Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 12 Apr, 2022

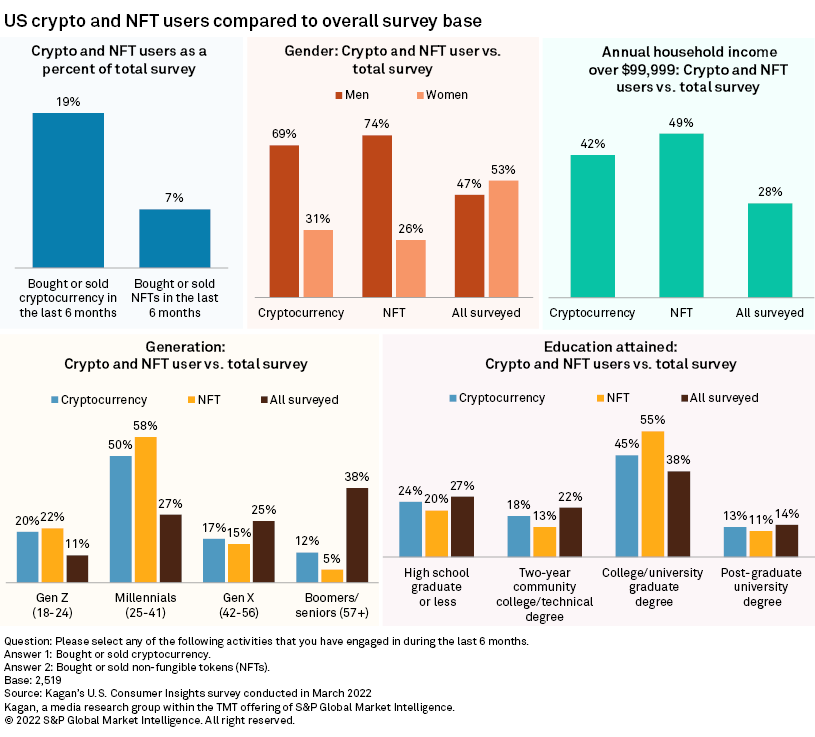

About one in five (19%) U.S. survey takers traded cryptocurrencies in the last six months, with just 7% exchanging a non-fungible token, according to Kagan's March 2022 U.S. Consumer Insights survey of 2,519 internet adults.

The buying of cryptocurrencies and NFTs, collectively referred to as "digital assets," is dominated by millennial men, video gamers, sports betters and college graduates residing in households earning more than $99,999.

Bitcoin, the bellwether peer-to-peer digital coin, was released during the 2009 U.S. housing crash by a group of online security experts seeking a nongovernment denominated digital currency built on and backed by software. These blockchain-enabled software systems are essentially distributed accounting ledgers, perhaps best envisioned as a cloud-based Excel spreadsheet the world can view to track the movements of these digital tokens.

The number of different blockchain coins has since grown to over 15,000. NFTs emerged a few years after the launch of bitcoin and fit in existing blockchains to create a singular blockchain-approved digital copy of an image or other content including music and video. The most famous NFT example might be Michael Winkelmann's "First 5000 days" image, which sold for $69 million in March 2021.

NFTs are also becoming elements in video games. According to our survey results, digital asset fans are a receptive audience. While 41% of the survey base owned at least one of the big three game consoles, the same figure for cryptocurrency traders was 72%, with NFT buyers higher at 84%. Digital asset traders were also far more likely to be weekly PC/console and mobile gamers compared to the overall survey base.

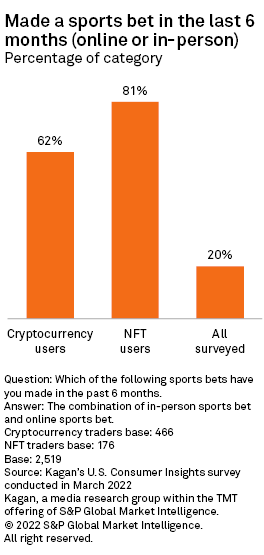

Digital asset traders are also huge sports betters. While just 20% of the surveyed base had bet on a live sports game in the last 60 days, the same figure for crypto traders was 62%, with NFT buyers at 81%. The notorious volatility associated with digital asset trading probably fits well with the risk profiles needed to place bets on sports. Overall, keeping an open mind is key for anyone wishing to learn more about this burgeoning new asset class.

Data presented in this article and associated Excel file was collected from Kagan's U.S. Consumer Insights survey conducted in March 2022. The survey totaled 2,519 internet adults, with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded up to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.