Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 30, 2024

By Sophie Boulter and Yijie Zhu

CO2 Storage Site Screening for Depleted Fields on the Texas Gulf Coast - Matching Source to Sink

CO2 Storage Site Screening for Depleted Fields on the Texas Gulf Coast - Matching Source to Sink

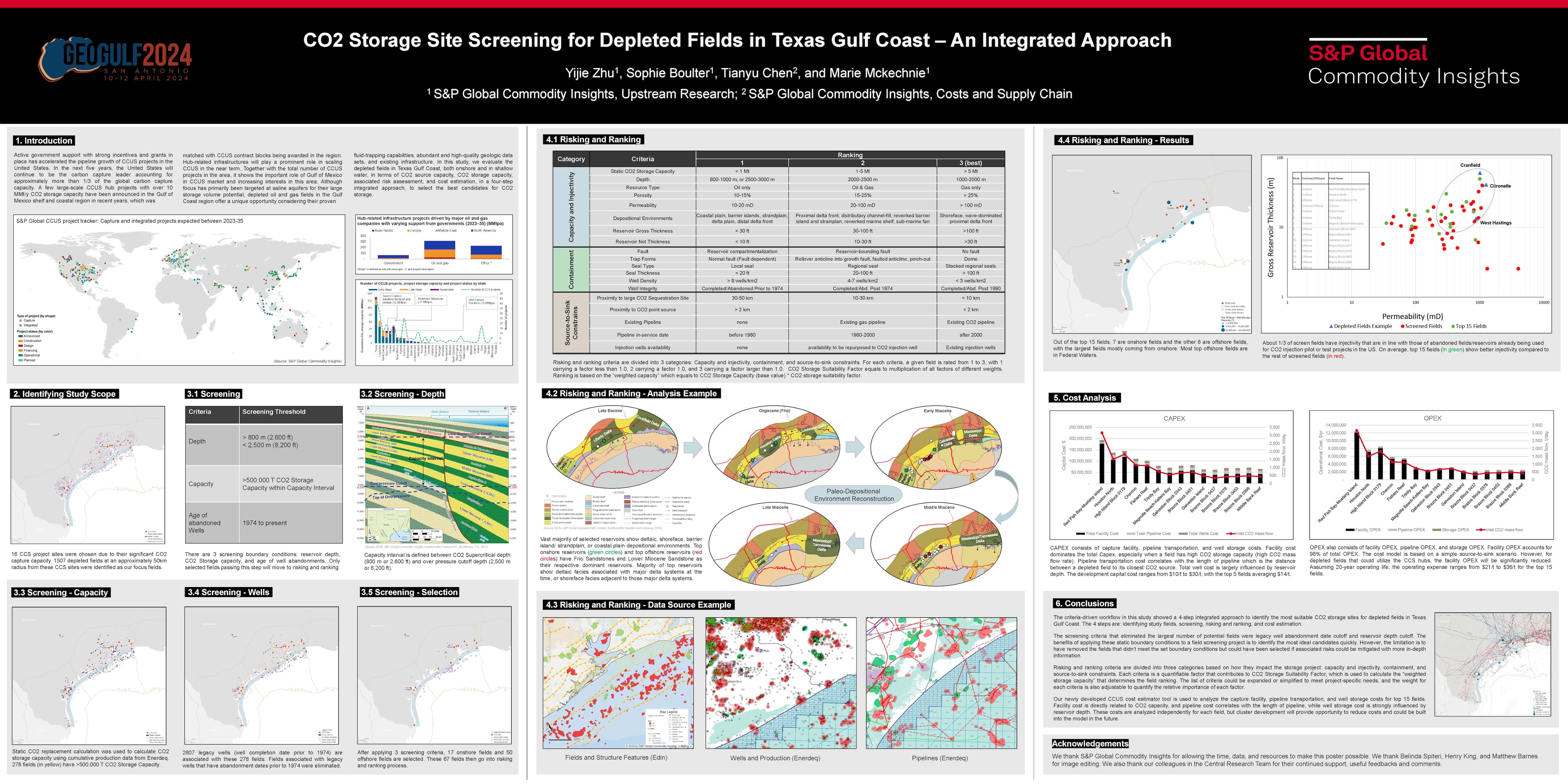

Active government support with strong incentives and available grants has accelerated the pipeline growth of CCUS projects in the United States. In the next five years, the United States will continue to be the carbon capture leader accounting for approximately more than 1/3 of the global carbon capture capacity. A number of large-scale CCUS hub projects have been planned or announced in the Gulf of Mexico shelf and coastal region in recent years. Many of these carbon capture projects are centered around the heavy industry in the Texas Gulf Coast, which led to a number of CCUS contract blocks being awarded in the region. Most notably Talos Energy has acquired CCS project sites with over 150,000 gross acres onshore Texas. Although focus has primarily been targeted at saline aquifers for their large storage volume potential, depleted oil and gas fields in the Gulf Coast region offer a unique opportunity considering their proven fluid-trapping capabilities, abundant high-quality geological data sets, rich hydrocarbon production history, and existing infrastructure. The BOEM estimates that there are over 13,000 sands associated with oil and gas that have CO2 storage potential.

The US Fields team carried out a CCS Storage Site Screening study furthering insight into the role that depleted fields could potentially play in carbon storage with a changing landscape of the Energy Transition, utilizing the large-sale CCUS projects in the area. The aim was to identify which depleted fields in the area have the potential to become safe carbon storage sites. There are various large-scale capture sites along the Texas Gulf Coast from 500,000 to 10MM tCO2/y capture capacity with operation status varying from announced and planned through to construction or operational. Chosen for this study were 16 of these capture projects spanning from Rio Grande, Corpus Christi, Galveston Bay to Houston. Around 1,500 depleted oil and gas fields were identified at an approximately 50km radius from these large CCS sites, with the working assumption that the capture sites were the CO2 source, and the depleted field were potential sinks.

Once the fields were identified through location, high-level screening commences by setting out three boundary conditions, in terms of capacity, depth, and presence of legacy wells. Fields that were at insufficient capacity within the capacity interval, and fields with ultra high-risk legacy well present were eliminated, leaving 67 fields for further risking and ranking. Out of these 67 selected fields, only 17 are onshore fields while the other 50 are offshore fields. The initial screening process has eliminated more than 1,400 fields. The screening criterion that eliminated the largest number of potential fields was the >500,000 tCO2 cutoff, narrowing the selection from 1,507 fields down to 278 fields. The other two boundary conditions are legacy well abandonment date cutoff and reservoir depth cutoff. In this study, it was deemed that wells with abandonment dates prior to 1974 were at an ultra-high leakage risk due to lack of regulations and plug and abandonment protocols, therefore depleted fields associated with these wells were eliminated. This has much higher impact on onshore fields than the offshore fields because many onshore fields were discovered a lot earlier than the offshore ones, in the 1950s and 1960s. The offshore fields are more impacted by the reservoir depth cutoff. In this study, the capacity interval is defined between CO2 Supercritical depth (800 m or 2,600 ft) and overpressure cutoff depth (2,500 m or 8,200 ft). However, regional overpressure depth ranges from 8,000 ft to 10,000 ft. The static 8,200 ft cutoff used in this study might have overlooked some deeper reservoirs, especially in the offshore region. A detailed overpressure map might be utilized for a more refined screening.

A risking parameter, CO2Storage Suitability Factor, was developed as part of the study. This parameter incorporates both geotechnical and economic risks that can be quantified by available field data. The risking and ranking criteria are divided into three categories based on how they impact the storage project: capacity and injectivity, containment, and source-to-sink constraints. Each criterion is given a risk factor that contributes to CO2 Storage Suitability Factor, which is weighted against the overall CO2 capacity to calculate the "weighted CO2 storage capacity" that determines the field ranking. This allows us to have a more balanced view of all the risks associated with each depleted field. As a result, top 15 fields have been identified as the most suitable CO2 storage sites for depleted fields. Out of the top 15 fields, 7 are onshore fields and the other 8 are offshore fields, with the largest fields mostly coming from onshore due to their large production volumes. However, top onshore fields are scattered spatially, therefore they might be more suitable towards a smaller scale carbon storage solution, whereas top offshore fields tend to be clustered, therefore a hub-related carbon storage development could be a better option.

Our newly developed CCUS cost estimator tool was used to analyze the capture facility, pipeline transportation, and well storage costs for top 15 fields in terms of CAPEX and OPEX. These costs are analyzed independently for each field in point source scenario. Facility cost is directly related to CO2 capacity, and pipeline cost correlates with the length of pipeline, whereas well storage cost is strongly influenced by reservoir depth. The development capital cost ranges from $10/t to $30/t for the top 15 fields, with top 5 fields averaging $14/t. Assuming 20-year operating life, the operating expense ranges from $21/t to $36/t for these top 15 fields, with top 5 fields averaging $25/t. With increasing 45Q tax credit from $50/t (2018) to $85/t in 2022 for carbon capture and storage in saline geologic formations from industrial and power generation facilities, many of these depleted field CO2 storage project can be profitable.

Overall, our study suggests that there are suitable depleted fields within the Texas Gulf Coast region for carbon storage potential. However, the onshore capability for large scale projects may be more limited in comparison to the offshore fields. The criteria-driven approach taken in this study allowed for a quick, source-to-sink overview of where the potential CO2 storage hotspots are for depleted fields within a set area. It allows for flexibility in adjusting boundary conditions and risking criteria, to meet project-specific needs. It can be replicated effectively for various depleted field screening projects in other regions.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.