Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Non-Ferrous, Ferrous

February 13, 2025

HIGHLIGHTS

China’s steel exports already faced 25% tariffs

Aluminum shipments to US plunged since 2018

China's steel and aluminum markets have shown resilience in the face of the 25% tariffs imposed by US President Donald Trump, indicating that such a move is not expected to adversely impact the two industries in the short term.

China already faces a 25% tariff on its steel exports, which has blocked most Chinese steel from the US market. Broader trade investigations into China's aluminum exports have also reduced shipments to the US since 2018.

China's steel exports are likely to remain strong, at least in the first half of 2025, market participants said during the week of Feb. 11.

Any tariff escalation typically would create greater uncertainty in global trade policies, pressuring the growth of China's manufactured goods.

** China's steel markets are more prone to trade barriers as domestic consumption remains under pressure due to property sector woes since 2021. Robust exports were the crucial driver behind the manufacturing growth.

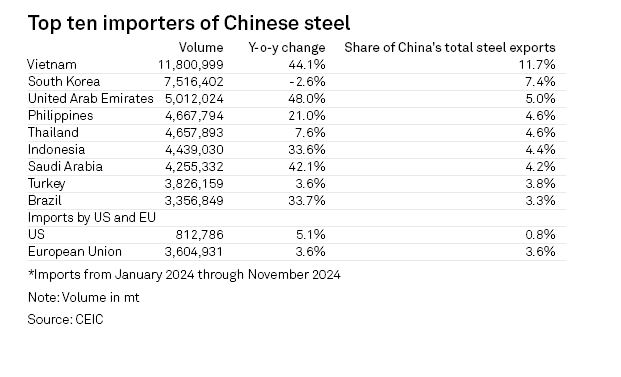

** China exported about 892,000 mt of finished steel to the US in 2024, up 5.5% year over year, but accounting for only 0.8% of China's total steel exports, data from research firm CEIC showed.

** In 2024, the total retail sales of China's consumer goods increased 3.5% year over year to Yuan 48.79 trillion ($6.72 billion), slowing from a 7.2% growth in 2023, NBS data showed.

** China's steel consumption by key sectors such as machinery and vehicles rose 2.3% year over year to 309 million mt in 2024, according to S&P Global Energy data.

** China's exports of manufactured goods are seen strong in the first quarter of 2025, market sources said.

** Exports of aluminum products are expected to see limited impact, as shipments to the US have significantly declined since 2018 due to trade investigations, market sources said.

** Over January-November 2024, China exported about 812,786 mt of finished steel to the US, up 5.1% year over year, according to the customs data

** The export value in dollar terms of China's mechanical and electrical products, the most steel-intensive manufacturing sector, increased 7.5% year over year to $2.125 trillion in 2024, customs data showed.

** In December alone, the export value in dollar terms of China's mechanical and electrical products increased 12.3% year over year to $119.107 billion, led by a rush to ship goods before tariffs hit China.

** The US was China's largest export destination for aluminum products in 2017, according to customs data.

** China exported 259,412 mt of aluminum products to the US in 2024, accounting for 4.1% of China's total aluminum products exports, according to state-owned research agency Antaike.

** As China's steel demand slowed faster than its output in 2024, the domestic hot-rolled coil and rebar prices averaged Yuan 3,648/mt ($502/mt) and Yuan 3,519/mt in 2024, down 8.9% and 10.8% year over year, respectively, according to Energy data.

** A robust demand from the electric vehicle and photovoltaic sectors, slower output growth and support from production costs kept China's aluminum prices elevated in 2024.

** The closing price of the most active aluminum contract on the Shanghai Futures Exchange averaged Yuan 19,909/mt ($2,724/mt) in 2024, up 6.5% from a year earlier, exchange data showed.