S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 5 Dec, 2023

By Heike Doerr

While the overall pace of water acquisition activity has modestly slowed in 2023, the total transaction amount for the year is expected to be near the 2022 value and exceed prior years. Interestingly, the number of pending large transactions — defined by Regulatory Research Associates as those with a value of $10 million or greater — has stayed mostly constant over the past 18 months.

RRA has observed inherent variability in the timing of transaction announcements and completions. It can take years to solidify a deal and, in certain instances, more than two years to secure regulatory approval.

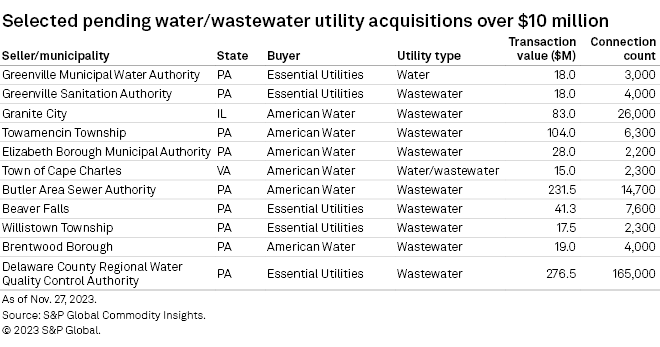

➤ RRA is tracking 11 pending large water utility acquisitions with a combined transaction value of $882 million. Two of the largest, totaling $314 million, are expected to close by year-end.

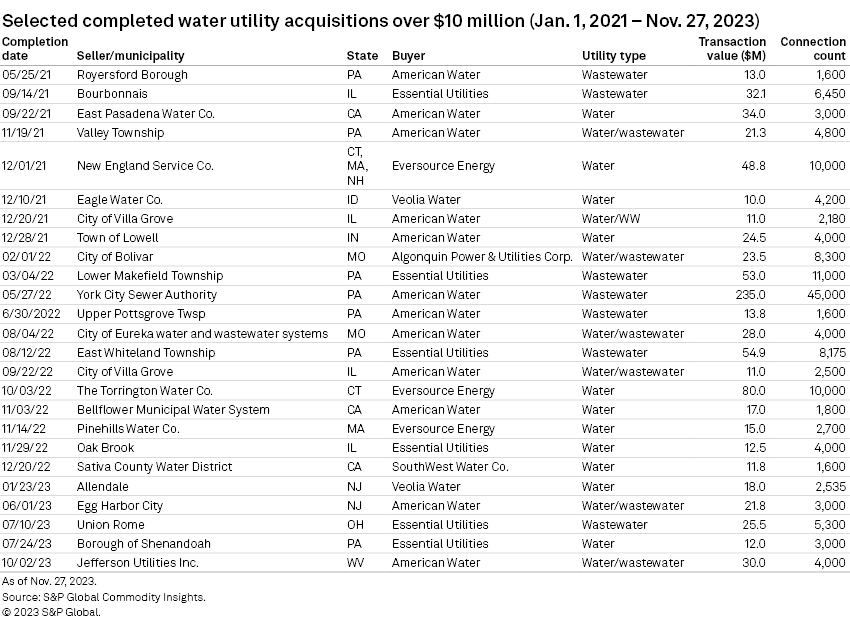

➤ Year to date, five large transactions have been completed for a total transaction value of $107 million. In 2022, 11 large water and wastewater acquisitions by investor-owned utilities were completed, totaling over $540 million. In each of the two prior years, eight transactions were completed annually with an approximate total transaction value of $200 million per year.

➤ Executives of the largest investor-owned water utilities continue to highlight favorable long-term acquisition trends while acknowledging increased challenges in Pennsylvania, the state where water transactions have been the most frequent.

➤ During recent elections, voters in Missouri and New Jersey overwhelmingly supported referendums to sell water and wastewater systems.

Senior executives continue to highlight acquisition pipeline

Essential Utilities Inc. CEO Christopher Franklin commented on a recent earnings call that the company continued "to see a strong and healthy pipeline of opportunities for additional growth" and referenced "active discussions with municipalities which have over 400,000 water and wastewater customers."

Similarly, earlier this month, American Water Works Co. Inc. CFO John Griffith told investors that the company's "outlook for future acquisitions remains very strong, as we expect to have over $250 million of acquisitions under agreement at the end of 2023 after the expected closings" of acquisitions of Butler Area Sewer Authority in Pennsylvania and Granite City wastewater treatment plant in Illinois. Griffith continued that as the company closes transactions, "the work to build and refill the acquisition pipeline is continuous. Our pipeline of 1.3 million customer connections is a strong leading indicator that supports" the company's 8% to 9% rate base growth guidance.

Over 50,000 water utility systems exist nationwide. Municipally-owned systems account for approximately 85% of the industry, while the remaining 15% are investor-owned or held privately. Financially, municipal systems are challenged by limited government funding, competing for financial needs against other municipal services and the general unwillingness of elected officials to raise taxes. Operationally, smaller systems lack the expertise to meet increasingly stringent water-quality standards. With significant capital spending projects looming and insufficient federal funding, municipal owners have been more agreeable to divesting water and wastewater systems.

In recent years, the sector has experienced an expansion in the geographic footprint of transactions and diversity in the acquirers of water and wastewater systems nationwide. Legislation that enables the acquisition of municipal systems has served as the necessary catalyst to consolidate this fragmented sector and inject needed investment into the country's deteriorating water infrastructure. Given sector demographics, the lion's share of water utility acquisition activity will continue to stem from the acquisition of financially challenged, small private systems and municipal utility systems by the largest investor-owned utilities.

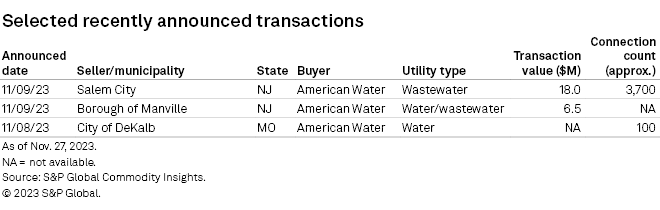

Referendums in Missouri and New Jersey clear way for system privatization

Missouri

Residents in the small city of DeKalb voted overwhelmingly for Missouri American Water Corp. (MAWC) to acquire the system, with nearly 98% of voters approving the transaction.

In recent years, MAWC has pursued small transactions in the state that have similarly required voter approval and been met with broad support. In November, the residents of Ironton supported an asset sale, and in November 2021, 90% of the voters in Stewartsville approved the transfer of the water and wastewater systems to MAWC.

In August 2020, more than 66% of voters in Eureka supported a ballot measure to sell the systems for $28 million. The transaction did not close until Aug. 8, 2022, highlighting the long timeline for some transactions to be completed.

New Jersey

In multiple elections, New Jersey voters overwhelmingly approved selling their systems to New Jersey-American Water Co. Inc. (NJAW), a subsidiary of American Water. Voters in Salem City approved the sale of the city's water and sewer system with over 60% of the vote.

Voters in Manville approved the sale of the borough's sewer system to NJAW with more than 80% of the vote. NJAW is the current water provider for Manville. The $6.5 million sale proceeds in Manville will be used to pay off all municipal debt and stabilize property taxes.

Neighboring towns of Somerville and Bound Brook similarly voted via referendum to sell to NJAW in two transactions totaling $12 million.

Earlier this year, NJAW acquired the water and wastewater systems of Egg Harbor City, NJ, for $21.8 million, adding 3,000 customers. The sale marked the first in New Jersey to be completed through the Water Infrastructure Protection Act (WIPA), signed into law in 2015. The WIPA permits the sale or lease of municipally owned water or wastewater systems that meet certain criteria — such as high contaminant levels or the need for repairs — without the public vote requirement.

Regulatory, legal challenges slow deal flow in Pennsylvania

RRA is tracking 11 pending large acquisitions with a combined transaction value of $882 million. Notably, all but two of these transactions are systems in Pennsylvania, and the two largest systems represent almost 60% of the transaction value.

With American Water and Essential Utilities having a meaningful presence in Pennsylvania, the state has been a trailblazer in implementing legislation and regulatory mechanisms that have become widely adopted as best practices in other states. "Fair valuation" legislation, such as Pennsylvania's 2016 law known as Act 12, facilitates the acquisition of systems that have a high level of contribution in aid of construction on the balance sheet. Act 12 pertained to the acquisition of small natural gas systems with service issues but was expanded by legislation passed into law in July 2019 to cover water and wastewater utilities, thus facilitating the acquisition of small distressed systems.

On Nov. 9, American Water subsidiary Pennsylvania-American Water Co. Inc. (PAWC) received approval from the Pennsylvania PUC to purchase the Butler Area Sewer Authority wastewater system for $230 million. The approval follows a settlement reached in August, and the transaction is expected to close before year-end. PAWC included the Butler system in its recently filed rate increase request.

Recently, the acquisition landscape has been more challenging.

PAWC announced in March that it would purchase the wastewater system of Towamencin Township, Pa., after NextEra Energy Inc. backed out of its proposed purchase. Towamencin Neighbors Opposing Privatization Efforts, an advocacy group, has been actively opposed to the privatization of the system. In May, voters passed a new local law forbidding township officials from selling the public sewer system. Residents have threatened to sue the township for not complying with the law and proceeding with a potential sale. PAWC does not anticipate the transaction to be completed until mid-2024.

Essential's subsidiary Aqua Pennsylvania Inc. (Aqua PA) has faced legal challenges in its $276.5 million acquisition of the Delaware County Regional Water Quality Control Authority (DELCORA), first announced in September 2019. In May 2020, Delaware County, Pa., filed a lawsuit alleging that DELCORA did not have the legal authority to establish and fund a customer trust with the net proceeds of the transaction.

Additionally, Aqua PA's already completed $54.4 million purchase of the East Whiteland wastewater system has come under a legal challenge that currently sits with the Pennsylvania Supreme Court. Shortly after Aqua PA acquired the wastewater assets, following PUC approval, the Office of Consumer Advocate filed an appeal of the PUC Order to the Pennsylvania Commonwealth Court. On July 31, 2023, the court ruled to reverse the PUC order that approved the acquisition. The company's motion for reargument was denied Sept. 26. The company, the PUC and the township filed an appeal to the Pennsylvania Supreme Court. In the interim, Aqua PA continues to operate and invest in the system.

Franklin addressed these challenges with investors, stating that the company intended "to work with regulators and stakeholders to improve the fair market value process and hopefully alleviate some of the headwinds that the sector has been facing related to municipal acquisitions, especially in Pennsylvania."

A look at large completed transactions

The table below includes details on the larger water and wastewater transactions over recent years.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.