Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Apr, 2018

Metals & Mining

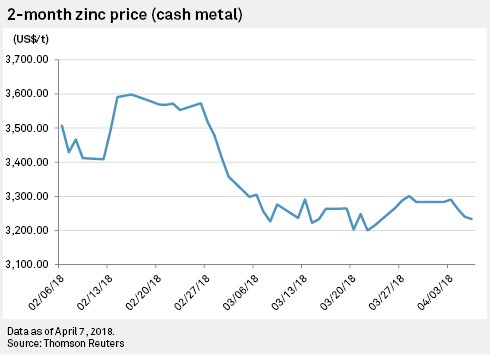

Zinc prices dropped sharply in March, with the cash price down 5.6% month over month, to close the first quarter at US$3,284/tonne; see graph below. The three-month contract on the London Metal Exchange averaged US$3,267/t in March, down 6.6% from the February average. This is the steepest monthly fall since August 2015, and prices have continued to decline in the first few trading days in April.

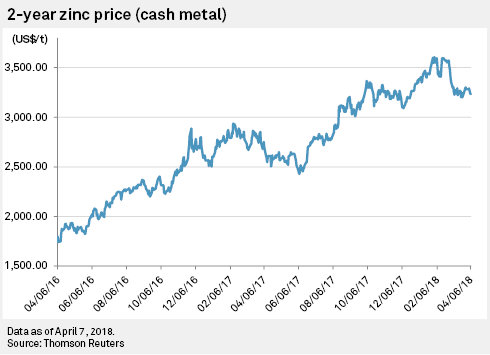

In mid-February, the cash zinc price had approached US$3,600/t — see second graph below — and the three-month price closed at a 10-year high of US$3,575/t on February 16. As noted in S&P Global Market Intelligence's latest issue of Commodity Briefing Service, zinc price movements so far this year have been the inverse of the value of the U.S. dollar, suggesting a muted movement in fundamental influences.

The monthly Commodity Briefing Service report on zinc notes that demand for the metal is not expected to be significantly impacted by import tariffs ordered by President Donald Trump or the threats of Chinese retaliation. Nevertheless, zinc market fundamentals have turned slightly more bearish over the past month, with an easing of tightness within the concentrate and refined zinc markets.

Meanwhile, there has been evidence of new capacity, with an increase in Chinese imports of concentrates from Australia boosted by commissioning of MMG Ltd.'s Dugald River mine in November 2017. Concentrate tightness will continue to ease with the restart of Glencore PLC's Lady Loretta mine, slated for the first half, and New Century Resources Ltd.'s Century mine in the third quarter.

Zinc prices also fell on the Shanghai Exchange, though to a lesser extent than on the LME. The three-month SHFE price was down 5.3% month over month. Furthermore, the SHFE cash to three-month spread shifted from contango to backwardation in mid-March, where it has remained.