S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 25 Apr, 2024

By Jason Sappor

On April 12, the US and UK governments imposed sanctions on Russia-origin metals for the country's invasion of Ukraine. To comply with the sanctions, the London Metal Exchange (LME) announced a ban on the delivery of Russia-origin nickel, aluminum and copper produced on or after April 13 into its warehouses.

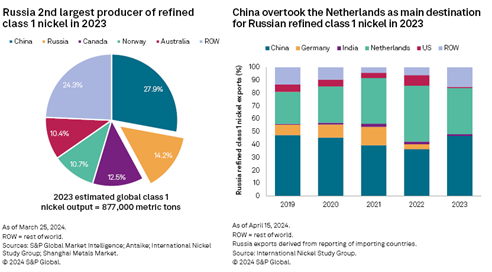

According to our estimates, Russia is the world's second-largest producer of refined class 1 nickel, the only LME-deliverable primary nickel product, behind China. The LME three-month (3M) nickel price reacted to the exchange's decision by jumping to a seven-month high of $19,355 per metric ton in trading on April 15, the first trading day following the exchange's announcement, before closing broadly unchanged on the previous trading day, at $17,846/t.

The LME 3M nickel price ended the first quarter at $16,749/t, up 0.88% from the end of 2023, amid volatility driven by concerns over delays to approval of mining output quotas in top primary nickel producer Indonesia and speculation over the trajectory of US interest rates. The price found some support during the first quarter when several high-cost miners in Australia and New Caledonia decided to curtail operations due to a slump in nickel prices created by a glut of nickel products from Indonesia.

Although we expect the US and UK government sanctions and the LME's subsequent ban on new Russia-origin nickel to support prices on the exchange in the near term, we anticipate that both measures will have a limited impact on global primary nickel market fundamentals. Previous sanctions imposed by the US, EU and UK on Russia following its invasion of Ukraine have already pushed Russia-based producer PJSC Mining and Metallurgical Co. Norilsk Nickel to redirect its European and US exports of refined class 1 nickel — which can be used to produce battery-grade nickel sulfate — to China. Trade data shows that Norilsk's pivot made China the leading destination for Russia's refined class 1 nickel exports in 2023, despite China rapidly building its own refined class 1 nickel capacity and having increased access to cheaper battery-grade nickel sulfate intermediate products, such as mixed hydroxide precipitate from Indonesia. The Netherlands was the biggest importer of Russian class 1 nickel in 2022; Rotterdam is a major EU port terminal and home of an LME warehouse that contains most of the exchange's nickel stocks.

Russia-origin metal had the largest share of LME nickel open tonnage at 36.1% on March 29, according to the latest data from the exchange. As the LME has banned only nickel produced in the country on or after April 13, the exchange has acknowledged the risk that LME warehouses could be hit by a wave of Russia-origin refined class 1 nickel supply produced before the cutoff date. This would put downward pressure on prices.

The impact of the US and UK government sanctions on Russia-origin metal will be discussed in more detail in our upcoming April 2024 Nickel Commodity Briefing Service report.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.