Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Feb, 2023

By Anna Ballantyne, Jamie Gallagher, and Temilade Oyeniyi

Highlights

CDS spreads are impacted by executive sentiment on earnings calls.

CDS spreads widen up to 21 days post-call when executive sentiment is negative

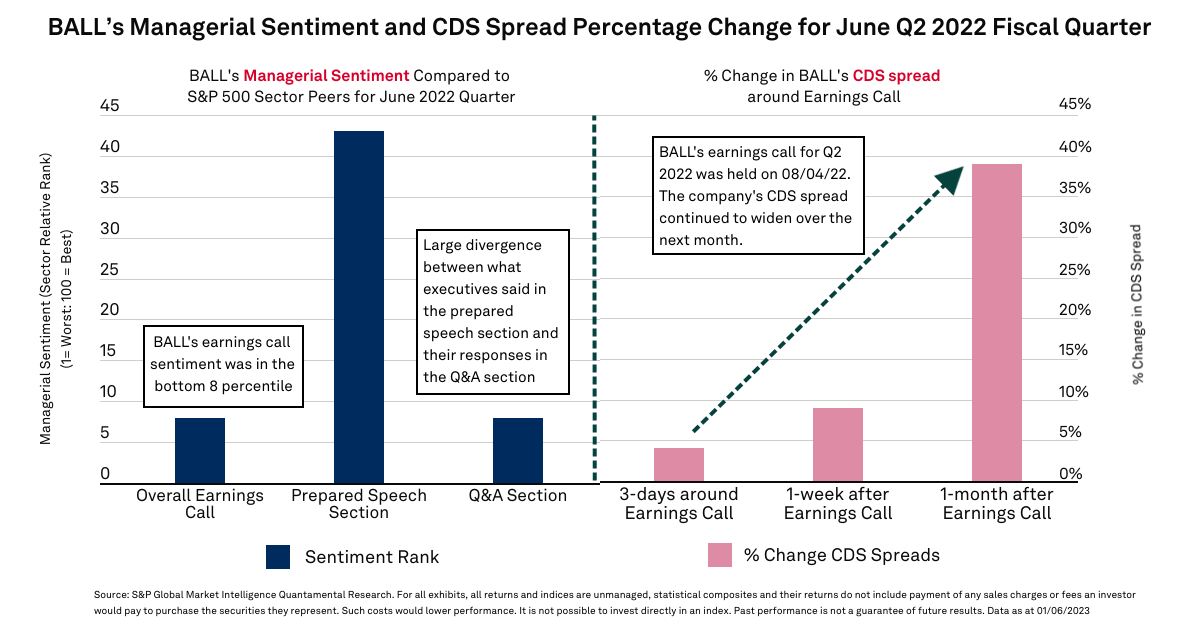

The effect of earnings call sentiment on equity prices is well documented.[1] However, issues that impact the credit risk of companies are discussed on earnings calls as well. For example, on Ball Corporation’s (NYSE: BALL) Q2 earnings call held on August 4, 2022, the company’s CFO said, “the earnings impact of volume deceleration and a higher use of working capital have led to lower-than-anticipated operating cash flow”. Credit facilities are repaid from cash flows and debt covenants typically include leverage provisions tied to earnings (e.g., debt / EBITDA) to protect the lender’s interests. BALL’s Q&A section sentiment score was in the bottom decile of earnings calls for all the companies in the S&P 500 materials sector (Figure 1, left chart)[2]

The findings in this report indicate there is a relationship between the level of earnings call sentiment and changes in CDS spreads. The mean percentage CDS spread change for companies with the worst sentiment is three times larger than that of companies with the best sentiment, 1-month post-earnings call (3.11% vs 1.11%), Figure 2.

Source: S&P Global Market Intelligence Quantamental Research. For all exhibits, all returns and indices are unmanaged, statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. Past performance is not a guarantee of future results. Data as at 01/06/2023

Overall, the mean percentage change in CDS spread is smaller for companies with the best sentiment readings across all three measurement windows.

Conclusion

While company earnings calls are targeted at equity analysts, information relevant to credit investors are discussed on these calls. This report documents that executive remarks have an impact on credit default swap spreads. The percentage change in CDS spreads of companies with the worst executive sentiment reading is larger than that of companies with the best sentiment reading post earnings call. Credit investors should consider using executive sentiment as an additional tool to gauge the direction of future CDS spread movements.

[1] See Zhao, F. “Natural Language Processing - Part II Stock Selection”. S&P Global Market Intelligence Quantamental Research, September 2018

[2] Sentiment was calculated as the number of positive words minus number of negative words scaled by the total number of words in the earnings call. Positive and negative words were determined using the Loughran-McDonald dictionary. Average number of securities in each decile was 26.

READ THE FULL REPORT