Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Aug, 2023

By Tim Zawacki

Two consecutive banner years of top-line growth for the US life and annuity industry fueled by macroeconomic dynamics and the COVID-19 pandemic make for a tough act to follow.

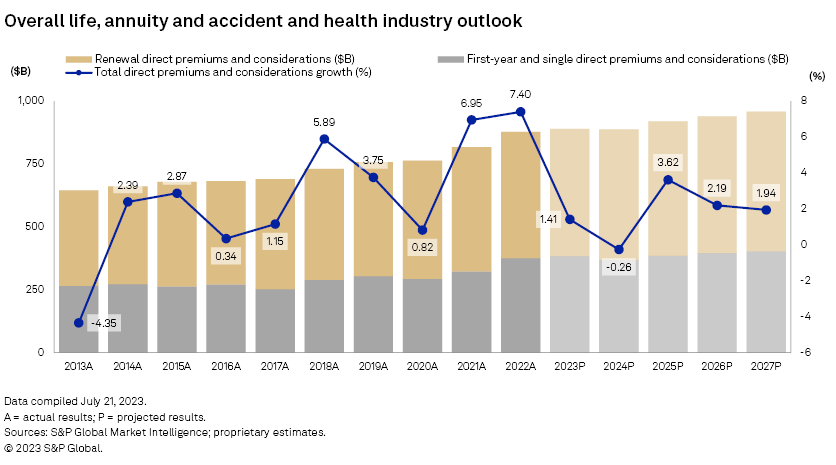

➤ The newly released S&P Global Market Intelligence US Life and Annuity Market Report calls for direct premiums and considerations across the sector, including accident and health business produced by life companies, to rise by 1.4% in 2023 and then decline by 0.3% in 2024. This follows atypically high growth rates of nearly 7.0% in 2021 and 7.4% in 2022. We expect that positive factors such as expectations for modest domestic macroeconomic growth, favorable demographic trends including the continued aging of the American population and the benefits of higher interest rates will be mitigated by some especially difficult year-over-year comparisons in certain key business lines.

➤ The ordinary life business will be challenged to recapture its pandemic-era momentum as we project that annual growth rates will settle down in the historical range in the low single digits.

➤ The ordinary individual annuity business is on pace for a second-consecutive record year for volumes as rising interest rates add to the value proposition of products such as multiyear guaranteed annuities, though we expect that 2023's growth rate will fall far short of the outsized expansion the industry achieved in 2022. We project a slight pullback in 2024 but anticipate that annual volumes will remain well above the levels that had been associated with the business line prior to the current Federal Reserve tightening cycle.

➤ Volatile markets and rising interest rates led to record group annuity direct premiums and considerations in 2022. We expect that favorable dynamics supporting the issuance of pension risk transfer group annuities will serve as the primary driver of production in 2023 and 2024, but the challenging comparison facing the business this year will prove too high of a hurdle to overcome.

Life languishes

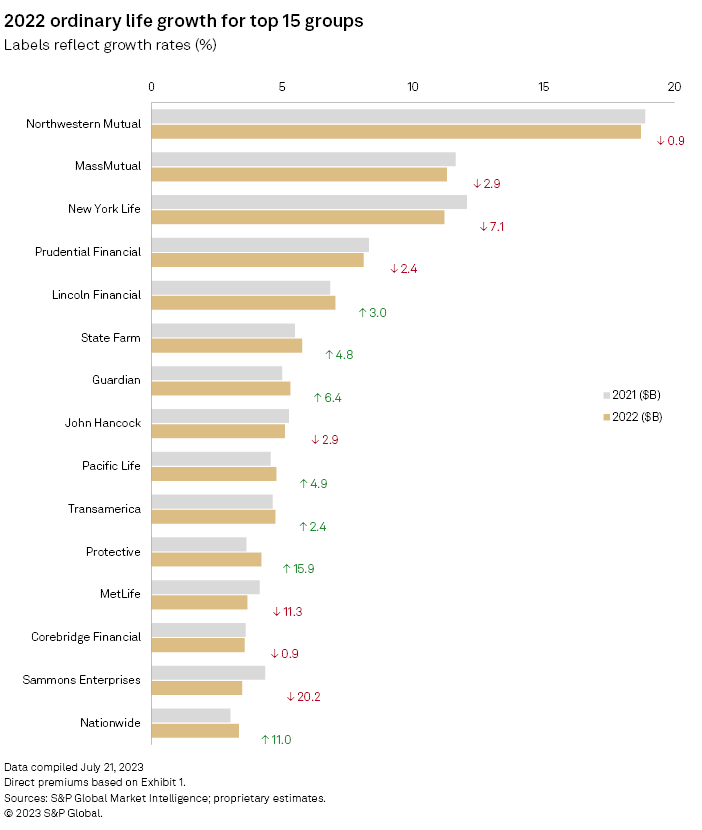

Direct premiums growth in ordinary life, a business line that had generated relatively stable if unexciting rates of growth through much of the previous decade, has experienced uncharacteristic volatility in recent years. Our outlook calls for a return to that historical pattern.

After a projected decline of less than 1.1% in 2023, which largely reflects the one-time negative impact of a challenging comparison in the first quarter, we anticipate that growth rates will roughly approximate the longer-term annual average of about 2.4%.

A unique confluence of events in 2021, including heightened consumer interest in life insurance during a global pandemic and the effects of a favorable federal income tax law change, led to a surge in new business volume that we do not expect the industry to come close to replicating. Direct first-year premiums and single premiums, a proxy for new business volume reported in annual statutory statements, soared by 25.0% in 2021, more than double the highest annual rate of expansion the industry had achieved in any of the previous 20 years. They fell by 7.0% in 2022, and we expect a retreat of 2.5% in 2023. However, the 2021 expansion was so strong that even after two years of retreat, we expect that ordinary life direct first-year premiums and single premiums in 2023 will still be 13.4% above the 2020 result.

LIMRA's Preliminary US Retail Individual Life Insurance Sales Summary put growth in new annualized life insurance premium at 2% for the second quarter, boosted by term and whole life products. But an annualized premium remained down by 3% for the first half of the year, reflecting the difficult first-quarter comparison. LIMRA sales statistics are distinct from the first-year premiums and single-premium disclosures in annual statements.

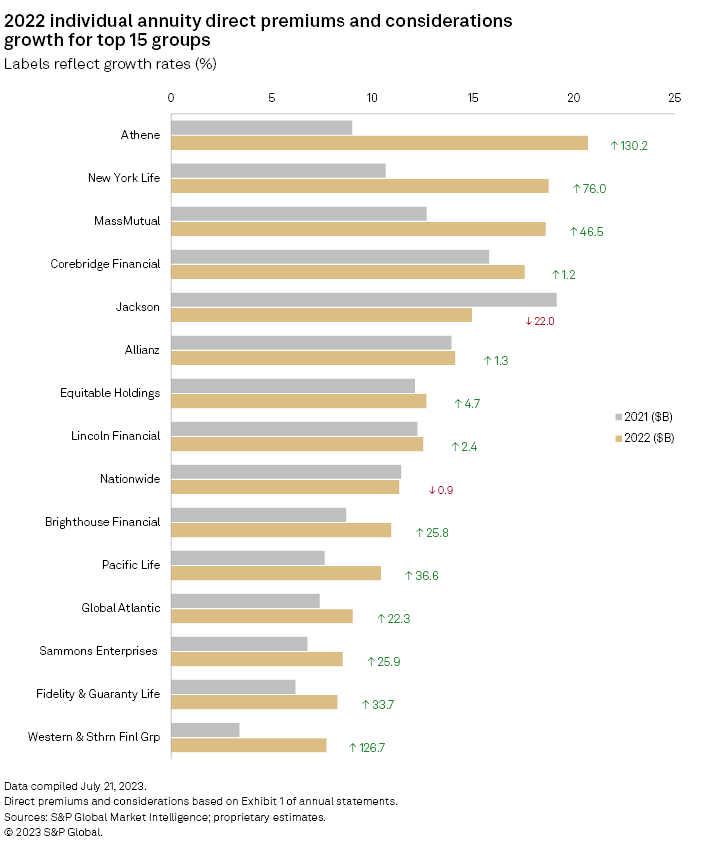

Interest rates fuel annuities growth

For individual and group annuities alike, there are catalysts for new business production aplenty with interest rates on the rise.

In 2022, the individual annuity business achieved growth in direct premiums and considerations of 18.1% as first-year premiums and single premiums and considerations surged by 23.2%. Both of those figures represented 20-plus-year highs. Production accelerated significantly in the second quarter of 2022 after the Fed began raising interest rates. The attractiveness of annuity crediting rates relative to certificates of deposit and other savings products offered by banks, which were slow to boost yields, contributed to the outsized expansion at a time consumer balance sheets were historically flush.

The favorable sales environment has continued in 2023 as interest rates climb: Direct ordinary individual annuity premiums and considerations soared by 43.2% in the first quarter. But comparisons became much more difficult in the second quarter and will remain lofty through the balance of the year.

LIMRA's Preliminary US Individual Annuity Sales Survey put growth across products at 12% on a year-over-year basis for the second quarter and 28% for the first half of 2023, with the divergence reflecting a 6% sequential decline in sales between the first and second quarters. Sales volumes in the third and fourth quarters of 2022 were higher than in the second quarter, and our full-year outlook for growth of 6.5% in individual annuity direct premiums and considerations anticipates a year-over-year decline in volumes during the second half of 2023.

Comments from Marc Rowan, CEO of Athene Holding Ltd. parent Apollo Global Management Inc., during an Aug. 3 conference call, may imply that outlook is overly cautious, particularly from a consumer demand standpoint.

Rowan said the insurer left a significant amount of potential originations "on the table" in the second quarter as it deemphasized "transactional" products like multiyear guaranteed annuities. Retail flows in Apollo's retirement services segment, which is headlined by Athene, surged by 80.9% during the period nonetheless.

In the pension group annuities business, Apollo reported that flows soared by 63.4% to more than $9.00 billion, not far from the $11.22 billion inflows that activity generated in full year 2022. The quarter's tally reflected an $8.05 billion pension risk transfer transaction between AT&T Inc. and Athene.

Rowan said he expects pension risk transfer volumes to be "very, very active over the next few years, US and overseas" as higher interest rates have led to more defined benefit plans being fully funded, which favors more de-risking activity by plan sponsors. The industry faces an especially challenging comparison in 2023 after a record year for pension risk transfers in 2022.

Caroline Feeney, executive vice president and head of US businesses at Prudential Financial Inc., said during an Aug. 2 call that her company anticipates "a strong second half" of 2023 in the pension risk transfer business, but, she added, "We don't expect to surpass last year's record pipeline."

Our group annuity outlook calls for a decline in direct premiums and considerations of 9.3% for 2023, reflecting somewhat lower pension risk transfer volumes and a nonrecurrence of the financial markets volatility that spurred a surge in stable value fund business in the second and third quarters of 2022. We expect the industry to essentially regain the lost ground in 2024 due to a favorable comparison and still-favorable supply and demand dynamics in the pension risk transfer business.

Key considerations

The historical results and five-year outlook presented in the US Life Insurance and Annuity Market Report reflect a sum-of-the-parts analysis of disclosures at the line of business level, aggregated to major product categories and the industry and focused on exhibits 1 and 2 of annual statements filed with the National Association of Insurance Commissioners. They exclude data for MetLife's American Life Insurance Co. (DE) and Assurant Inc.'s American Bankers Life Assurance Co. of Florida, the two individual US-domiciled life entities that generated at least $100 million in direct premiums and considerations in the most recent calendar year, of which more than 90% were from Canada and/or "other alien" jurisdictions as defined by the NAIC.

References to accident and health business are limited to business attributable to entities that file life statement banks and exclude those licensed as property and casualty and managed care companies. The 2023 US Accident and Health Insurance Market Report provides a comprehensive outlook on that business across the three insurance sectors.

Projected results rely in part on select macroeconomic projections compiled by IHS Markit, a division of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.