Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Apr, 2024

By Zain Tariq and Nathan Stovall

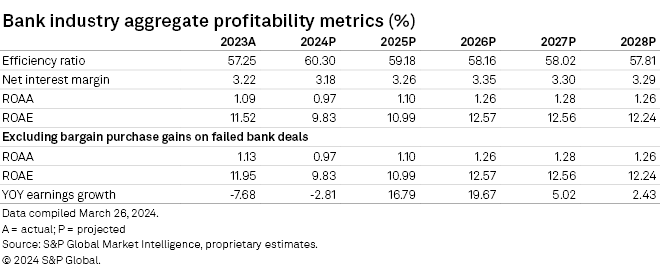

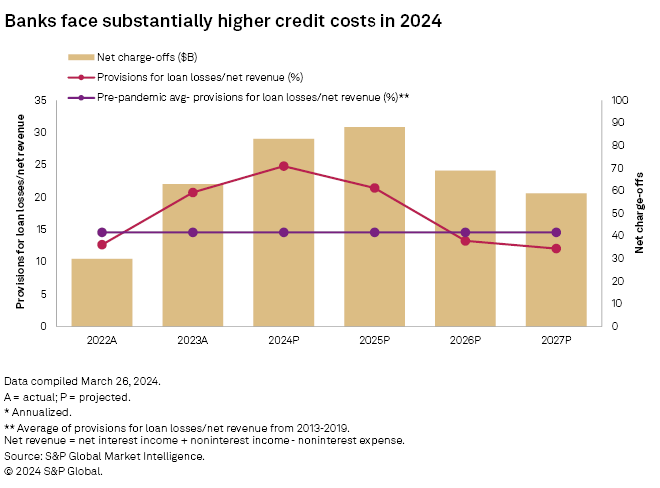

Liquidity pressures should ease in 2024, but bank managers will face a new headwind in the form of higher credit costs, resulting in a modest hit to earnings, according to the 2024 US Bank Market Report.

Deposits remain firmly in focus, even with interest rates expected to fall in the second half of 2024. Customers continue to shift funds into higher-cost products and demand higher rates for their funds, while regulators are encouraging banks to hold more liquidity, leading to pressure on net interest margins. That pressure will eventually subside but will be replaced by higher credit costs, particularly as banks begin to recognize losses on their commercial real estate portfolios and reserve for future problems. Still, much of that reserve build will occur in 2024, allowing US bank earnings to rebound strongly in 2025 and 2026 as provisions for loan losses decline and become a much smaller headwind to earnings.

Deposits remain in focus even as liquidity pressures ease

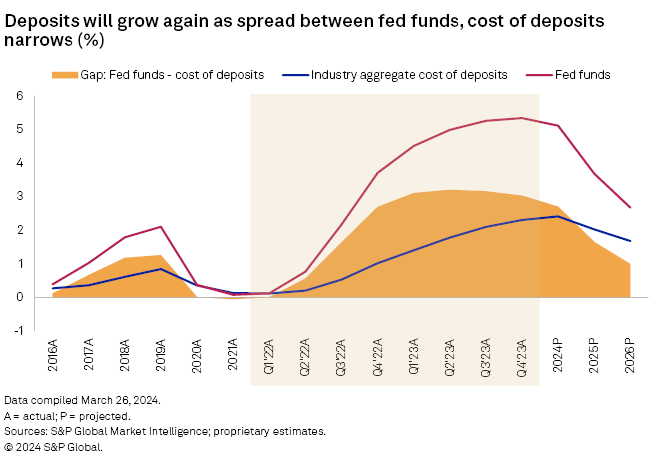

Deposit outflows slowed in the third quarter and reversed in the fourth quarter of 2023, with growth resuming in the period. After six straight quarterly declines, deposits grew 1.4% in the fourth quarter of 2023.

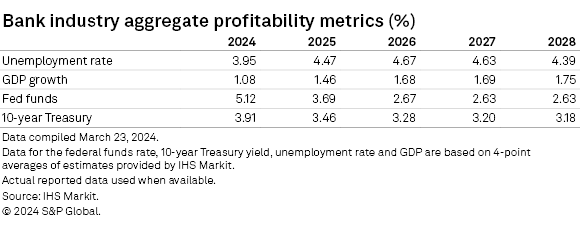

Facing outflows, banks defended their deposit bases with significantly higher rates. Growth returned as banks increased what they paid for deposits and narrowed the gap with higher-yielding alternatives in the treasury and markets. That spread is evident when looking at the difference between the average fed funds rate and the industry's cost of deposits, which peaked in the second quarter of 2023. By the fourth quarter, the gap declined by 18 basis points, and we expect that spread to narrow further in 2024 and decrease even more significantly in 2025.

In the aftermath of the large bank failures in 2023, regulators have also pressured banks to bolster their liquidity and encouraged institutions to hold more cash and maintain multiple levers to pull to access funding.

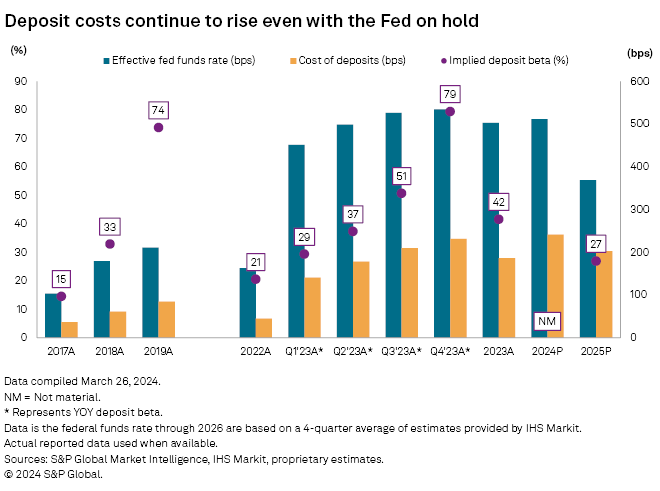

Fierce deposit competition should persist amid regulatory pressures and higher-for-longer interest rates as banks place a higher value on deposits than other forms of funding. Banks deposit costs rose further in the fourth quarter of 2023 even in the absence of rate hikes by the Fed, in part due to a continued shift of funds out of noninterest-bearing deposits and into higher-cost products for institutions, such as brokered deposits and certificates of deposit (CDs).

Interest-bearing deposits have risen 5.1% over the last two years, while noninterest-bearing deposits have plunged 28.0%. The decline pushed the industry's noninterest-bearing concentration down to 21.8% of total deposits at year-end 2023 from 25.9% at year-end 2022 and 28.9% at year-end 2021. We expect noninterest-bearing deposits to decline further in 2024, dipping to 20.75% of deposits.

CDs have become much larger portions of banks' funding bases. Those products should continue to grow, leading to higher deposit costs. Funding costs will also face upward pressure as CDs originated in 2023 mature and reprice at higher rates.

Rate cuts will offer some relief from deposit pricing pressure late in 2024, while additional rate declines in 2025 will allow deposit costs to fall even further. However, deposit costs should remain relatively sticky even as rates decline, with banks continuing to prize deposits and facing regulatory pressure to do so.

Many bank depositors have also become more rate-sensitive as rate hikes have awakened many customers accustomed to receiving rates below 1% to 2% on their deposits in the aftermath of the global financial crisis. Younger consumers had never received higher rates since deposit rates remained muted between 2009 and 2022.

We expect deposit costs to rise in the first half of 2024, even with the Fed's expected pivot to easing rates around midyear. We then project deposit costs to decline modestly in the second half of 2024. Funding costs should drop much faster in 2025, when we project betas, or the percentage change in Fed funds that banks pass on to their customers, to reach 27%, below the level in 2023. While the beta will not be as high when rates fall, bank margins will still rebound in 2025. We project net interest margins will trough in 2024 and then increase by 8 basis points in 2025.

Looking ahead

Credit costs remain historically low for the banking industry, and institutions continue to see minimal stress in their borrowing base. However, borrowers will begin to feel the impact of substantially higher rates, particularly in the commercial real estate (CRE) segment, resulting in higher credit losses.

While we do not expect considerable deterioration in credit quality, we anticipate greater delinquencies and charge-offs in the future. Banks have tried to prepare for slippage by tightening lending standards and building reserves for loan losses. We expect relatively slow loan growth in 2024 as institutions approach new originations more cautiously. Rising funding costs could also give some banks pause to grow their balance sheets notably, but many banks are also putting less cash to work in the bond market as they seek to remain liquid. We also expect banks to continue to build reserves as they work to shore up their balance sheets to clear any potential hurdles ahead.

CRE delinquencies have risen off historically low bases as well, increasing for five straight quarters to the highest level in nearly a decade. Banks have increased reserves against their CRE portfolios, particularly related to office credits. Losses on CRE portfolios have also risen but remain well below levels witnessed during the Great Recession.

Loss content will be location-specific and differ across the subcategories of the asset class, but community banks will feel some pain in their commercial real estate books, particularly as borrowers digest the impact of higher interest rates, less credit availability and lower occupancy since the pandemic.

Regulators have reiterated the importance of banks maintaining strong risk management of their CRE portfolios, particularly for institutions with elevated CRE concentrations. In some cases, regulators have imposed independent minimum capital requirements for banks with elevated CRE concentrations.

The number of banks exceeding regulatory guidance for CRE concentration fell for the third consecutive quarter, dropping by 11 sequentially to 532 in the fourth quarter. That number could decline further as banks slow CRE loan growth, engage in risk transfer trades or selectively prune positions.

The test will come when many CRE credits mature, and some borrowers struggle to refinance loans at significantly higher rates. We expect stiffer financial conditions will cause credit quality to slip and lead to notably higher charge-offs in 2024. However, even with net charge-off losses in 2024 expected to jump 30% from 2023 levels, losses and the reserves required to fund them should prove a modest hit to earnings as opposed to the headwind that would occur during a severe downturn.

We expect provisions to rise to 24.8% of net revenue in 2024, up from just 20.7% in 2023. From 2013 to 2019, banks' provisions equated to 14.6% of net revenue on average.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.