S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Solutions

Capabilities

Delivery Platforms

News & Research

Our Methodology

Methodology & Participation

Reference Tools

Featured Events

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

Solutions

Capabilities

Delivery Platforms

News & Research

Our Methodology

Methodology & Participation

Reference Tools

Featured Events

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

S&P Global Offerings

Featured Topics

Featured Products

Events

Support

Metals & Mining Theme, Non-Ferrous, Ferrous

March 27, 2025

HIGHLIGHTS

US announces 25% tariffs on imported cars, auto parts

European automakers urge dialogue to avoid trade war

Mexico, South Korea, Japan, Canada, Germany, UK, Slovakia affected

Potential consequences for European steel producers linked to automotive

Newly announced auto tariffs by the US will not only affect imports but also US-based automakers producing vehicles for export markets, the European Automobile Manufacturers' Association, or ACEA, said March 27 in response to 25% import taxes on cars and auto parts imposed by US President Donald Trump.

Trump said the tariffs would take effect April 2, with charges on businesses importing vehicles starting the following day. Taxes on auto parts are expected to begin in May or later. The measures are intended to boost the US economy and job creation, Trump said. The new levies come on top of the existing 25% duties on steel and aluminum, as well as on goods from Mexico, Canada and China.

ACEA voiced deep concern over Trump's announcement of additional tariffs on the auto sector. It emphasized the need for the EU and US to engage in dialogue to find an immediate resolution and avert the damaging consequences of what it termed as a "trade war".

"European automakers have been investing in the US for decades, creating jobs, fostering economic growth in local communities, and generating massive tax revenue for the US government," said ACEA Director General Sigrid de Vries. "We urge President Trump to consider the negative impact of tariffs not only on global auto makers but on US domestic manufacturing as well."

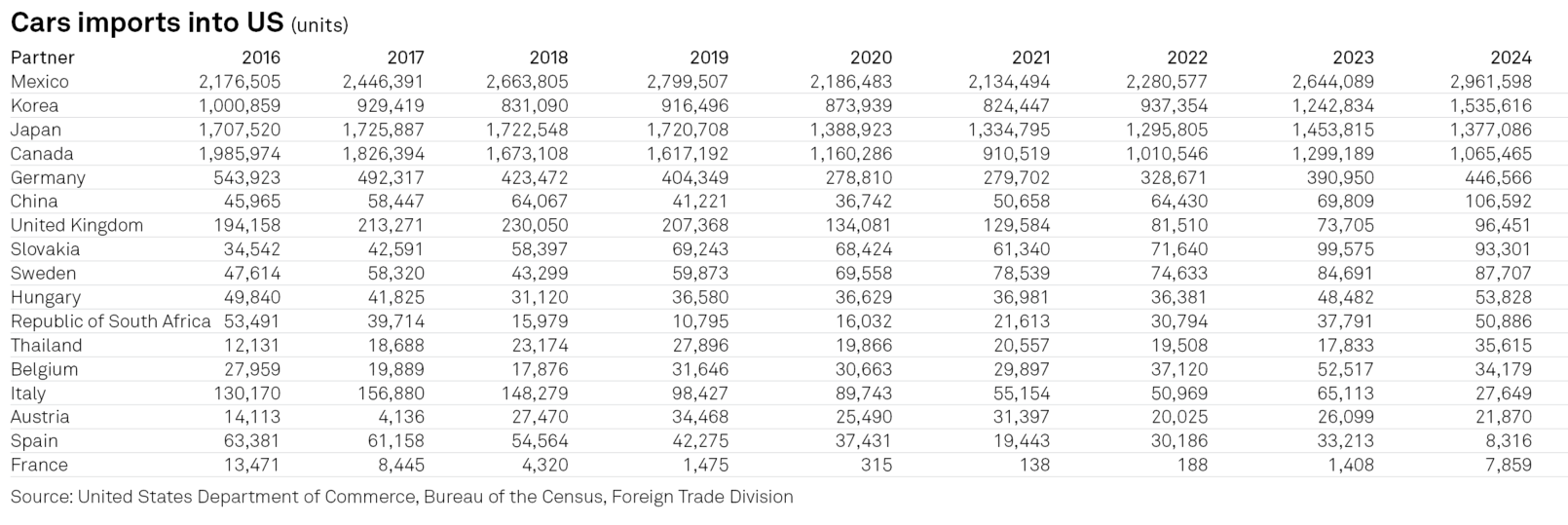

ACEA highlighted that European manufacturers export 50%-60% of the vehicles they make to the US, making a substantial positive contribution to the US trade balance. According to the data from the US Department of Commerce, the main countries affected will be Mexico, South Korea, Japan and Canada. Mexico alone exported around 2.97 million vehicles to the US in 2024, accounting for 80.2% of Mexico's total vehicle exports. Germany, As the fifth-largest vehicle exporter, shipped 446,556 cars to the US last year, making it the European country most affected, followed by the UK (96,451) and Slovakia (93,301).

The tariffs are also likely to affect European steel producers and service centers linked to the auto industry, especially given the existing 25% tariffs on their products. The auto industry is the second-largest consumer of steel, accounting for 17% of steel procurement in the EU.

Platts, part of S&P Global Commodity Insights, assessed hot-rolled coil in Northwest Europe at Eur640/mt ex-works Ruhr March 26, up Eur5 day over day. Steel prices have been under pressure since the beginning of the year due to the weak economy. Although prices have risen from Eur560/mt registered on Jan. 2, they remain far below the peak of Eur760/mt reached in February 2024 and the historical high of Eur1,230/mt recorded in March 2022.

According to Eurofer and ACEA data, new passenger car registrations increased slightly by 0.8% in 2024, reaching about 10.6 million units, still 2.4 million below pre-pandemic levels (13 million in 2019). In February, Eurofer noted in its economic outlook that demand is likely to remain weak until macroeconomic conditions and consumer incomes improve. A full recovery in global trade, particularly from the US and China, will be crucial for EU car exporters, it said.

Gain access to exclusive research, events and more