consumers offers a broadening set of alternatives to monetize renewable power. Indeed, the procurement of renewables is diversifying from typical government tenders or renewable portfolio standard obligations—which will remain key tools to bring projects to market—to include direct power purchase agreements (PPAs) between project owners and corporations seeking to green their power.

For example, in Europe, renewable project owners signed over 22 TWh worth of corporate PPAs (CPPAs) in 2021—a 50% year-on-year volume increase. North America saw a record year for such CPPAs in 2021. In Latin America, Brazil is leading CPPA activity with contracts signed primarily with mining, refinery, chemicals, and manufacturing companies. Corporate clean energy procurement is expected to expand further in 2022—as will the formats and sophistication of these agreements.

5) Infrastructure challenges and grid reliability will dominate policy discussions.

As renewables continue to grow, infrastructure challenges will rise in importance. In Europe, for example, local opposition to the development of renewable infrastructure poses significant risk to the region's renewable ambition. With wind and solar resources typically located farther away from load centers, transmission is also gaining importance. In the United States, the Department of Energy recently launched the "Building a Better Grid" initiative to spur the development of long-distance, high-voltage transmission lines and transmission policy is a top priority for the Federal Energy Regulatory Commission. Meanwhile, the global energy supply crunch and climate-related extreme weather-induced power supply disruptions of 2021 have pushed supply security and grid reliability to the forefront of policy discussions. The variability associated with higher penetrations of wind and solar is also testing power system reliability, especially as climate change brings on more extreme weather.

As renewables become mainstream, ensuring that they provide additionality and align with power demand becomes more important. Spot markets will also be increasingly relied upon to provide real-time price signals and support peak demand and system flexibility. China, for example, is accelerating its spot market construction and in India, piloting of market-based economic dispatch and draft regulations on competitive ancillary services are key policy frameworks shaping the country's efforts to strengthen grid reliability. Sub-Saharan African countries are also gradually deregulating their power markets and introducing full or partial cost-reflective tariffs to ease the burden on strained utilities and allow investment in new generation and network upgrades.

6) The mix of clean technologies gaining policymaker and investor attention is broadening.

The tensions between decarbonizing power grids and ensuring reliable and affordable power supply are leading governments and companies to consider an expanding range of clean energy technologies. While established solar PV and onshore wind technologies will dominate new builds globally this year, attention will grow in 2022 on alternatives like battery energy storage systems, offshore wind, low-carbon hydrogen, carbon capture and storage (CCS), and nuclear.

To offer two examples among many:

Want access to this full report? Sign up for the Climate and Sustainability Hub to access selected energy research, analysis, and insights, in one integrated platform.

Learn more about our global power and renewables industry market coverage.

Etienne Gabel is a senior director with our Latin America gas, power, and renewables team.

Benjamin Levitt is an associate director with our North American Power and Renewables research team.

Rama Zakaria is an associate director in our Global Power and Renewables team.

Posted on 8 March 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.