Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Feb, 2022

By Thomas Mason

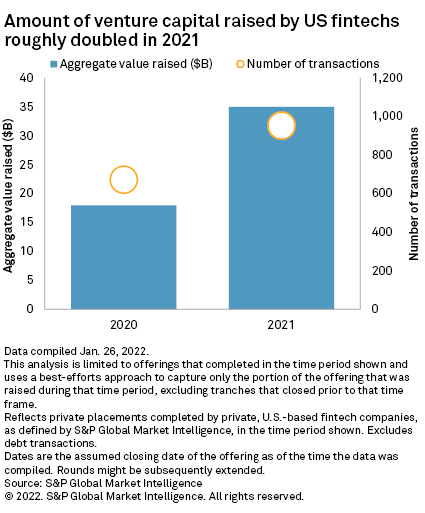

Venture capital funding to U.S. financial technology companies soared in 2021, both in transaction value and volume. While we anticipated "another strong year," the magnitude of the increase — a near doubling in transaction value — was surprising.

U.S. fintech funding had a banner year in 2021, but it will be a tough act to follow. Sagging valuations in the public equity market and potential interest rate hikes do not bode well for future investing activity. Private capital remained plentiful in January 2022, based on the aggregate total for all U.S. industries, but we will be watching for signs of a slowdown.

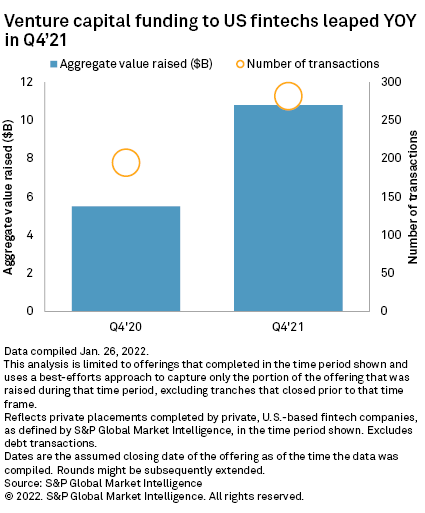

The strong increase in fintech funding in 2021 was not simply due to favorable year-over-year comparisons coming off a slowdown in activity in 2020 during the height of the pandemic. Funding activity fell from March 2020 to April 2020 but quickly recovered. A look at just the fourth quarters of 2020 and 2021 echoes the full-year findings: The aggregate amount raised increased by more than 95% and the volume of transactions jumped over 40%.

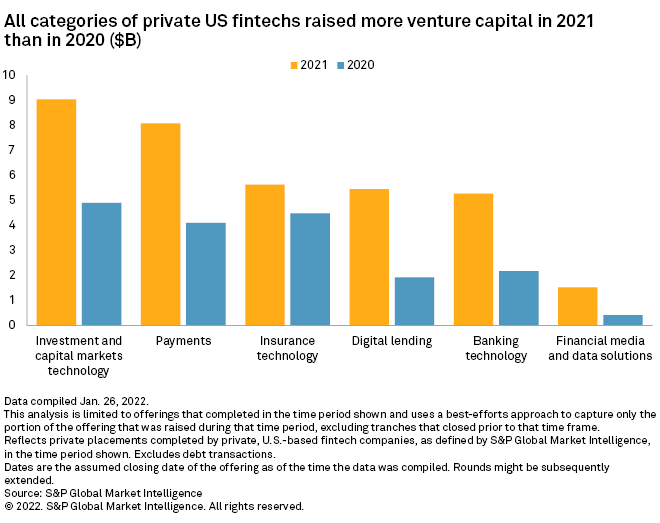

Investment and capital markets technology companies were the biggest beneficiaries of the venture capital wave in 2021. By our estimate, about $9 billion flowed to that space, a total that does not even include Robinhood Markets Inc.'s $3.4 billion capital infusion in February 2021. At the time, the details were lacking, but we now know Robinhood raised nonconvertible debt, which we exclude from our equity funding round analyses.

The investment and capital markets tech category also dominated in 2021 based on the number of funding rounds, with 33% more than the next-highest category. The roughly 250 rounds that investment and technology companies closed accounted for 26% of the total rounds from all U.S. fintech companies in 2021.

The large jump in funding to investment and capital markets companies in 2021 was likely due to the booming stock and cryptocurrency markets, as well as successful investor exits. The year contained dramatic displays of retail investor activity, with an avalanche of trades in GameStop Corp. in late January and a June spike in purchases of Dogecoin, among other examples. These might have spurred venture capital bets on consumer apps and the infrastructure companies that support them. Robinhood's IPO likely added to venture capital investor optimism, demonstrating that a startup can grow from a $3 million seed round to a $2.3 billion public offering in eight years.

Four of the top 10 U.S. fintech raises in 2021, by amount raised, were from investment and capital markets technology companies. The largest of those four came from New York Digital Investment Group LLC, illustrating the popularity of bitcoin. NYDIG helps institutions offer bitcoin services and could arguably be put in other categories, such as banking technology or payments, given its client base. But since NYDIG has brokerage subsidiaries dedicated to bitcoin trading, S&P Global Market Intelligence classifies it as investment and capital markets technology.

Another large raise came from a more clear-cut provider of investment and capital markets technology: DriveWealth Holdings Inc. The company provides a host of back-end services, like clearing and settlement, for trading and investing apps, including Block Inc.'s Cash App. While startups with consumer-facing apps tend to grab the media's attention, venture capital firms are generally as interested, if not more interested, in business-to-business startups in the investment and capital markets tech arena.

Looking ahead

It is still early in 2022, but there are some troubling signs for the fintech sector. Many of the startups that have gone public since the start of 2020 are now trading below their IPO prices and, more generally, growth stocks appear out of favor with investors at the moment. If the market rout continues, it will likely mean fewer fintech startups go public, if any. We have already seen special purpose acquisition company deals scrapped from investing app Acorns Grow Inc. and homeowners insurtech Kin Insurance Inc., and we expect IPO plans from other companies to be put on hold. A souring stock market could also dampen M&A activity, since publicly traded acquirers would have weaker currencies to pursue deals and would likely go into capital preservation mode.

While neither an IPO or M&A slowdown would immediately impact venture capital funding — funding might even increase for a while if startups stay private longer — those factors could eventually deter investments if venture capital investors view exits as less lucrative or infeasible. Another key barometer for the future of venture capital funding, in our opinion, is interest rates. If the Federal Reserve hikes rates, as expected, it will increase the hurdle rate for investors, making private capital more expensive and, most likely, decreasing its supply.

On the bright side, venture capital funding across all sectors did not slow in January 2022, even with the broader stock market's tumble. Additionally, several seasoned startups, like Stripe Inc. and Chime Financial Inc., remain private and should continue to complete large rounds as long as they do not go public or get acquired.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Segment