Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Jun, 2024

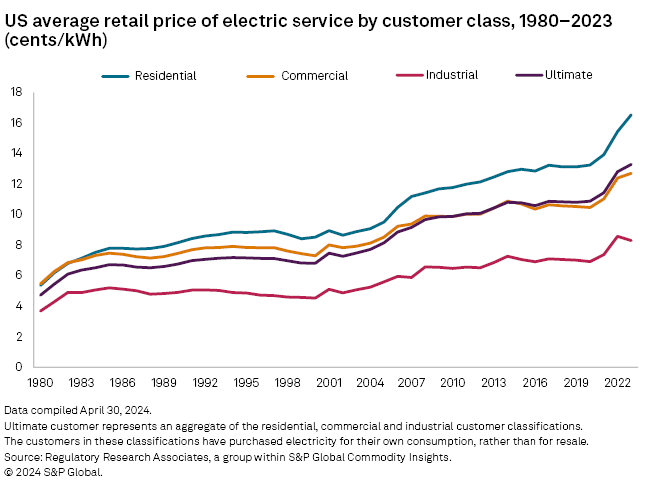

The average retail price of electricity per kilowatt-hour paid by ultimate customers in the US in 2023 rose 3.7% on a nominal (unadjusted for inflation) basis to 13.29 cents compared with a nominal increase of 12.1% in 2022 to 12.82 cents and by 5.83% to 11.44 cents in 2021. The ultimate customer classification is an aggregate of the residential, commercial and industrial classes.

The increase in price per kilowatt-hour in 2023 was much less acute than in 2022, when prices increased abruptly within each of the residential, commercial and industrial customer classes, according to bundled electric sales data gathered and analyzed by Regulatory Research Associates from information originally sourced from the US Energy Information Administration.

➤ The 2023 overall electric price at the ultimate customer level — an aggregate of the residential, commercial and industrial classes — rose 3.7% on a nominal basis or 0.1% on a real basis compared with 2022.

➤ Electricity prices may be only incrementally higher in 2024 if geopolitical issues remain tractable.

➤ While the fraction of electricity generated from natural gas has continued to grow, reaching 43% in 2023, the cost of natural gas dropped back to customary levels in 2023 and 2024 to date as shale gas production has reached new heights.

Considering heightened geopolitical risks, with multiple international conflicts that could impact global energy supplies and transportation, and supply chain and raw materials issues in other industries, nominal and real retail electric prices may creep up again in 2024 across the customer classes.

However, assuming geopolitical issues remain tractable, the potential electric price increases may be more moderate compared with 2023, considering the ongoing actions of the US Federal Reserve to diminish inflation through interest rate increases as well as expectations for the cost of natural gas to remain reasonable as more supply comes online from ongoing production gains.

The price of natural gas is expected to be the most significant variable in electric generation costs in 2024. However, natural gas supplies are forecast to be ample in 2024 from ongoing growth in production from US shale basins. The EIA expects electricity prices in 2024 to be similar to 2023 levels, driven by stability in natural gas prices in the US.

While natural gas demand has grown materially over the last several years from LNG exports and increasing use in industries outside the power generation sphere, US producers have responded with generous increases from the Permian and other shale gas basins.

Electricity prices paid by ultimate customers vary widely geographically

Electric customers in Hawaii paid the highest ultimate prices in the country in 2023, at 39.2 cents/kWh. Other states with high average prices were Connecticut at 30.7 cents/kWh and Massachusetts at 30.4 cents/kWh. In 2023, Wyoming, North Dakota and Louisiana had the lowest prices, with the average ultimate customer paying 7.88 cents, 8.41 cents and 8.64 cents, respectively, for each kilowatt-hour.

We note that retail competition for electric generation service exists in 22 state jurisdictions; in these states, the data presented in this study is for power sold to retail customers who have not selected an alternative or competitive power provider and continue to be served by the incumbent local distribution utility under state commission-approved standard-offer service rates.

Texas operates under a unique market structure, and standard-offer service does not exist. Rather than the incumbent utility, competitive electric providers serve all customers within the Electric Reliability Council of Texas Inc. at rates not regulated by the Public Utility Commission of Texas. As a result, this report only incorporates Texas companies that have not restructured and continue to be traditionally regulated.

Electric price spikes were generally limited before 2022

In prior years, despite significant simultaneous investment in infrastructure and considerable change in power generation composition, electric price increases were modest.

Yet, inflation reared up in 2021 and peaked in 2022. Various factors, such as disruptions in manufacturing and supply chains and increases in the costs of raw materials, including energy commodities, were some of the contributing factors underlying the significant rise in average retail electricity prices in 2022.

Prior to 2021, the prices of energy commodities, such as natural gas, were reined in by over a decade of increasing gas supplies flowing from the shale revolution, with substantial production growth blooming in the Marcellus and Permian basins.

Increased energy costs propelled higher electric prices, as most energy commodities prices rose in 2021 and 2022. Natural gas prices increased in both years due to producers struggling to match growing industry demand and burgeoning LNG exports. While producers had been focused on improving profitability and financial strength rather than solely growth, they could respond to increased demand signals and pour resources into greater production. The increased production, primarily from the Permian, helped significantly alleviate natural gas supply constraints and moderate gas prices to power generators in 2023.

Although US dry gas production grew by 3.7% in 2022, averaging 98.1 Bcf/d, it could not match the overall demand for natural gas that year, according to the EIA. However, the EIA projected that natural gas production would continue growing and shortages would generally be alleviated in 2023 and 2024. Actual 2023 US dry gas production averaged 103.8 Bcf/d, and present EIA estimates for 2024 indicate production will average 102.1 Bcf/d and grow to 104.1 Bcf/d in 2025. Rising production is expected to continue to moderate prices over the next several years.

Historical electricity price trends

Over the past decade, real electricity prices for ultimate customers are down 0.1%. In addition to a trend of declining fuel prices until 2021, lower electricity prices in recent years have also been attributable to lower interest rates and the resultant drop in authorized equity returns at regulated utilities. Considering the Federal Reserve's ongoing plans to address inflation through higher interest rates, however, higher capital costs for utilities are likely to eventually impact electricity prices.

Over 2012–2022, nominal bundled electricity prices for residential, commercial and industrial customers were up 27.4%, 23.6% and 31.6%, respectively. On an inflation-adjusted basis, however, prices fell 1.0% for residential customers and 3.6% for commercial customers, while they rose 4.4% for industrial customers.

In an effort to align data presented in this report with data available in S&P Global Market Intelligence's online database, earlier historical data provided in previous reports may not match historical data in this report due to certain differences in presentation. In addition, the data within this report is largely derived from information obtained from the EIA. The error capture and update methodology utilized by the EIA is outside the control of S&P Global Market Intelligence. Accordingly, S&P Global Market Intelligence does not guarantee the accuracy, completeness or timeliness of any content provided herein.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.