Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 01, 2023

By Etienne Gabel

In 2022, global energy markets were shaken by the Russia-Ukraine war and Russia's interruption of gas supplies to Europe, momentous clean energy legislation in the United States and other major markets, post-COVID-19 global economic growth (albeit dampened by China's continued lockdowns), supply chain disruptions, and rising inflation, and important climatic events such as droughts in Europe and China.

As 2023 began, the Global Power and Renewables team of S&P Global Energy examined five key trends that we believe will define power and renewables markets worldwide this year. In this blog post, we summarize three of them.

For a more detailed discussion of the anticipated trends, see the full report.

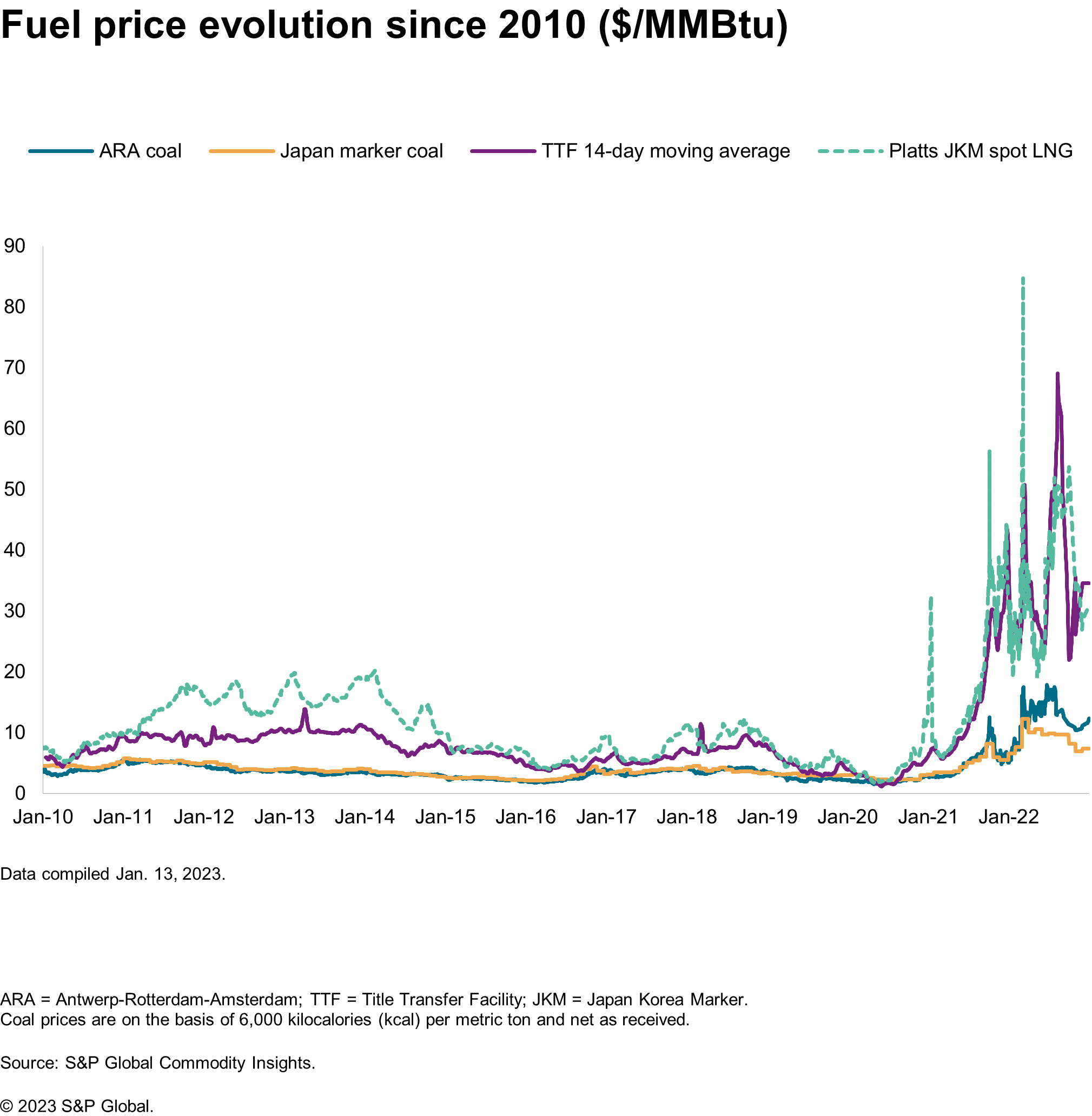

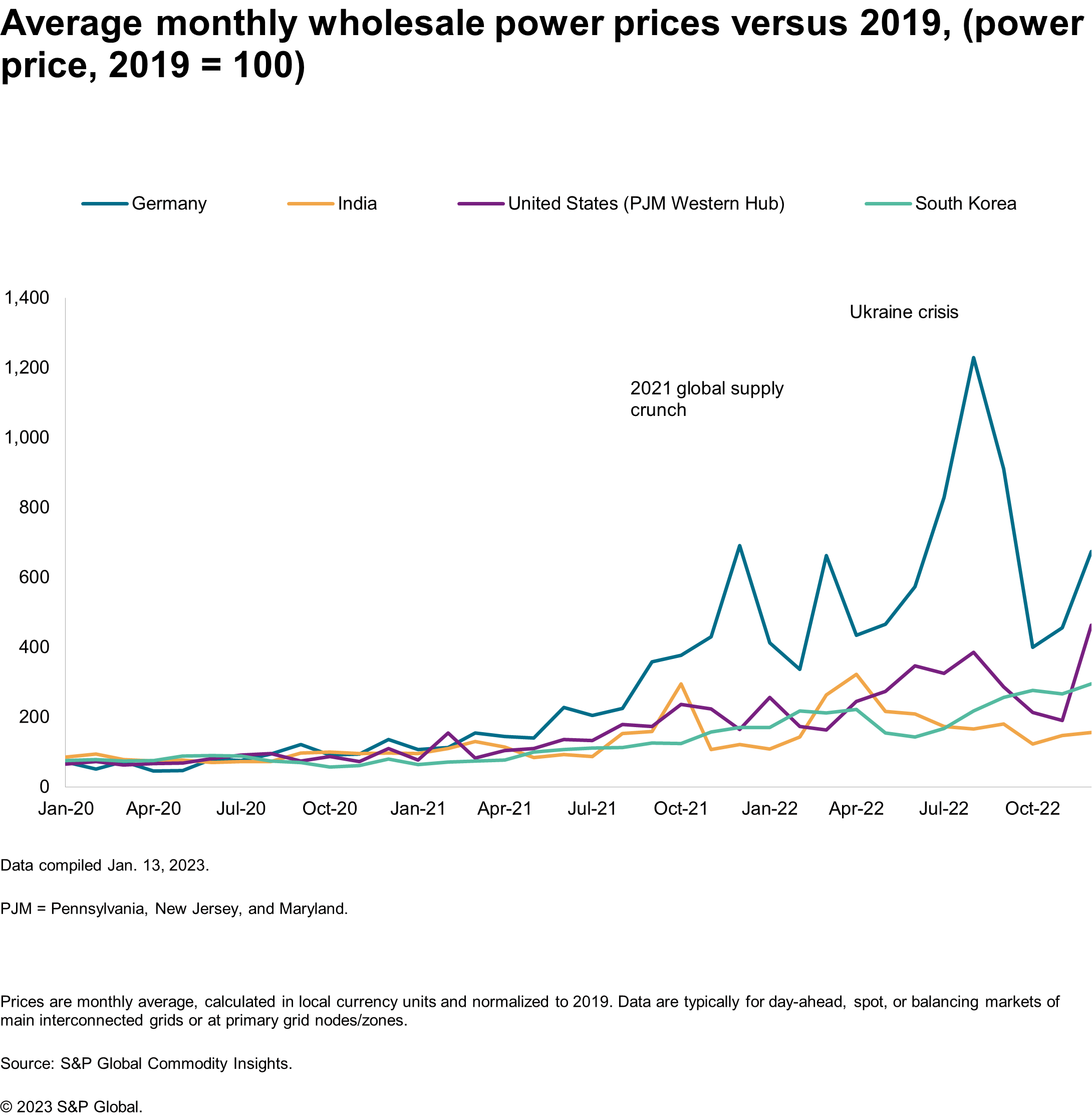

Global gas, coal, and oil prices surged in 2022, and although they dampened of late, international political and economic crises cloud the price trajectories we may see in 2023 (see Figures 1 and 2). Nevertheless, there are already indications that many regions will observe high or volatile electricity generation costs through this year:

A prolonged high cost for power will likely be socially and politically unmanageable and lead some countries toward reforms in 2023, whether these be marginal or more substantial.

New policies addressing the affordability crisis already emerged in 2022. Countries like Canada or South Korea capped fuel costs, wholesale power prices, or end-user electricity tariffs. Others like Colombia or Thailand diminished or slowed power tariff hikes driven by inflation. Now, in 2023, the European Commission will look into a significant change in the market design to likely cap generator revenues.

Figure 1

Figure 2

The energy supply crisis that arose in 2021-22 will likely persist in 2023. The resulting focus on energy security among market stakeholders will actually bolster many power markets' energy transition in 2023.

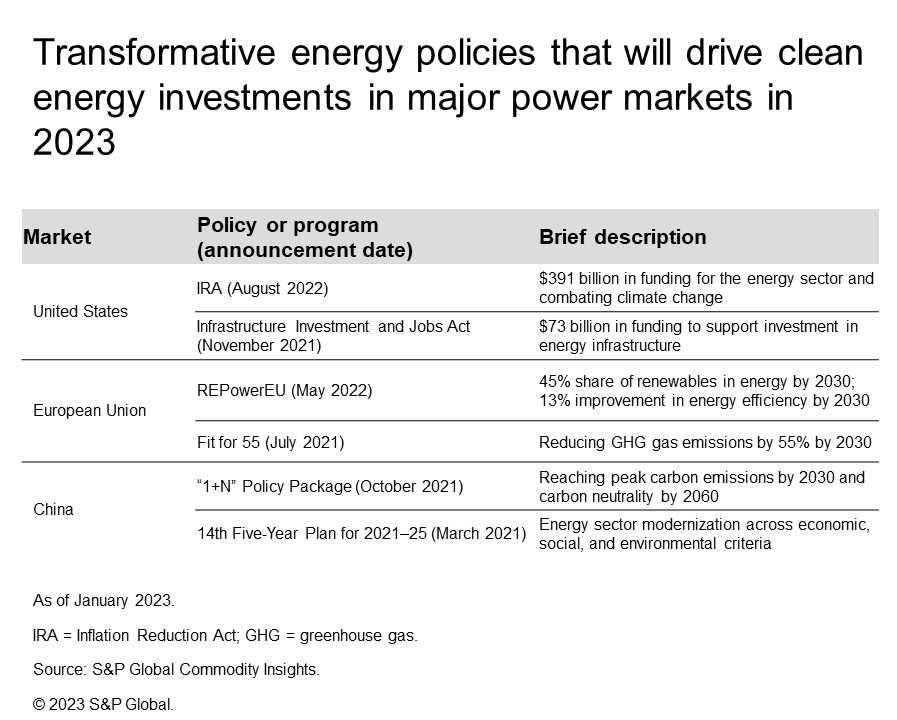

Indeed, as attention fell on energy prices and inflation, policymakers have passed momentous energy transition policies that will rapidly translate into real investments in clean energy (see Table 1). The power sector is sensitive to commodity price fluctuations, and renewable energies offer governments and investors a cheap source of domestic generation on a levelized cost basis, a refuge from volatile fuel prices, and a safeguard against assets being stranded on the road toward decarbonization.

S&P Global expects the world to add up to 380 GW of clean energy this year, representing 75% of all new capacity in 2023. This will make 2023 a record year for clean energy additions.

That is not to say that energy security and energy transition will always come together smoothly for policymakers and investors, whether in 2023 or beyond. This may be particularly true in emerging economies with domestic fuel resources. In China, the end of COVID-19 lockdowns in 2023 will likely increase coal-based emissions. Elsewhere, the energy crisis altered the fuel mix because of short-term "patches" (e.g., delayed thermal retirements in Germany) or newfound opportunities (e.g., India procuring cheap gas from Russia).

Table 1

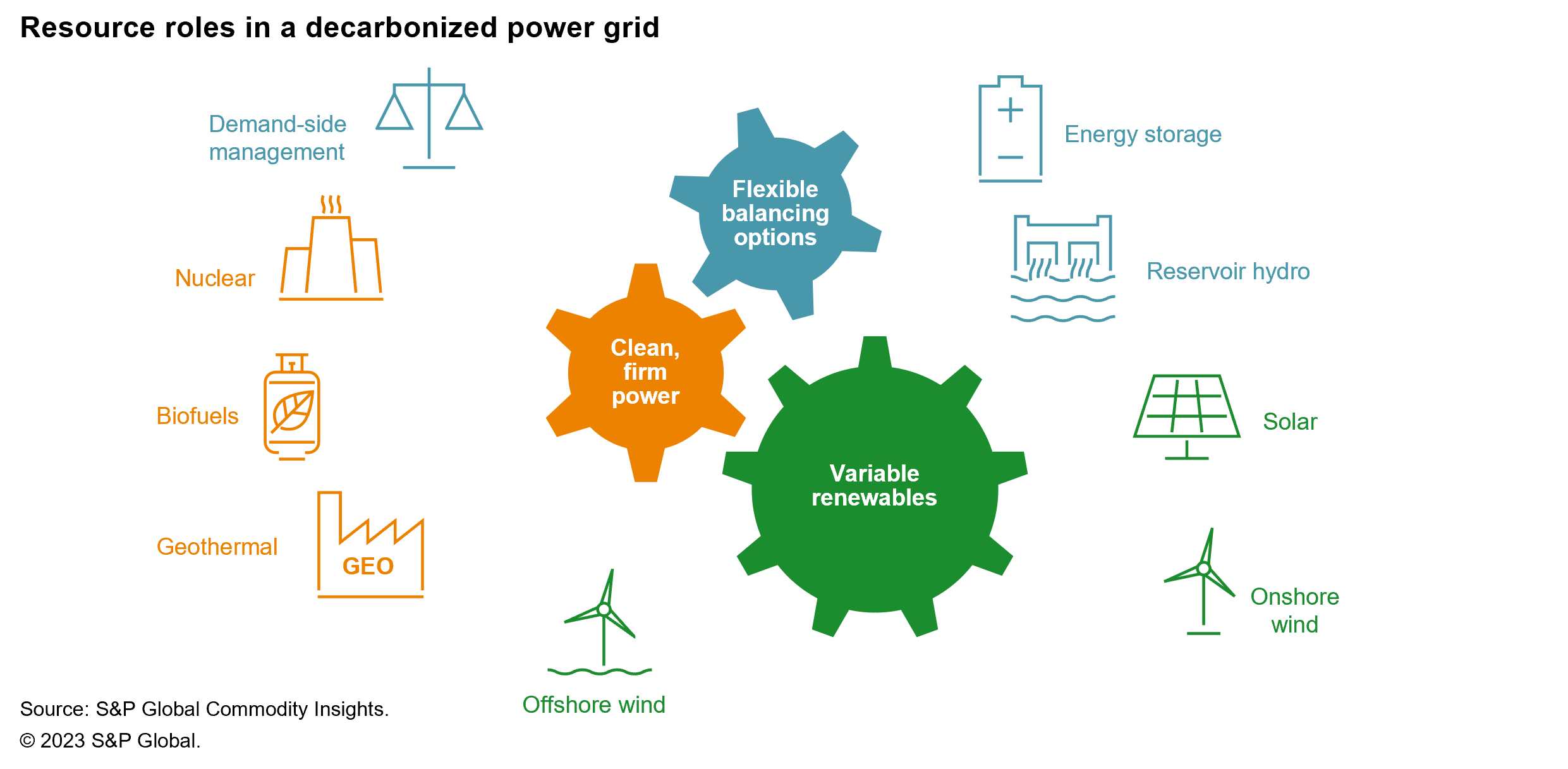

As wind and solar generation becomes increasingly widespread in power markets globally, concern over their variability and impact on power system reliability is mounting. Several firm and/or flexible clean energy solutions, emerging or mature, are expected to gain traction in 2023 (see Figure 3).

High and volatile power prices could make 2023 a big year for energy storage. In markets like Japan or California, pumped storage and batteries increasingly temper the swings in solar and wind generation. By 2025, China is targeting 62 GW of pumped storage and 30 GW of batteries. India's pipeline of energy storage projects totals 30 GW.

This year will also be an active year for nuclear. Japan wants to restart its existing fleet, South Korea is looking at nuclear life extensions, and China has over 15 reactors under construction. In addition, some countries like Turkey and Egypt seek to build nuclear power plants for the first time.

Building reliable power systems will require solutions beyond the generation side too. In the United States, for example, the Federal Energy Regulatory Commission aims to impose new rules to accelerate transmission builds, and the Inflation Reduction Act offers funding and loans for the electric grid.

Lastly, the demand side could also play a role. For example, Europe's REPowerEU initiative proposes a target primary energy consumption of 20% below 2020 levels by 2030.

Figure 3

For a more detailed discussion of the anticipated trends, see the full report Five anticipated trends in 2023 for global power and renewables markets.

Etienne Gabel, senior director at S&P Global Energy with the Global Power and Renewables team, specializes in the analysis of market and regulatory developments in power sectors worldwide.

Posted on 1 March 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.