Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Dec 08, 2022

By Renata Machado and Stephanie Vargas Ortega

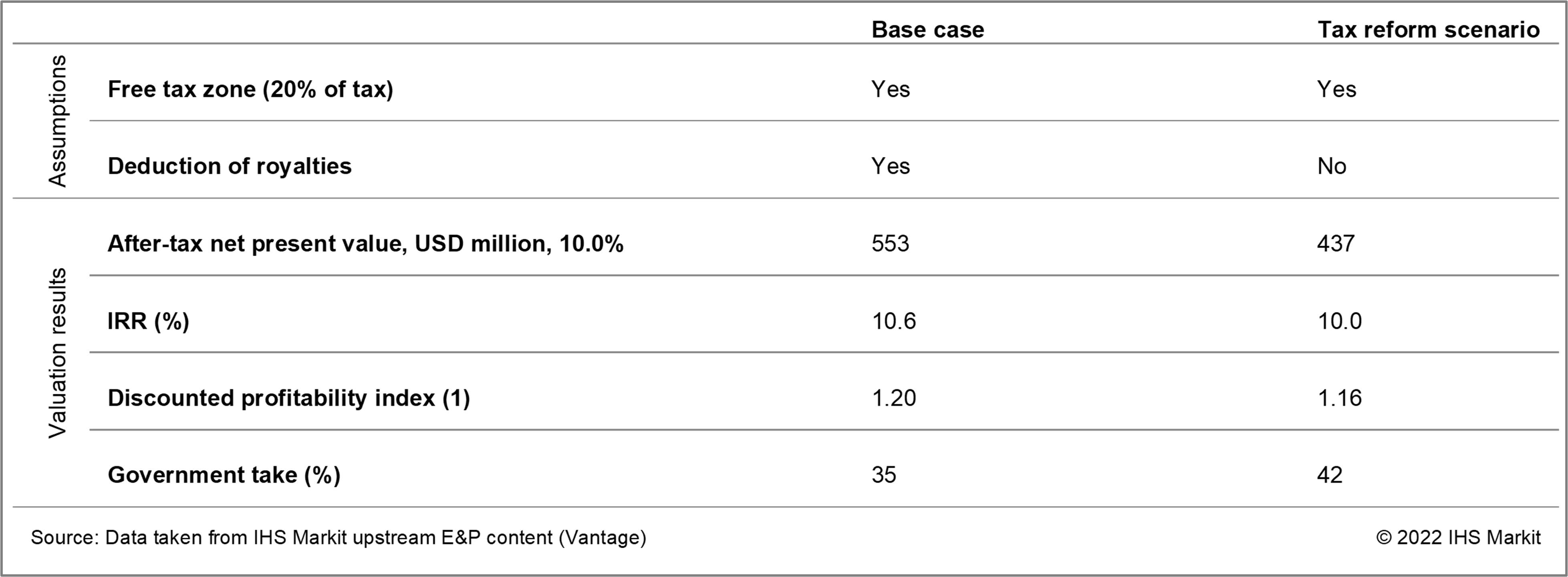

In 2022, the recently elected government of Gustavo Petro submitted to Congress a tax reform bill ("Reforma Tributaria para la Igualdad y la Justicia Social") aiming for a fiscal adjustment to make the tax system more egalitarian in the country. The tax reform was approved by the Congress on 3 November 2022, although it is still pending sanction from the president. The bill will increase government revenue in the short term which is expected to be applied on social strategic programs. For the oil and gas industry, there are two main changes. One is the suppression of the deductibility of royalties and the second is a new tax rate, oil producers will be taxed an additional 5%, 10% or 15% based on the yearly average of crude price compared to the average of the last 120 months.

The deductibility of royalties for income tax purposes will put Colombia in a unique position when compared to other key oil and gas countries in Latin America, such as Argentina, Brazil and Mexico which consider the calculation of corporate income taxes based on entitlement production resulted from the deduction of royalties.

The Gorgon asset is a future gas project, located offshore, 68 km northwest of Arboletes in deep waters. The Gorgon-1 field was discovered in 2017 and it is adjacent to the Kronos-1 and Purple Angel-1 fields discovered in 2015 and 2017, respectively. Ecopetrol holds 50% interest in the field after signing an agreement with Shell EP Offshore Ventures Ltd, in 2020.

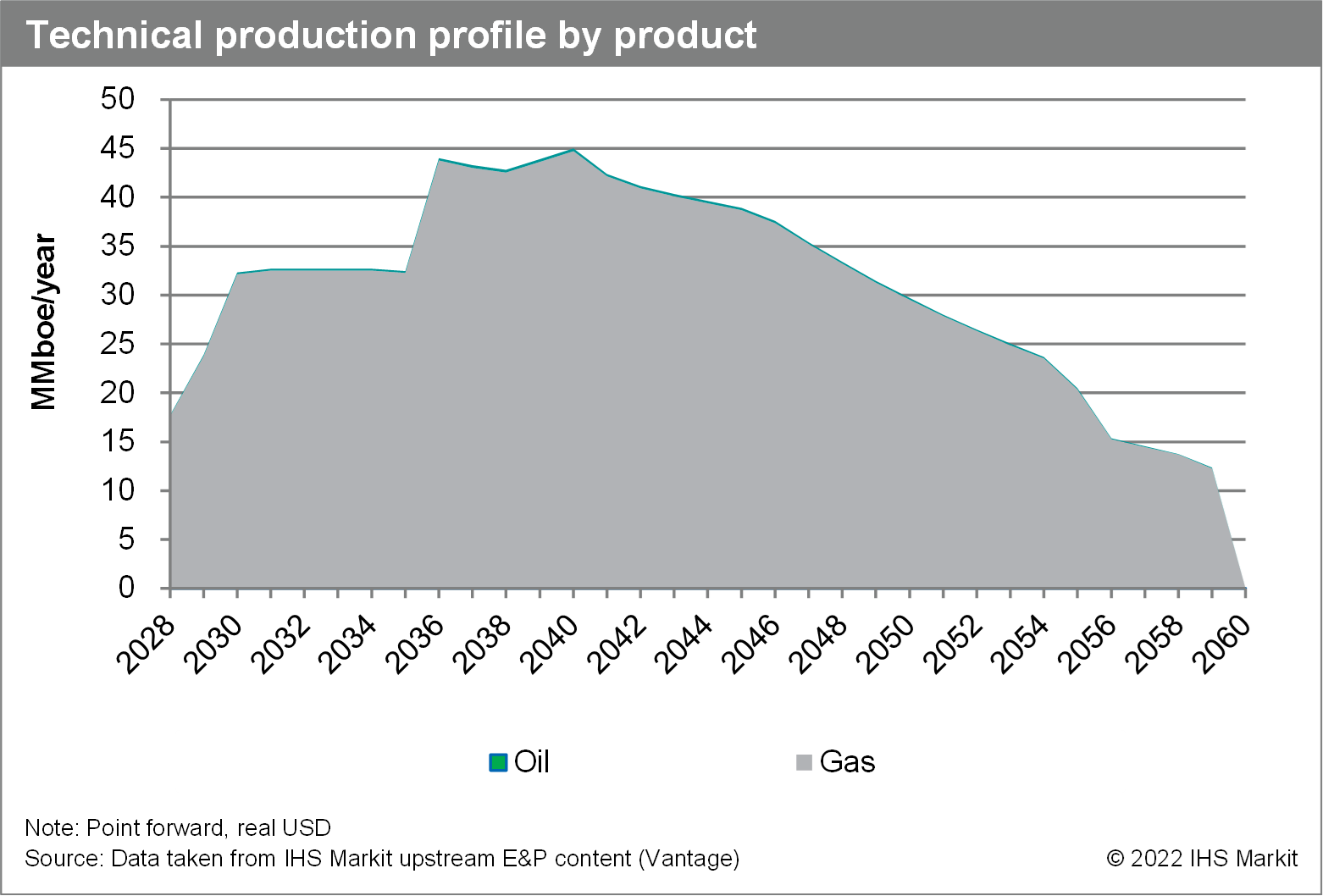

IHS Markit Vantage Latin America team has modelled the Gorgon asset considering two development phases for optimum recovery of 2P resources. Due to water depth and reservoir content, two spar buoy platforms are considered to be deployed, each possessing a topside module capable of processing 650 million cubic feet per day (MMcf/d) of gas, and 5,000 barrels per day (b/d) of oil. A start date in 2028 has been assumed for the project considering operator's view.

To recover resources in place a total of 15 production wells were modelled per phase, 10 drilled from the topsides and 5 wells through a subsea tie-back. Each phase is assumed to account for 3,000 billion cubic feet (Bcf) of technical recovery.

The export route was modelled considering a 120 km pipeline to shore. The gas pipeline was designed to account for the production of both development phases in order to manage cost and capacity of the pipeline over the life of the field. The total capital expenses (capex) including premiums, escalations and inflation account for approximately USD 7,000 million considering development capex and decommissioning costs. Onshore gas processing facilities are not included in the scope of the project.

The Gorgon field is under the Concession (Royalty/tax) regime and the Free Trade Zone fiscal status. Fiscal Terms applicable are fees, production participation taxes, windfall taxes, royalties and corporate income taxes.

Valuation analysis is based on Vantage's base case oil price scenario (benchmark Brent oil price of USD 95 per barrel, adjusted for oil quality and escalated at 2% every year) and the domestic gas price is based on 2022 gas price estimated by IHS Markit Gas Markets and projected forward using 2% inflation adjustment per annum. It is important to note, however, that this is a pre-FID project development concept and there are many unknowns related to technical development feasibility and which considers no geological risk.

Looking at the impact of the tax reform bill over the Gorgon asset, the after tax NPV for base case scenario could decrease over USD 100 million when considering no deduction of royalties, while government take will increase from 35 to 42%.

The tax reform is changing the rules of projects that have already started investments (seismic and exploration), nevertheless they are still far from their maturity, creating different conditions from those that existed when the companies signed contracts and assumed investment commitments with the Colombian government.

The challenge for Colombia's government will be achieving the economics to support energy transition while diminishing oil and gas investments and increasing its dependency on imported gas. The tax reform will restrict the development of national resources and lead to challenges in a world where focus is shifting away from globalization to localization, and where the energy industry is more actively thinking about energy security than ever before.

Find the full report in Tax reform impact on the most promising gas asset of Colombia

For more information regarding asset evaluation, portfolio view, and production forecasts, please refer to Vantage

For more information regarding well, field & basin summaries, please refer to EDIN

For more information on natural gas demand see: Latin American Natural Gas Outlook: Andean region

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.