S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Solutions

Capabilities

Delivery Platforms

News & Research

Our Methodology

Methodology & Participation

Reference Tools

Featured Events

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

Solutions

Capabilities

Delivery Platforms

News & Research

Our Methodology

Methodology & Participation

Reference Tools

Featured Events

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

S&P Global Offerings

Featured Topics

Featured Products

Events

Support

Metals & Mining Theme, Non-Ferrous, Ferrous

April 07, 2025

HIGHLIGHTS

Raises concerns about US tariffs' impact on derivatives and trade diversion

Suggestions for EU response include: prioritizing EU steel, trade defense measures, CBAM review

Focus on retaining scrap volumes in EU, enforcing local content requirements

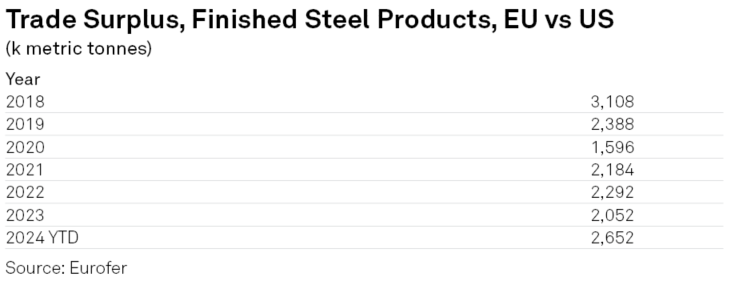

Representatives from the steel and metals industry raised strong concerns about the broader ramifications of US tariffs, including impacts on derivatives and the serious risk of trade diversion, during a high-level dialogue hosted by European Commission President Ursula von der Leyen on April 7. The meeting aimed to discuss the implications of US tariffs on steel, aluminum, and related derivative products, the EC said.

The meeting focused on gathering industry views and proposals for the most effective EU response to the US measures.

While the representatives welcomed the EC's Steel and Metals Action Plan and the Clean Industrial Deal, they also suggested implementing a few points.

Eurometal, the association of traders and EU service centers, suggested using public procurement to prioritize EU-based steel content while supporting local manufacturing and innovation, particularly in sectors essential for the green transition and EU defense capabilities, Eurometal said in a letter sent to its members seen by Platts, part of S&P Global Commodity Insights.

The industry called for new trade defense measures for steel, beyond existing safeguards set to expire in June 2026, to counter potential export deflection from other major steel-producing countries.

"We welcome the Commission President's initiative and her understanding of the need of urgent action in the current context. The meeting was positive and we look forward to a follow up," the spokesperson of Eurofer, the European Steel Association said to S&P Global Commodity Insights.

"The European steel industry during the meeting stressed the importance of an urgent, full implementation of the Steel and Metals Action Plan (SMAP) and warned that the Impact of US steel tariffs on EU steel is likely to be huge," Eurofer said.

The post-safeguard measure should come quickly and not in the third quarter, according to Eurofer the current safeguards are "irreparably flawed due to relaxation, as most traditional imports enter EU without any tariff, " the spokesperson said April 7.

The new measure should expand its product scope, firstly, by adding steel products that were not in the safeguard scope and, secondly, by expanding the scope to downstream steel-intensive products mirroring the steel derivates expansion of the US steel tariff.

Participants also expressed concern about diminishing scrap volumes used for recycling in the EU and requested effective measures to retain sufficient volumes within the EU. They also underlined the importance of local content requirements, notably pointing at the huge potential of public procurement in this regard.

Additionally, participants supported the accelerated review of the Carbon Border Adjustment Measures to address remaining loopholes.

"President von der Leyen sent a clear signal: keeping aluminum production and recycling in Europe is critical to our continent's future," European Aluminium General Director Paul Voss told Platts on April 7 while commenting at the meeting. "We welcome this recognition at the highest political level and look forward to quick and effective action to stop scrap leakage, strengthen trade defense, and address the impact of US tariffs."

Eurometal also emphasized the strain on US downstream industries and logistics operators, which are already grappling with inflationary pressures on imported products and declining transport margins. With the US steel market being 25%-30% import-dependent, these protectionist measures could inadvertently undermine US competitiveness, contradicting their intended purpose. This context was vital for transatlantic negotiations moving forward.

Although Europe sends more goods to the US than it receives, the situation is different when it comes to services. This indicates that the service sector, especially in technology, could be the primary channel for Brussels to respond effectively.