Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Feb, 2024

By Tony Lenoir and Adam Wilson

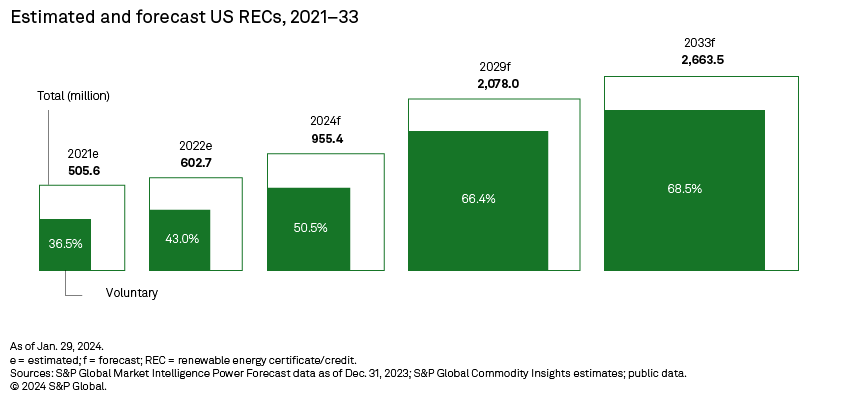

The number of voluntary renewable energy certificates (RECs) overtakes the compliance amount in 2024 in our latest US REC market outlook. This underscores the potency of the nonpolicy market mechanisms now driving the US generation fleet's switch away from fossil fuels — a transition that for years hinged on renewable portfolio standards. That said, as unmandated green energy is not influenced by set alternative compliance payments, the push and pull between consumers and power suppliers yields much lower average REC prices, weighing on the voluntary segment's share of total dollars in the US REC market.

Largely fueled by a seemingly insatiable corporate appetite for green energy, voluntary renewable energy certificates — once an afterthought amid the focus on renewable portfolio standards — are expected to overtake their compliance counterparts in the next 12 months, on their way to accounting for more than two-thirds of overall US certificates in the second half of our latest US REC 10-year forecast.

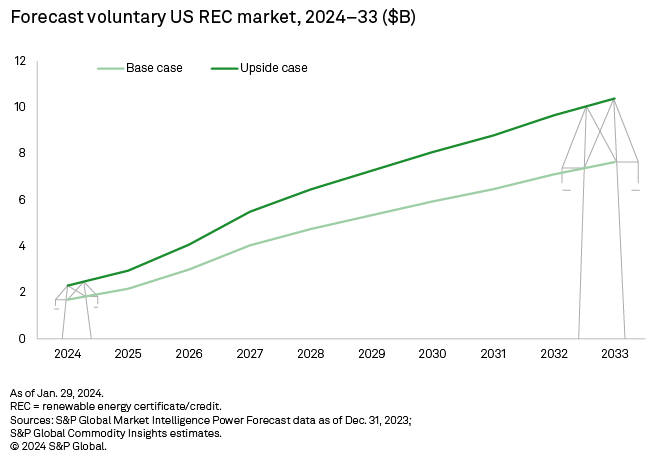

But with the lack of binding mandates resulting in voluntary REC prices being lower than those seen in compliance markets, the dollar share of the voluntary segment in the overall US REC market remains limited throughout the outlook, oscillating between 9.9% and 19.3% in our base case scenario.

In the long run, the combination of economic, strategic and tax incentives trumping fear of noncompliance fallouts arguably results in a self-propelled renewables ecosystem — potentially rendering compliance markets obsolete.

Our latest forecast calls for US voluntary renewable energy certificates (also known as renewable energy credits) to advance at a 15.9% compound annual growth rate from 2024 through 2033, leapfrogging the projected 473.1 million compliance credits in 2024 and crossing the 1.8-billion mark by 2033 — an overall increase of 1.34 billion in the 10-year interval. In monetary terms, the voluntary market rises from a projected $1.69 billion in 2024 to $7.64 billion by 2033 in our base case model. In our upside case scenario, the projected 2033 figure crosses the $10-billion threshold.

Voluntary RECs are unrelated to renewable portfolio standards (RPS). In other words, unmandated supply and demand dynamics set the pace of this segment of the US REC market, including average rates. Complementing the compliance market, which has ensured a floor for US renewable generation output, the voluntary space thus helps US renewable capacity grow, contributing to the displacement of fossil fuels in the generation mix.

Corporate offtakers are at the forefront of the voluntary REC market, pursuing (mostly) environment-related sustainability objectives and facing mounting concerns over energy security amid shifts in international relations. Renewables not only contribute to corporate decarbonization objectives, but they also provide a certain degree of insulation against the vicissitudes of global fossil fuel politics, mitigating potential power-related disruptions to operations. Our 2023 Corporate Renewables Update report showed nearly 62 GW of US renewable capacity contracted by US corporations through deals tracked as of Feb. 1, 2023.

Over 40 GW of this corporate demand is tied specifically to datacenter companies and hyperscalers. Power demand of datacenters — already putting stresses on energy providers in highly concentrated markets — is projected to double in just the next three years, according to an International Energy Agency report. This projection could even prove conservative as the rapid emergence of AI computing is leading to aggressive forecasts of energy demand increases across the globe.

Given many of the largest datacenter owners also have self-imposed clean energy targets, this expected ramp-up in electricity needs will result in a comparative increase in corporate appetite for renewable electricity. While these companies are not known to dip into the voluntary REC market to fulfill their clean energy goals, they are expected to front-run this demand increase by securing power purchase agreements for newly planned renewable projects, thereby reducing the forecast pool of RECs available to the voluntary market.

On the supply side, long-term 30% production and investment tax credits from the Inflation Reduction Act of 2022 — tax breaks that can rise all the way to 50% when some siting and domestic component quotas are met — largely offset lower voluntary REC prices.

A deteriorating geopolitical picture, which has recently led to shipping lane disruptions and ever more ambitious pushes towards electrification, can only ensure further momentum across the voluntary market. Even on its own, electrification — notably of the transportation sector and of heating systems — is a powerful amplifier. By increasing the overall demand for power, electrification ensures that the rising share of voluntary RECs, itself fueled by increasing demand for renewable energy, takes place across an electric load that is expanding.

In other words, economic, geopolitical and societal developments are combining to maintain strong momentum in the voluntary US REC market, translating into a fast-expanding proportion of green energy on the grid and posing the question of the need for additional, or more stringent, RPS.

Furthermore, expectations that voluntary RECs will soon significantly outnumber their compliance counterparts — that is to say, a marketplace with much more REC supply than is needed to meet RPS demand — also suggest limited upside for average US REC market prices despite market distortions brought about by the existence of alternative compliance payment thresholds. As costs for new renewable generation continue to decline and availability grows via the voluntary market, alternative compliance payments themselves may increasingly become obsolete.

Data visualization by Chris Allen Villanueva.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign