Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 15, 2023

Introduction

Because of the high oil and gas prices until about fall 2022 and the need, especially for European countries, to diversify, for energy security reasons, the number of hydrocarbons suppliers, there is an increased interest in exploring for petroleum (oil and gas) in the offshore of Algeria, Libya, and Morocco (concerning the latter, primarily in the Atlantic Ocean).

Until now, most of the offshore petroleum exploration and exploitation in the Mediterranean Sea has occurred, with generally positive results, in the Eastern Mediterranean off countries such as Cyprus, Egypt, Israel, and Lebanon.

Algeria, Libya, and Morocco share a strategic proximity to Europe, so that, in addition to utilizing their hydrocarbons for their own domestic consumption (especially in Algeria, domestic consumption has been increasing steadily over the past few years), they might export some of the production across the Mediterranean Sea.

This analysis provides some legal-fiscal notes to investors that might be interested in investing in Algeria's, Libya's, and/or Morocco's offshore oil and gas sector.

Algeria — Offshore Legal-Fiscal Terms

In Algeria, there is no stated distinction between the legal-fiscal regime for onshore and offshore hydrocarbons.

Yet, Art 202 of Law No. 19-13 of Dec. 2019 (the law that changed the hydrocarbon legal-fiscal framework) states that reduced rates of royalty and Petroleum Revenue Tax (in French, impôt sur le revenu des hydrocarbures, IRH), not less than 5% and between 10%-20%, respectively, may be granted in order to achieve sufficient profitability when one or more of the following three features are present:

As Algeria's offshore becomes deep quickly off the coast (in comparison to Tunisia's and Libya's offshore), reduced rates may be applied.

Libya — Offshore Legal-Fiscal Terms

Libya's legal-fiscal terms for offshore operations differ from those used in onshore operations in relation to the calculation of the contractor's profit share.

The share of production allocated to the contractor in sharing profit, which is called "excess petroleum," after deducting National Oil Corporation's (NOC, Libya's national oil company) primary allocation and cost recovery, is further shared between NOC and the contractor based on the remaining production and the ratio of the contractor's cumulative revenues to its cumulative costs (R-factor).

Excess petroleum is based on:

The balance of the excess petroleum is allocated to NOC.

Morocco — Offshore Legal-Fiscal Terms

Morocco distinguishes between onshore and offshore operations in relation to the royalty rates applied.

The royalty rates are between 10% and 7% for oil and 5% and 3.5% for gas based on the type of producing field, i.e., onshore and shallow offshore at the higher value, and deep offshore at the lower value.

For onshore and shallow offshore, the first 300,000 tons of oil and 300 million m3 of gas, and for deep offshore, the first 500,000 tons of oil and 500 million m3 of gas produced from each exploitation concession, respectively, are exempt from royalty.

For both offshore and onshore, a total exemption from corporate income tax (CIT, whose standard rates are between 10% and 31% depending on the taxable income) on production for a consecutive ten-year period is available from the start of regular production.

Conclusion

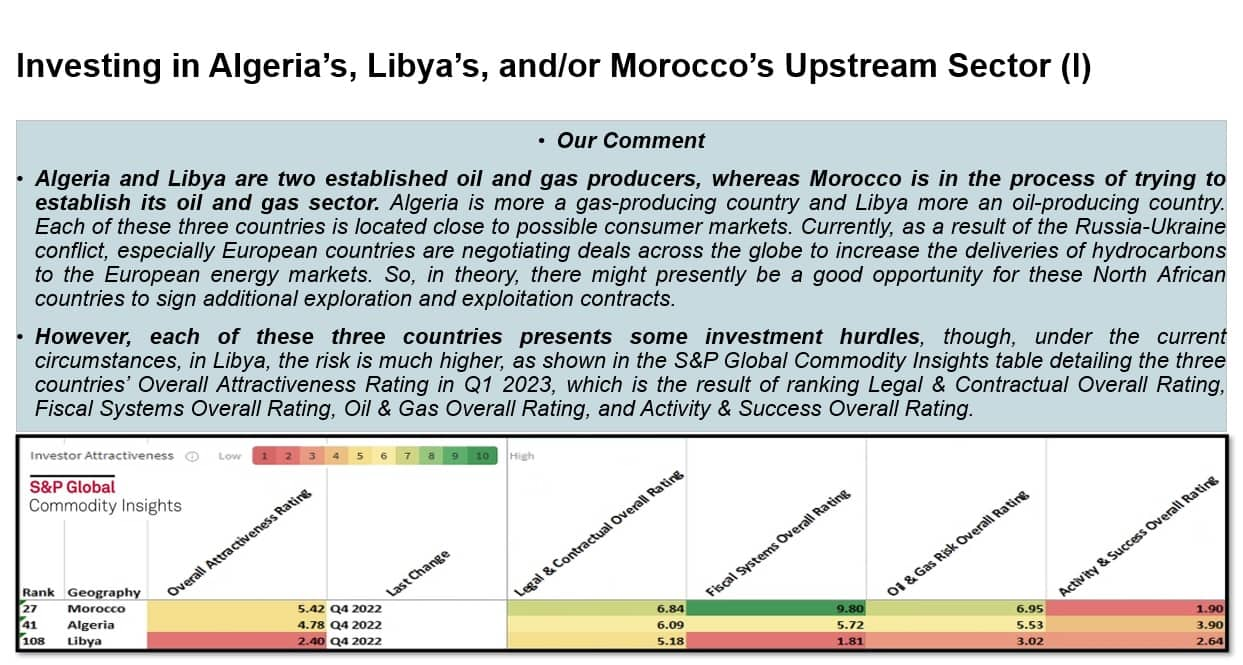

There is currently widespread interest from prospective investors—as well as from EU countries interested in security of hydrocarbons supplies—in oil and gas opportunities in the offshore of Algeria, Libya, and Morocco. The three countries' offshore legal-fiscal terms, though they are very different in relation to attractiveness to prospective investors, are more favorable than the corresponding onshore terms.

This article is an excerpt from the longer, more detailed legal presentation "O&G Exploration in Algeria, Libya, and Morocco: Legal and Fiscal Notes About Offshore Investment" which was published on April 19 2023 (available to our subscribers here).

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.