Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Aug 21, 2023

Building the amount of wind and solar (and other resources) needed to achieve a US net zero power grid and a net zero economy will be a challenge on a number of logistical, supply chain, and regulatory fronts. One challenge that often gets scant attention is the basic question of revenue adequacy. S&P Global Energy research paper "Net zero's missing money challenge: US power market implications of the 2022 Fast Transition Case" dives in on that specific topic. Here are the highlights.

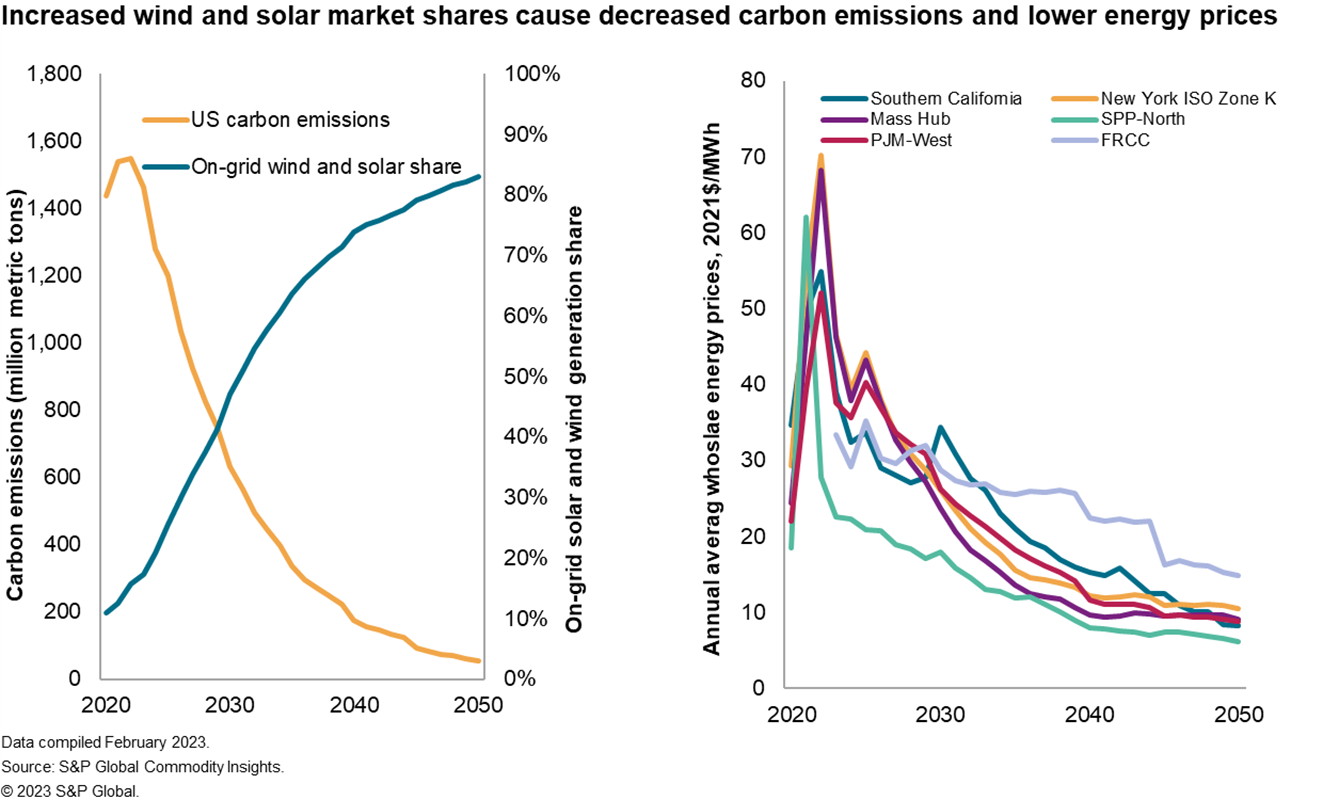

Renewable energy will pummel wholesale energy markets. An under-appreciated impact of the massive renewable energy buildout required to achieve a net zero carbon emissions economy is the likely implosion of the wholesale electricity markets. We expect this to happen because achieving net zero will flood the grid with solar and wind generators that bid at very low or zero prices reflecting their minimal variable operating costs, or even at negative prices if they need to continue operating to receive the benefit of production tax credits.

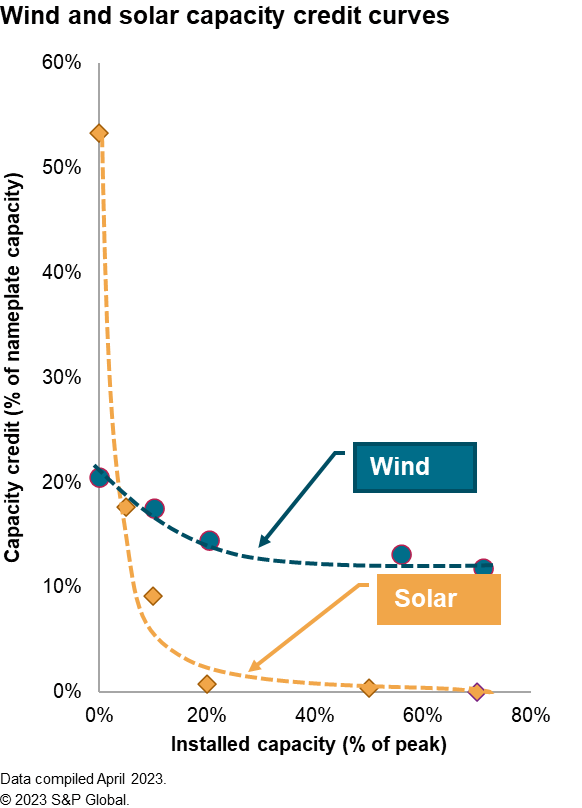

At these low prices, how will these renewables be paid for? Conventional wisdom holds that competitive wholesale power markets should be able to provide adequate compensation, including profit, for new power resources, including renewables. But that won't be the case with today's wholesale power market structures. Energy revenue from competitive markets will decline as prices drop; in effect the renewables are destroying the very market they will be most relying on. Capacity markets also will offer little compensation, as renewables' effective load carrying capability, which translates into capacity revenue, also declines as wind and solar penetration increases. As shown in the figure below, solar's capacity credit declines more rapidly than wind's. This is derivative from solar being only available during daylight hours and typically pushing the net system load towards the evening. Ancillary services can offer a third revenue stream, but these markets tend to be of low value owing to the number of potential suppliers.

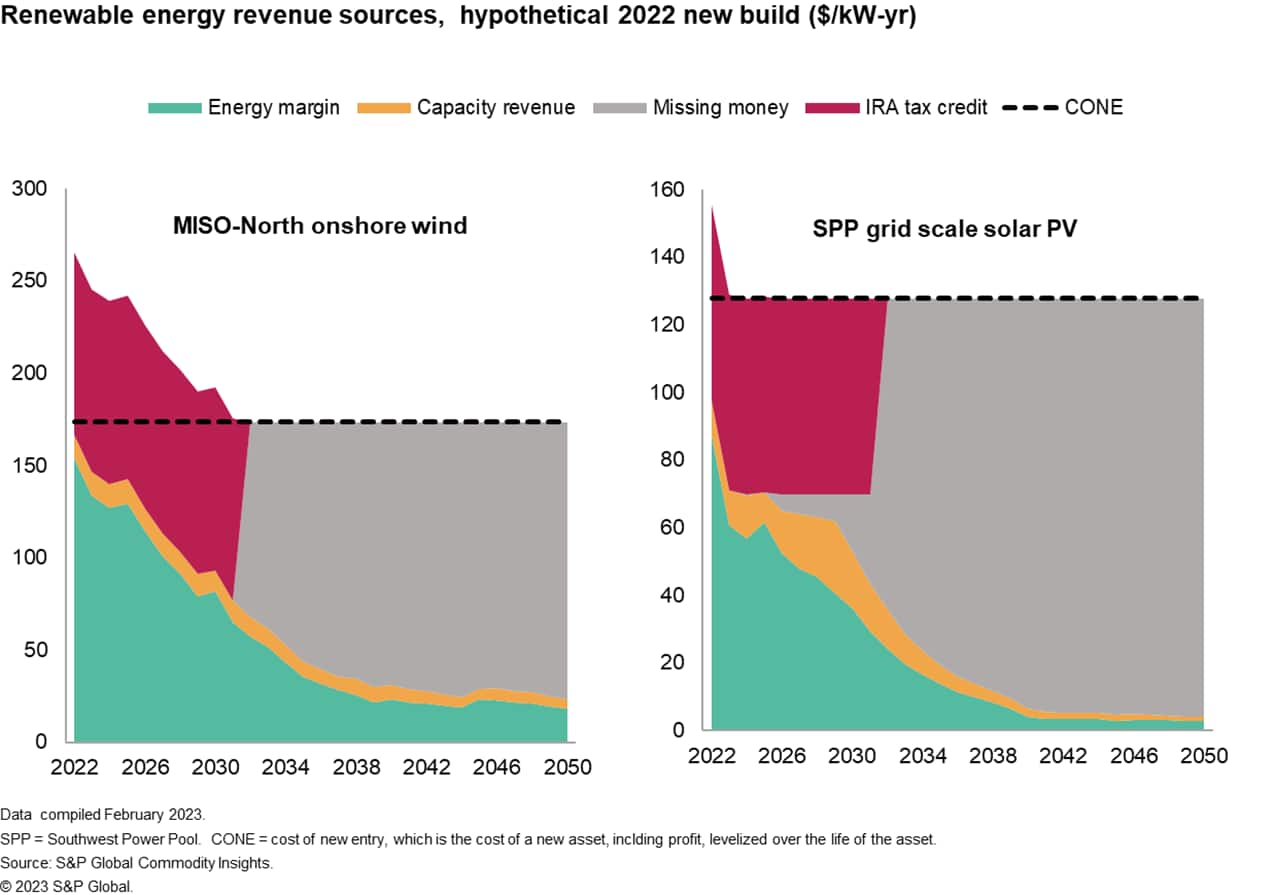

Follow the Missing Money. The net impact of the declining availability of these revenue streams is that wholesale power markets will not be compensatory for new renewable energy, creating a tremendous potential for revenue shortfall, which S&P Global characterizes as "Missing Money". This issue will be pervasive across the US in a net zero future; the two examples presented here—solar PV in SPP and wind in MISO-North—were selected to demonstrate Missing Money's universality. As indicated in the chart below, the clean energy federal tax credits in the 2022 Inflation Reduction Act (IRA) provide a substantial but time-limited boost to wind and solar financials. However, the IRA's tax credits are limited to the first 10 years of operations, back end loading the financial challenges. Furthermore, the IRA's tax credits phase out once US power sector CO2 emission decline 75% from 2022 levels, which S&P Global believes would occur around 2035 in a net zero by 2050 future, so these tax credits won't be available to later market entrants. And the likely decline in future wind and solar capital costs will not be enough to offset the lower market revenues.

Will these new renewables get built anyway? Yes. But not from today's market revenues alone. In a net zero future there will need to be other mechanisms in place to motivate investments. These could focus on wholesale markets via the development of new wholesale market "products" targeting these resources, or government mandates that shift the funding responsibility to load-serving entities who can then shift costs directly to end users, or continuation of IRA-style tax credits. Or quite possibly a combination of all three.

So where is the risk? The risk is in believing that the current wholesale market structure plus the current IRA tax credits are adequate—they are not. Those renewable energy developers considering purely merchant projects, or even those securing contracts for a time period shorter than the assets' expected lifetime, will find the current market and regulatory construct to be "un-bankable." Such merchant risk, even if it is only the "merchant tail risk" associated with a medium-term PPA, is too easily dismissed as something to worry about later, something that future regulation will help address. Maybe. But if past behavior is a window to the future, such merchant risks tend to be over-discounted by developers, and the markets should not be expected to be very accommodating to bailouts.

Learn more about our North American energy research.

Mark Griffith, Senior Research Director, S&P Global Energy, focuses on long-term strategic energy market analysis, assessing how factors like climate change policy and the competition among fuels and energy technologies can influence market participants' strategic and operational decisions.

Posted 21 August 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.