Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Oct 19, 2022

By Ian Conway and Keryn Tsimitakopoulos

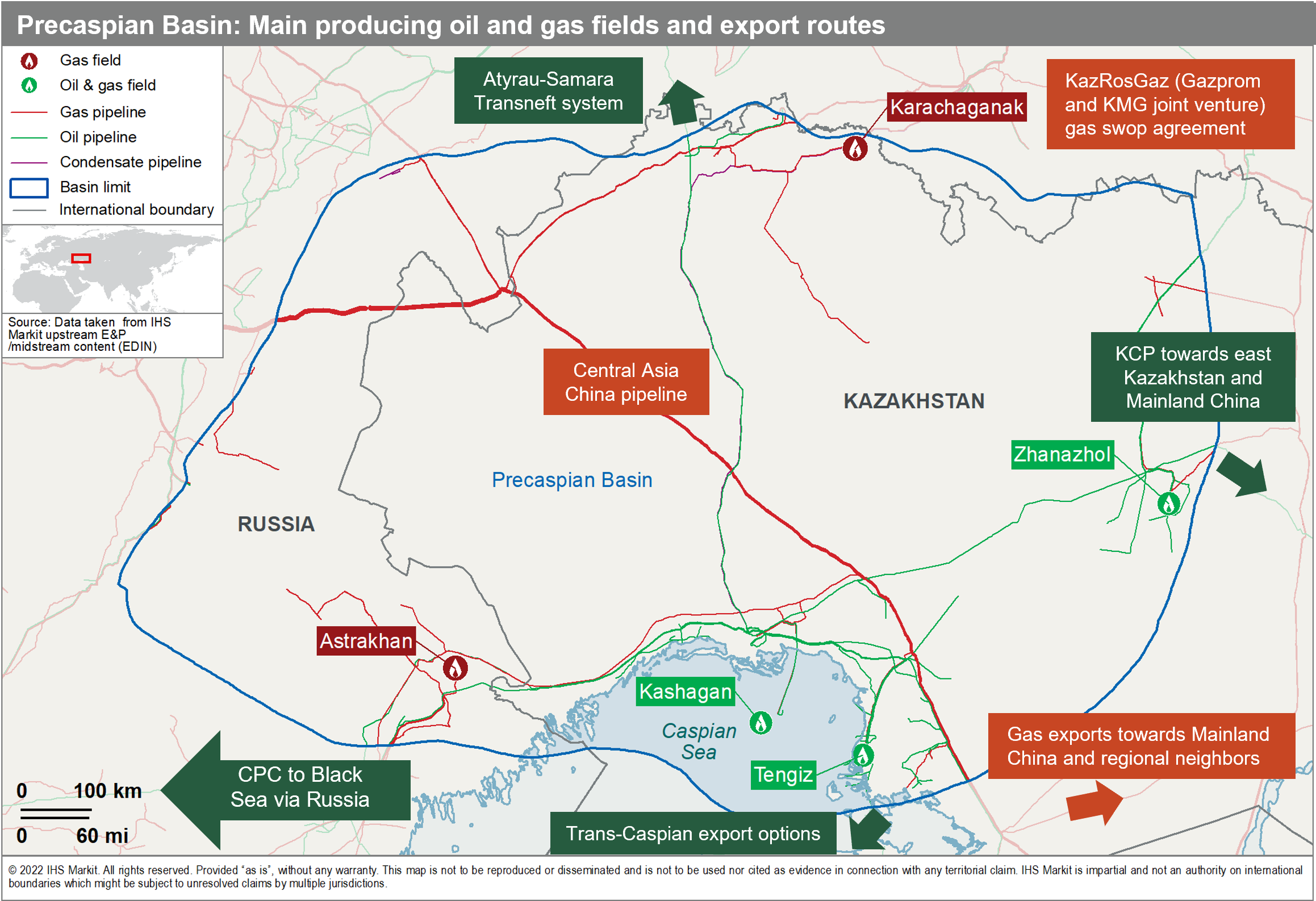

The Precaspian Basin, which lies in northwestern Kazakhstan and also partly in Russia, is one of the top global conventional basins in terms of total remaining recoverable resources, holding around 52 billion boe. Remarkably, over 82% of these volumes reside in just five giant and supergiant producing fields; Astrakhan in Russian territory, and Tengiz, Kashagan, Karachaganak and Zhanazhol in Kazakhstan.

The basin remains an important location for upstream value generation for global integrated oil company (GIOC) equity stakeholders Chevron, ExxonMobil, Shell, TotalEnergies and Eni, each holding varying interests in the key producing oil and gas fields. China's National Petroleum Corporation (CNPC) owns a stake in Kashagan, plus equity production from fields along the eastern basin margin.

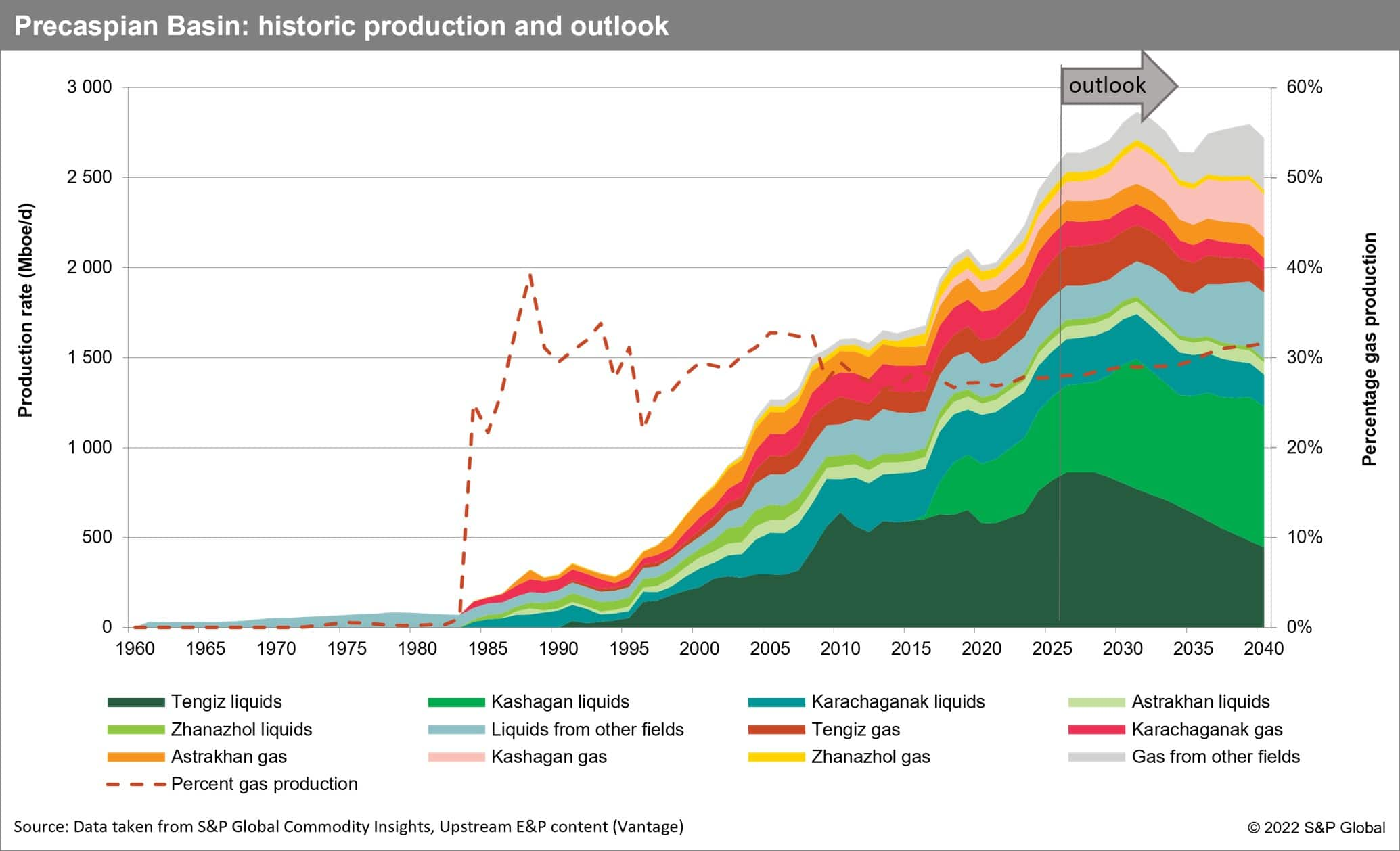

Historically, focused foreign-led investments have led to highly material oil and gas discoveries in the pre-salt play systems; and introduction of modern technology to the basin subsequently has paved the way for nearly unabated production growth since Kazakhstan declared independence just over 30 years ago. Existing and sanctioned projects could see basin liquids production growth of up to 500, 000 barrels per day over the next ten years, with total production of oil and gas volumes rising to over 2.8 million barrels of oil equivalent per day by 2032.

Over 3 billion bbl of liquids and 11 Tcf of gas remain in stranded projects within the basin, with no commitment towards development. Development challenges, particularly in the Southern Precaspian Subbasin, include the recovery of hydrocarbons from deep and complex fractured carbonate reservoir systems and the execution of operations within a very shallow and environmentally fragile offshore terrain. Aggregate capital spending for Tengiz and Kashagan, two of the world's largest upstream projects, has already exceeded $100 billion, with more development planned for both.

Kazakhstan hopes that the Kashagan field and its infrastructure will serve as an anchor for the development of satellite fields offshore, but GIOCs now appear reluctant to take on further full-scale "mega-project" developments. Instead, they prefer to invest in smaller scale phased projects in or close to fields which are already in production.

Precaspian hydrocarbons extracted from the pre-salt generally contain high levels of corrosive impurities and require significant processing to become palatable for international markets. With rising volumes of associated gas inhibiting crude production rates, further phases of field development will include the expansion of gas re-injection capacity, and upgrades to gas processing and transport facilities.

The basin's landlocked geographical location means that exports mostly rely on pipelines. The Caspian Pipeline Consortium (CPC) operates a 1500-kilometre pipeline running from Kazakhstan's Atyrau region to the Russian Black Sea port of Novorossiysk and includes Chevron, ExxonMobil, Shell and Eni among its stakeholders.

The CPC pipeline carries 80% of Kazakh crude and has been excluded from Western sanctions against Russia following the invasion of Ukraine because it remains the major export route for Kazakhstan's foreign-led Tengiz, Kashagan and Karachaganak oil producing assets.

Since June 2022, to avoid shipments being mistaken for Russian barrels, Kazakh producers have designated their product as "Kazakhstan Export Blend Crude Oil" (KEBCO). Buyers were initially reticent to take KEBCO, but now regular outlets have been established in Europe and buyers appear to be willing to pay a premium compared to similar medium sour crude from Russia.

The CPC has been subjected to various flow and loading disruptions this year—from storm damage in March, security inspections in July and repairs to cracks in subsea buoyancy tanks from the end of August — all of which have highlighted the vulnerability of crude exports from the basin. Kazakhstan would like to maintain the long-standing relationship with its northern neighbor, but there is a risk that Russia could block exports because of the significant crude ownership and reliance on the pipeline by Western companies.

Infrastructure damage caused by exceptionally adverse weather conditions during the 2021-2022 winter season and intensifying geopolitical tensions between Russia's trading partners have led the Kazakh authorities to encourage field operators to consider alternative export routes. Both trans-Caspian and eastward overland export routes towards China face a combination of economic and logistical challenges; however, the current high oil price environment could mean that some of the more expensive export solutions will be commercially viable over the near term.

The transition to greener sources of energy is presenting "new challenges" for the industry in Kazakhstan with an increased focus on ESG criteria.

More than 90% of Kazakhstan's remaining gas resources are found in the Precaspian Basin and development of gas infrastructure has allowed monetization of gas resources to both domestic and regional markets. More than 50% of Kazakhstan's population now has access to piped gas; whilst exports are routed to Russia, China, Kyrgyzstan, and small volumes to Uzbekistan.

The basin's natural gas resources will aid Kazakhstan's transition to lower carbon energy sources as it bridges the gap between coal and renewable power supply over the next two decades.

Satisfying domestic demand therefore remains the primary driver for boosting indigenous gas production; however, gas supply growth is being restricted by the need to reinject substantial volumes into giant and supergiant fields to enhance oil recovery. Current economic incentives appear insufficient to deliver adequate future domestic gas supplies.

This year Kazakhstan is offering record numbers of new block entry opportunities, with some licenses reserved for national companies.

In the Precaspian basin new offerings along the southern basin margin, near to the super-giant Tengiz development, contain producing assets with possible upside potential to be found in deeper sections. Nevertheless, GIOC's collectively are declining opportunities to acquire additional exploration acreage in the basin, apparently concerned over the high cost and long lead times for development projects, and the increased challenges over export routes. Kazakhstan authorities therefore are hopeful that the new block offerings will attract interest from domestic investors.

***

This blog is an extract from a featured basin profile report which is available for S&P Global Energy Connect platform Commercial Plays and Basins subscribers only.

***

For more information regarding basin scale commercial and strategic insights, please refer to Plays and Basins

For more information regarding contractual, fiscal and above-ground risk, please refer to E&P Terms and Above-Ground Risk

For more information regarding well, field and basin summaries and midstream infrastructure, please refer to EDIN

For more information regarding asset evaluation, portfolio view and production forecasts, please refer to Vantage

For detailed E&P activity coverage and context by country/territory, please refer to GEPS

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.