Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 04, 2022

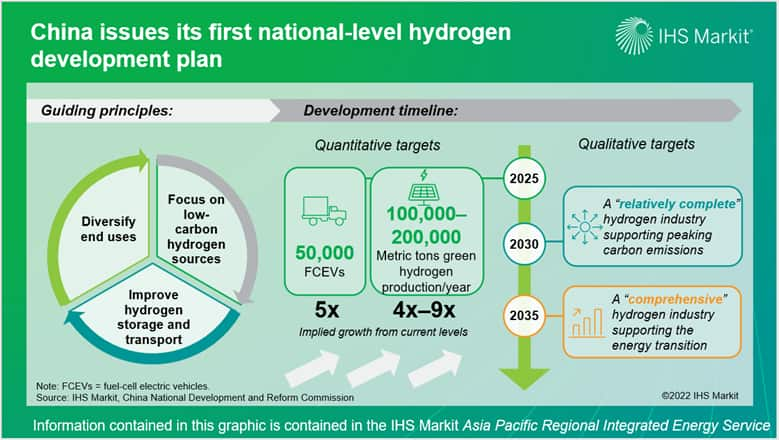

On 23 March 2022, China released the first national-level development plan for the hydrogen industry (the Plan), underscoring the importance that the central government now places on the role of the hydrogen industry in achieving China's emissions ambitions.

The Plan lays out several principles to guide the industry's development in the near and long term across the value chain, focusing on producing hydrogen from low-carbon sources, improving storage and transport, and diversifying end uses.

On the production side, the Plan emphasizes low-carbon options and "strict control" over fossil-fuel based hydrogen production. Hydrogen by-products—from existing facilities like chemical plants and coke ovens—and green hydrogen produced from renewable power will be prioritized until green hydrogen production scale improves to become the main source of supply. In the midstream segment, the Plan highlights the need for technologies to increase efficiency and reduce costs for hydrogen storage and transport to address the locational mismatch between green hydrogen supply and demand. On the demand side, the Plan calls for diversifying hydrogen use beyond the transport sector to include seasonal energy storage, heat and power for distributed energy projects, and feedstock substitution or heat for industry uses.

The plan only includes two quantitative targets: 50,000 fuel-cell electric vehicles (FCEVs) and 100,000-200,000 metric tons per year of green hydrogen production by 2025. The two targets reflect not only the existing progress but also the high expectation for these sectors, with financial assistance a key enabler going forward. China's FCEV fleet will need to increase by around fivefold to reach the targeted level by 2025, and annual growth will need to more than double from the average rate seen during 2020-21. There are enough proposed green hydrogen projects to support the production target, but uncertainty over downstream demand may cause headwinds for some projects.

Looking beyond to 2030 and 2035, the Plan lays out key market expectations but shies away from setting concrete targets. By 2030, the Plan aims for a relatively complete hydrogen industry with "orderly" and "reasonable" hydrogen consumption and green hydrogen playing a role in helping China to achieve its peak carbon emissions goal. In 2035, a comprehensive hydrogen industry will have been established with diversified uses of hydrogen across the transport, energy storage, and industry sectors.

Like most high-level central government development plans, the Plan leaves out details and, instead, wraps up with a proposal for a "1+N" style framework to issue follow-up policies. In the coming months and years, other government agencies will issue supporting measures and implementation plans to realize the overall development goals set forth.

Learn more about our hydrogen and renewable gas research.

Megan Jenkins is a Senior Research Analyst covering Greater China's power and gas markets.

Posted 04 April 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.