Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Nov 07, 2022

By Bob Fryklund

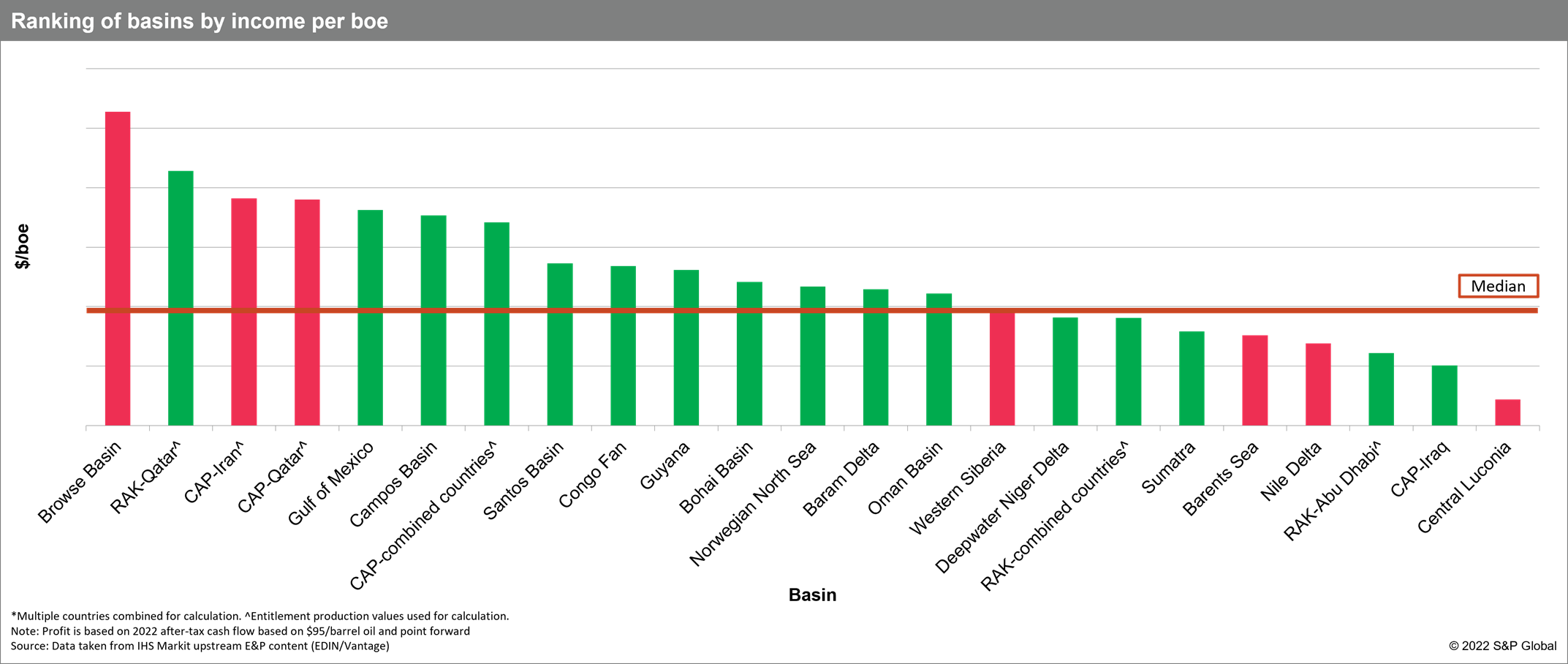

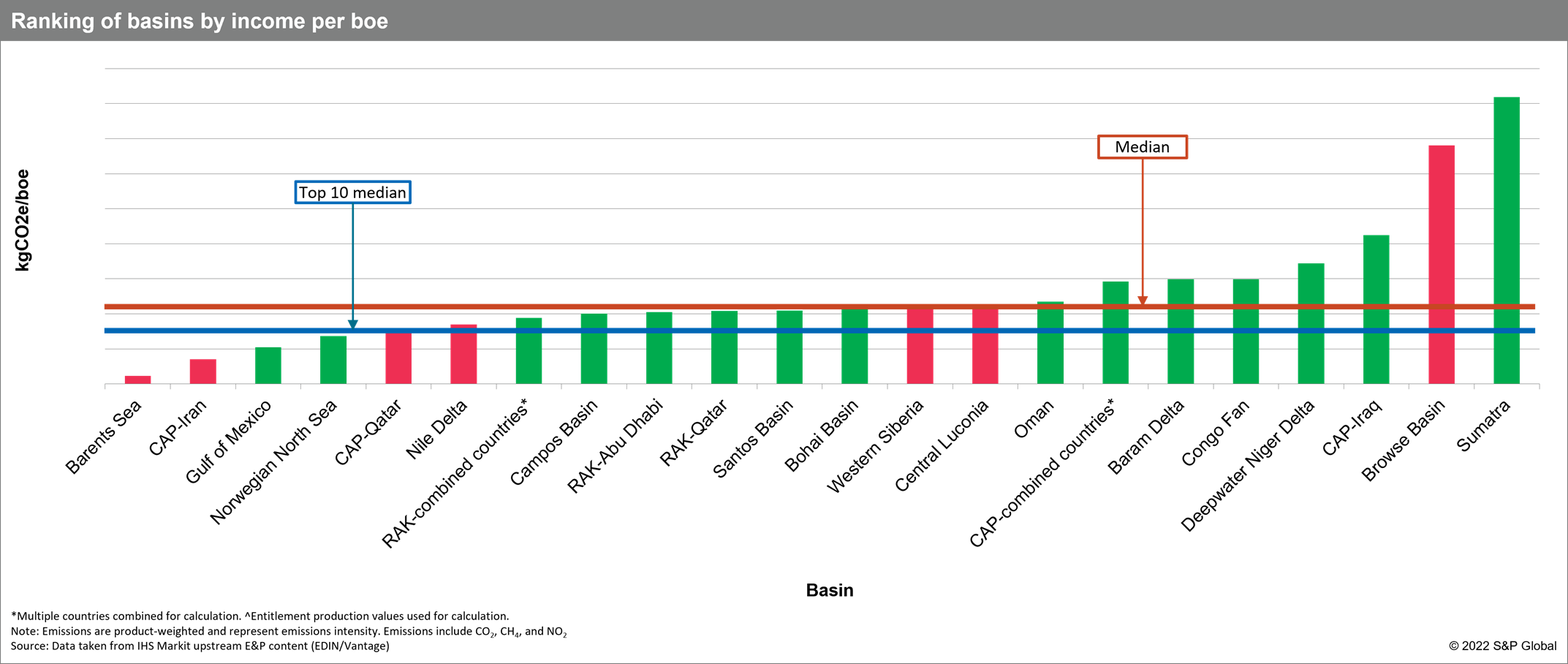

As the energy industry moves toward a low-carbon future, performance metrics must go beyond dollars and barrels and begin to include emissions.

More and more energy companies are beginning to show interest in incorporating emissions and emissions reduction into their overall strategy.

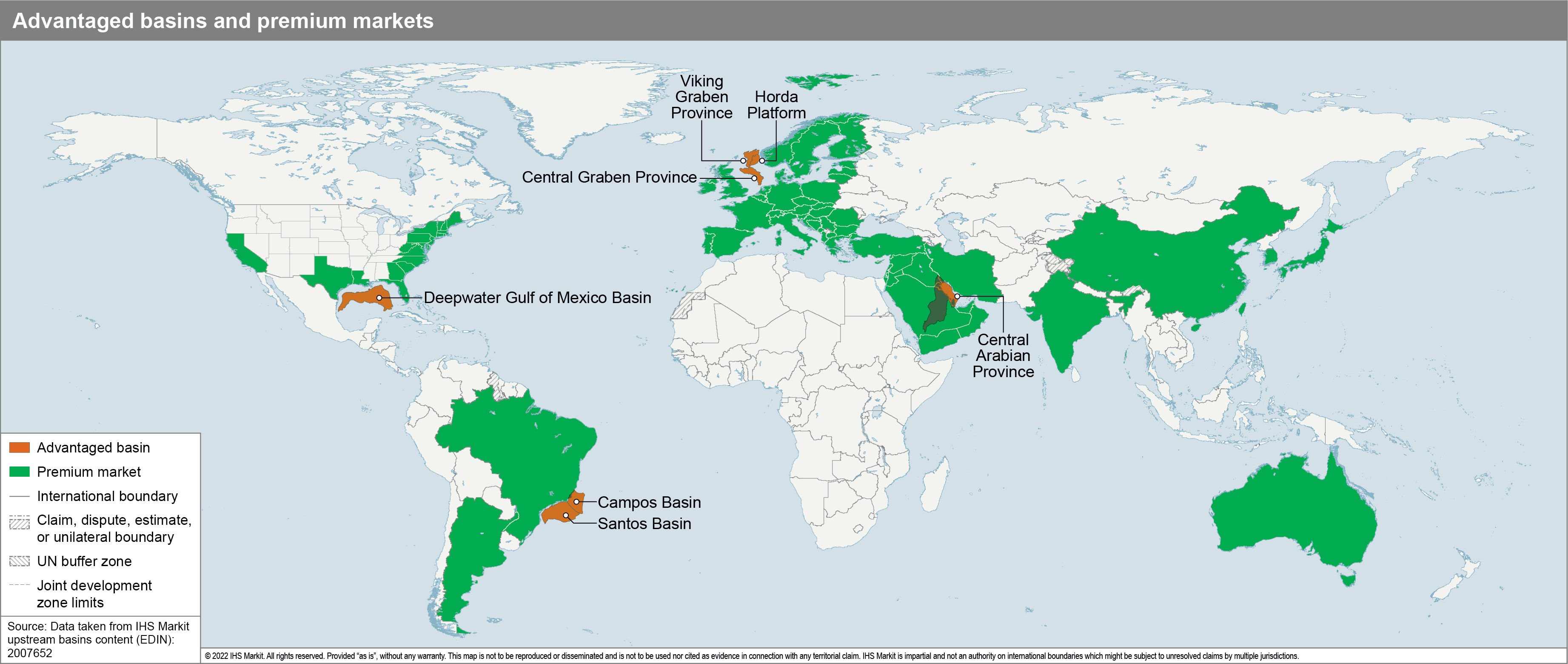

The basin of the future excels at the intersection of scale, profit, and emissions. It is critical that the products from these basins are near premium long-term markets. This study evaluates 25 global basins and examines which basins have a combination of low emissions intensity and high after-tax cash flow for every barrel of oil equivalent (boe) produced. These results demonstrate which basins are currently strong performers, and which basins might benefit from investment.

This blog is an extract from the study and the full report is available for S&P Global Energy Connect platform Commercial Plays and Basins subscribers only.

For more information regarding basin scale commercial and strategic insights, please refer to Plays and Basins

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

Posted 07 November 2022 by Bob Fryklund, Vice President, Upstream Energy, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.