Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jan 09, 2024

By Chengyao Peng and Weixiao Qin

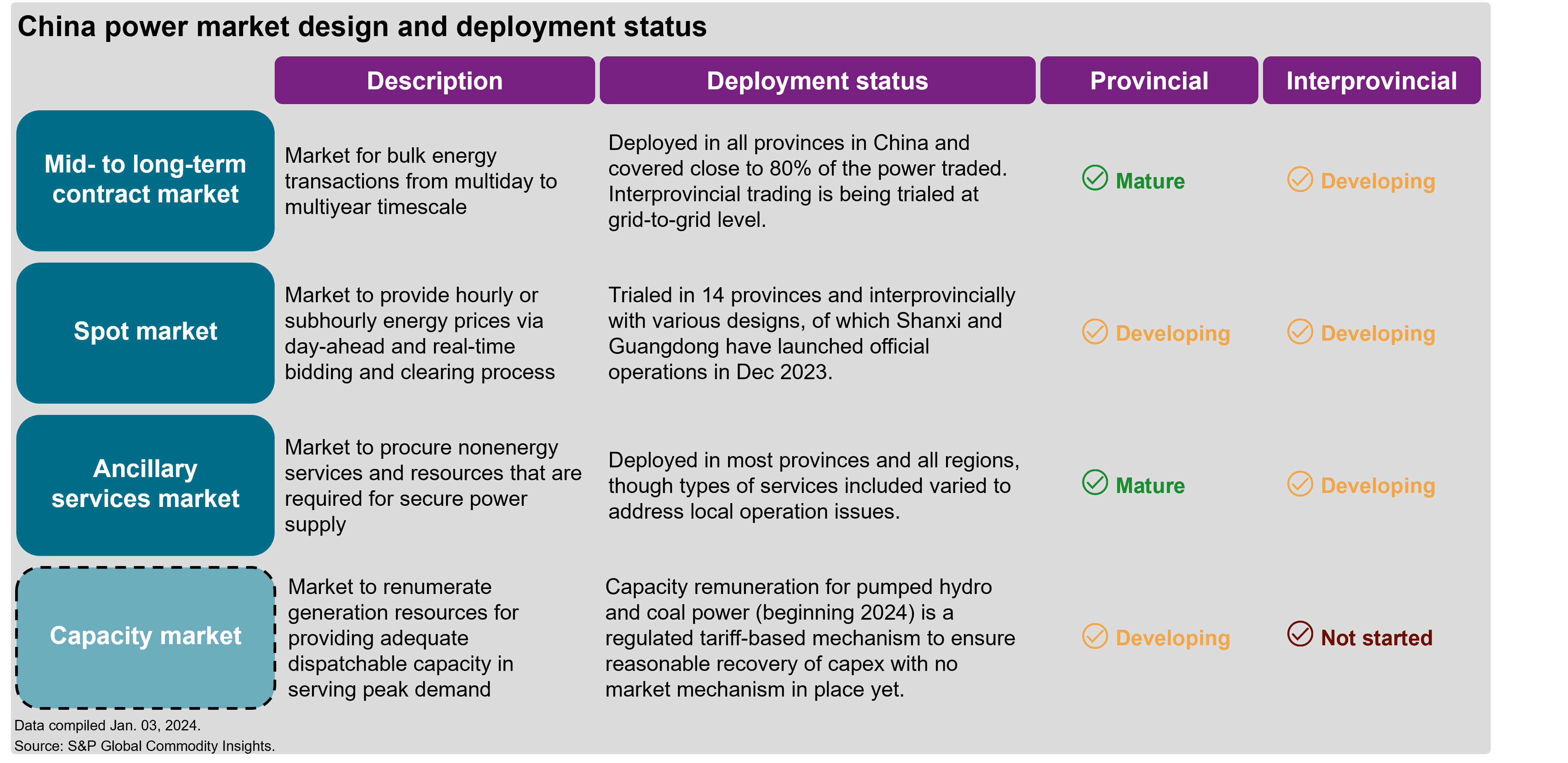

Power market reform in China leaped forward since late 2021 with all coal-fired power entering marketing trading, abolishment of regulated retail tariff for commercial and industrial (C&I) power users, start of pilot trading of green power contracts, and liberalization of ancillary services. Looking forward, China aspires to establish a national unified power market preliminarily by 2025 and at a basic level by 2030. S&P Global Energy recently launched the China Power Market Design Tracker which aims to provide a comprehensive overview of the evolving power market designs and co-ordinations at different product and geographical levels in China.

Several provinces have commenced daily M2LT trading that enabled market players to make more timely adjustments to their portfolios. In addition to peak/valley/off-peak split in transactional time intervals, M2LT markets are evolving into more granular breakdown of hourly contract volume to synchronize with spot market settlement. Besides thermal and renewable power, participation from generation technologies has expanded with a strong push for virtual power plants (VPPs) and energy storage systems (ESS) to enter market trading across provinces. However, interprovincial M2LT contract market is still taking shape as it remains largely grid-to-grid only today.

Detailed designs tend to vary across spot markets to cater to local power system characteristics. Nonetheless, some common features exist in China spot markets, including a centralized model, day-ahead and real-time trading at 15-minute interval, and paying generation a location-based rate while charging load a uniform price. Among the pilot spot markets, Shanxi and Guangdong have successfully proceeded to official spot market operations in December 2023 after running trial trading and settlement for 33 and 24 months, respectively. Other provincial and regional markets are expected to gain traction as well to prepare for nationwide rollout of spot markets.

Coupled with spot market development, downward ramping is beginning to be replaced by spot market dispatch while co-optimization of energy, reserve and frequency regulation is being explored. Market players are becoming increasingly diversified as more capable resources, such as VPPs and renewables with co-located ESS, are being admitted as providers. A shift to require power users to co-pay for ancillary service expenses is observed as markets evolve toward fairer cost allocation based on the beneficiary pays principle. In complement with provincial markets, all the seven regional grids operate their respective regional ancillary service markets to mobilize resources for multilateral support of power system security as well.

In its recent announcements, China launched a nationwide capacity renumeration mechanism for coal-fired power to facilitate its capital expenditure return and called for accelerated spot market development in preparation for a national unified power market. Policy updates will continue to be a key driver in power market design and development in China.

Learn more about our Asia Pacific energy research and insight by clicking here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.