S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 29 Feb, 2024

By Tony Lenoir and Adam Wilson

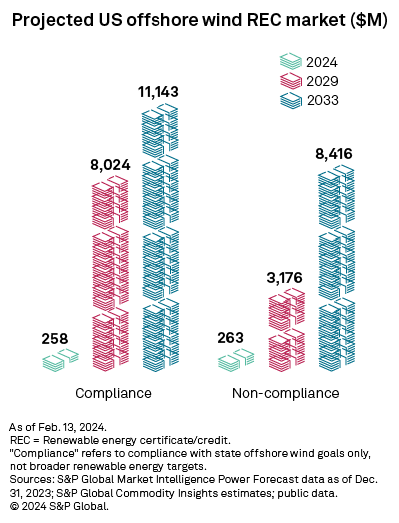

The offshore wind industry in the US continues its sluggish pace as market boosts from the Inflation Reduction Act of 2022 incentives and bolstered federal support were countered in 2023 by rising costs, higher interest rates and ongoing supply chain disruptions. On the heels of this market reset, renewable energy credit prices for offshore wind projects are expected to increase. Combined with state offshore wind targets, this is forecast to lead to an offshore renewable energy credit (OREC) market size of $11.1 billion by 2033 based on S&P Global Market Intelligence projections, while a more conservative scenario places the 2033 OREC market closer to $8.4 billion.

➤ The US offshore wind industry continues to dust itself off coming out of a tumultuous 2023 that experienced numerous contract cancellations, project delays and two projects permanently shuttered after inflationary pressures disrupted the economic viability of existing offshore contracts. The industry continues to move forward, however, as state offshore wind targets and increased federal support are driving developers and state regulators to renegotiate more favorable long-term contracts.

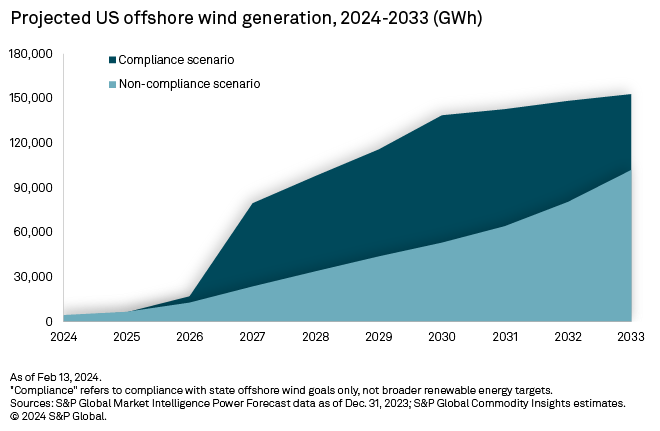

➤ Considering these market hurdles, two forecast scenarios are presented to reflect offshore wind generation growth, should states keep pace and meet their respective offshore wind capacity targets (compliance scenario) and if project delays result in these states falling behind their development schedules and failing to meet their capacity targets in time (noncompliance scenario).

➤ The compliance scenario forecasts US offshore wind generation to surpass 150,000 GWh by 2033, while the noncompliance scenario predicts just over 100,000 GWh of operating offshore wind generation by the same time. Higher offshore renewable energy credit prices that reflect the market volatility of 2023 are also forecast, resulting in a total OREC market of $11.1 billion in the compliance scenario compared to $8.4 billion in the noncompliance scenario by 2033.

Currently, Market Intelligence has identified 39 offshore wind projects in development across the US, with a cumulative capacity of nearly 42 GW. Just two projects are in operation, but the combined capacities of these projects are only 41 MW. This figure is set to increase, as the 800-MW Vineyard Offshore Wind Project in Massachusetts and the 132-MW South Fork Offshore Wind Project in New York have started producing power and are set to be commissioned sometime before the end of 2024.

So far, 10 states have implemented offshore wind capacity goals totaling 76.8 GW, with timelines ranging from 2027 (5.6 GW for Massachusetts) to 2045 (25 GW for California). In 2021, the Biden Administration set a US-wide goal of 30 GW by 2030. Further, as part of the Inflation Reduction Act, offshore wind projects that begin construction before Jan. 1, 2026, are eligible for a 30% investment tax credit, provided prevailing wage and apprenticeship requirements are met. Beyond that, projects will be eligible for tech-neutral production tax credits through 2032.

In some instances, the energy community bonus credit of the Inflation Reduction Act may further offset the high costs of developing offshore wind projects along the US coastline. By siting their onshore interconnection facilities in geographies qualifying as energy communities under the legislation, the US offshore wind projects may be eligible for a 10% tax credit step-up on top of the act's base investment tax credits. Identified energy communities border an estimated 28% of the continental US seashore, including about 19% of the East Coast, 32% of the West Coast and 41% of the Gulf Coast.

Market Intelligence Power Forecast projections build sufficient capacity for states to reach their respective offshore wind targets. The fourth-quarter 2023 forecast shows generation rapidly increasing through 2033, with the combined US offshore wind output expected to surpass 100,000 GWh by 2029 and topping 150,000 GWh by 2033.

Post-pandemic market turmoil has complicated development timelines for offshore wind projects, however, putting the achievement of these state-level goals in question. As a result, a noncompliance scenario is also presented, reflecting recent project cancellations and delays. This scenario anticipates the US reaching 100,000 GWh in 2033 — four years later than the compliance scenario.

Two projects have already been canceled and several others have been postponed as developers work to negotiate new contract prices. Offshore wind veteran Ørsted A/S recently announced the cancellation of the Ocean Wind 1 and Ocean Wind 2 projects in New Jersey totaling 2.2 GW, as well as suspending development of the Skipjack 1 and Skipjack 2 projects in Maryland, claiming the contracts were no longer economically viable. While most disputed offshore projects will continue attempts to renegotiate more favorable OREC contracts, Ørsted shuttered Ocean Wind 1 and 2 due to the low likelihood of the projects qualifying for bonus tax credits.

Equinor ASA and BP PLC canceled the OREC agreement for the 1.3-GW second phase of the Empire Wind in New York after state regulators rejected requests from developers to raise OREC contracts for three different offshore wind projects signed in 2019 and 2022. The OREC prices that developers deemed not financially worthwhile ranged from $107.50/MWh to $118.38/MWh. Ørsted agreed to purchase a 50% stake in one of these projects — the 924-MW Sunrise Wind offshore project — if it wins an increased price in New York's fourth offshore wind solicitation. Results of this solicitation are expected to be announced in February.

Offshore wind REC values are based on expected future market fundamentals and represent the incremental revenue required after expected wholesale energy and capacity market revenue. Near-term expected revenue requirements have increased notably after the industry faced a tumultuous 2023, owing to inflationary pressures. Due to the long-term, contractual nature of offtake agreements, bidding for many US offshore wind power purchase agreements occurs in the early stages of permitting (5-7 years prior to investment decisions). As capital expenditures rose in 2023, many PPAs found themselves under water.

Beyond 2030, industry scale drives capital cost reductions and improved capacity factors, furthering reductions in OREC costs. Higher capacity factors and greater capacity value relative to onshore wind increase the value of this technology. Tax credit availability is also critical for offshore resources, and the tax credits in the Inflation Reduction Act are assumed to continue until US power sector greenhouse gas emissions reach 75% below 2022 levels. Offshore wind will continue to rely on further regulatory support beyond these revenue streams in the form of ORECs resulting from state procurement mandates.

Additionally, new offtake agreements for offshore projects in several East Coast states will include adjustment mechanisms to protect developers and state authorities from future inflation price shocks. Such mechanisms were not commonly included in project contracts prior to 2023.

Procurement results prior to 2024 are unlikely to be indicative of the revenue that offshore resources can expect, but recent announcements indicate where the market is headed over the next several years. Projects awarded by New York in 2023 had a weighted average offtake agreement (inclusive of wholesale market revenues) of $145/MWh. In late January 2024, New Jersey announced the results of its latest solicitation — two projects with a combined capacity of 3,742 MW and a weighted average offtake price of $149/MWh. The solicitation results for New York and New Jersey translate to estimated net OREC prices of $90.35/MWh and $87.36/MWh, respectively. We expect average OREC prices to reflect these high levels through 2030 before declining.

OREC price forecasts, applied to the compliance forecast generation scenario, project an offshore REC market value reaching $5.1 billion by 2027 and then doubling to $10.6 billion by 2032 before settling at $11.1 billion by 2033. OREC market value grows slower in the noncompliance generation scenario, not reaching $5 billion until 2031 but climbing to $8.4 billion by 2033.

Data visualization by Chris Allen Villanueva and Shirley Gil.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign