Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Video — 12 Apr, 2023

By Sarah Cottle

In our latest According to MI blog, we’re talking about a modern-day bank run, a return to normal for supply chains, and generative AI has its iPhone moment.

Banks in focus

After the second and third largest bank failures in US history, our research shows that:

Having deeply underwater bond portfolios proved unfavorable for at least SVB Financial Group, which purged its available-for-sale securities portfolio for liquidity and ultimately saw a run on its bank. The bank run and others that followed sparked investors' concerns over the stability of the industry's funding. The events also prompted some members of the investment community to write down the values of bonds in their held-to-maturity portfolios, which are not marked to market, when evaluating companies in case more banks need to harvest securities for liquidity needs. While that approach could continue to weigh on bank stocks, most banks likely will not have to go down that road and will continue to utilize alternative sources of funding like wholesale funding, CDs or the Federal Reserve's new term funding program. Read on >

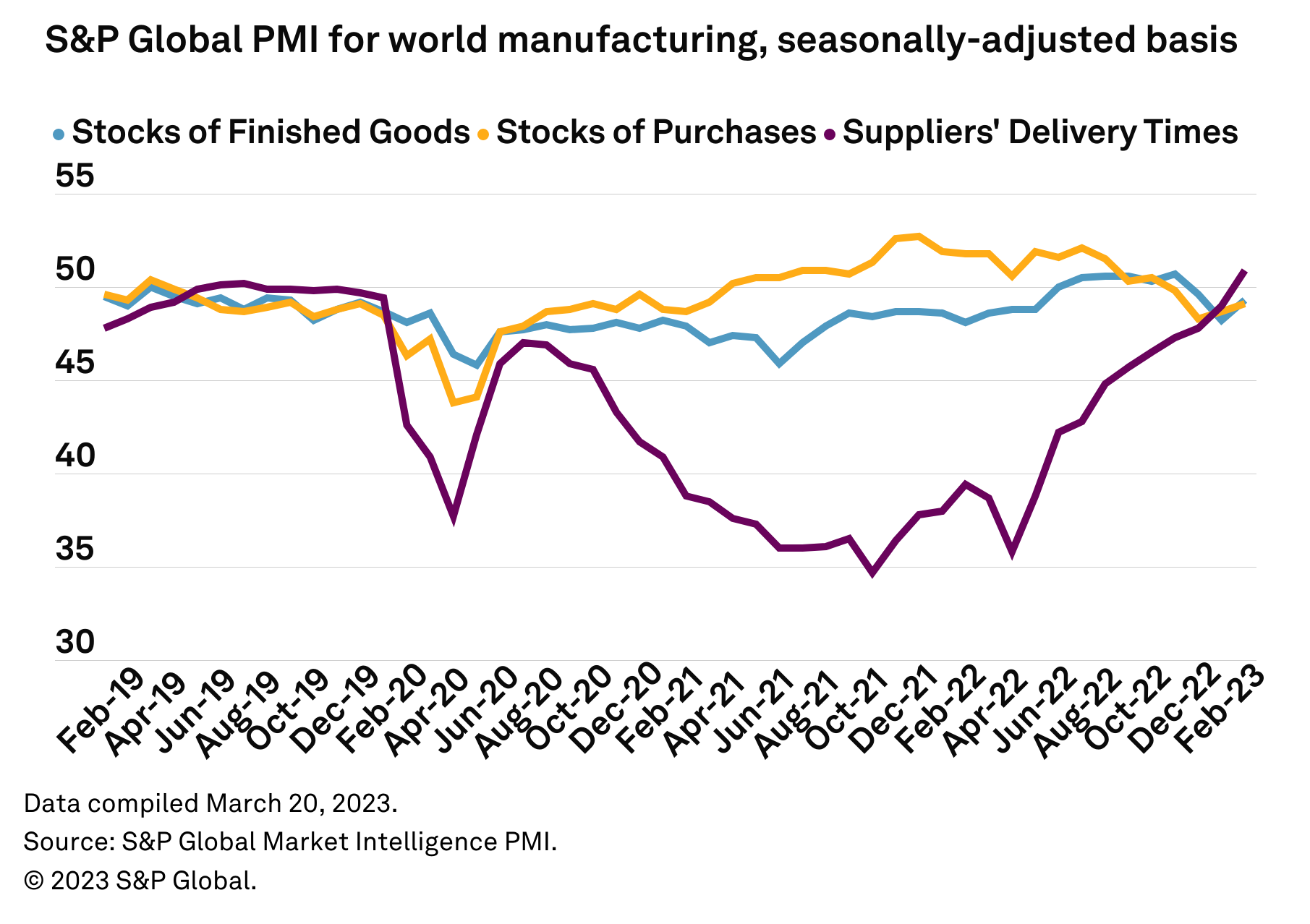

Supply chain normalcy

According to Market Intelligence, we’re getting back to normal in 2023.

View Infographic - Global Supply Chains Q2’23 >

Latest on AI

Pivoting to tech, where the release of ChatGPT has the whole world talking about generative AI.

We’ll be closely monitoring regulation here, as US authorities are already warning companies about overhyping AI in their advertising. Listen to podcast - The future of practical AI >

And that’s According to Market Intelligence.

Theme

Products & Offerings