Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Feb, 2023

By David Hayes

U.S. bankers expect the economy will slip into recession in the second half of 2023, if not sooner, and for credit losses to rise off historically low levels, according to S&P Global Market Intelligence's 2023 U.S. Bank Outlook Survey.

* A majority of bankers surveyed expect a U.S. recession by the end of summer 2023.

* The industry's net charge-off ratio is expected to increase, and over 30% of respondents expect lower credit quality this year for both consumer auto and commercial real estate loans.

* The federal funds target range is expected to remain above current levels as inflation drops but remains high throughout 2023.

Recession expected this year

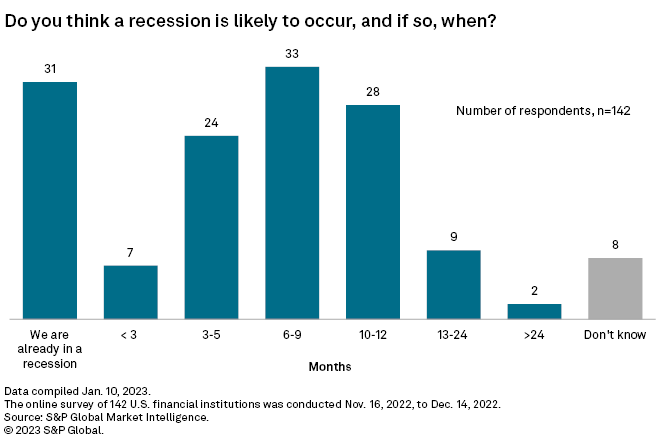

Late 2022, S&P Global Market Intelligence surveyed U.S. bank and credit union executives, and two-thirds of respondents expect the U.S. economy to be in recession within the next nine months. Of the 95 respondents that expect a downturn by roughly the end of summer 2023, 31 believe that the U.S. is already in recession. Only 11 respondents stated that they believed a recession would occur a year or more from the time of the survey.

While the National Bureau of Economic Research, or NBER, has not officially declared a recession, U.S. gross domestic product did contract in both the first and second quarters of 2022. However, U.S. GDP rebounded in the third quarter, growing at a 3.2% annualized pace.

Nonetheless, multiple large U.S. banks have said during this earnings season that they too expect a recession to occur in 2023.

JPMorgan Chase & Co. CFO Jeremy Barnum said during the bank's fourth-quarter 2022 earnings conference call that the bank's "central case" now includes a mild recession, with the unemployment rate peaking at about 4.9%.

The unemployment rate was 3.5% in December 2022, according to the latest release from the U.S. Bureau of Labor Statistics.

Similarly, Bank of America Corp. also announced in its fourth-quarter 2022 earnings that its baseline scenario included a mild recession.

Net charge-off ratio to climb

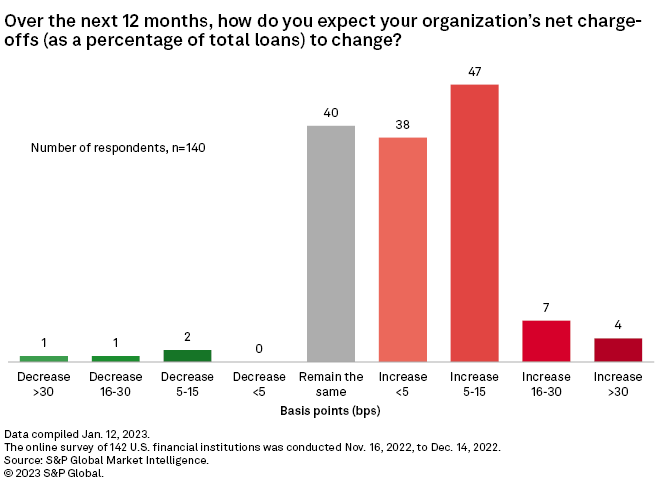

In light of the expected downturn, a majority of survey respondents also predicted that net charge-offs would increase in 2023 from relatively benign levels now.

Ninety-six of 140 respondents predicted net charge-offs would increase as a percentage of total loans over the next 12 months, with a plurality of 47 predicting the ratio would increase by 5 to 15 basis points. Only four respondents predicted their company's net charge-off ratio would improve in 2023.

For the last 12 months ended Sept. 30, 2022, U.S. banks and thrifts reported a combined 0.23% net charge-off ratio as a percent of average loans.

While a 15-basis-point increase would be significant, it would still be below the industry's 0.50% net charge-off ratio in 2020 and just a fraction of the roughly 2.50% ratio recorded in both 2009 and 2010 following the U.S. housing market collapse.

One-third of respondents expect consumer auto loan credit quality to slip

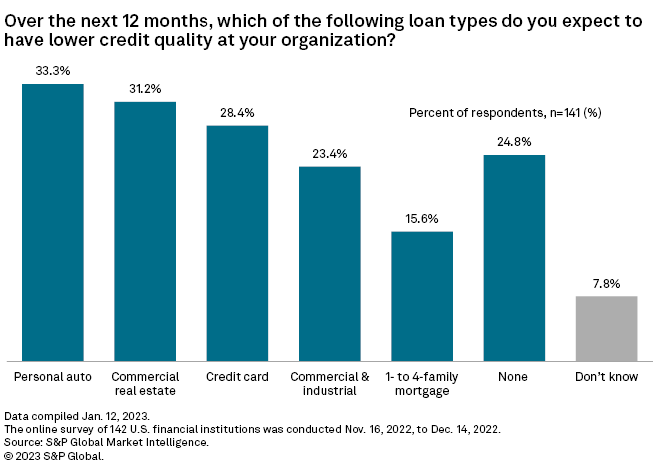

Over 30% of survey participants expect credit quality to decline for both personal auto loans and commercial real estate loans over the next 12 months, the highest percentages among the five loan types included in the survey.

Despite widespread concerns that a recession is on the horizon, credit quality remained largely benign in 2022.

At the end of September 2022, only 1.23% of loans and leases at U.S. banks and thrifts were past due or in nonaccrual status, down from 1.38% a year earlier.

Similarly, the percent of nonfarm, nonresidential commercial real estate loans past due or in nonaccrual status was just 0.71% at the end of September, down 29 basis points year over year.

Consumer auto loan credit quality, on the other hand, has already started slipping. At the end of the third quarter, 2.39% of auto loans held by U.S. banks and thrifts were past due or nonaccruing, up 60 basis points year over year and the highest quarterly mark since the first quarter of 2020, when the ratio hit 2.60%.

Inflation to stay above Fed target this year

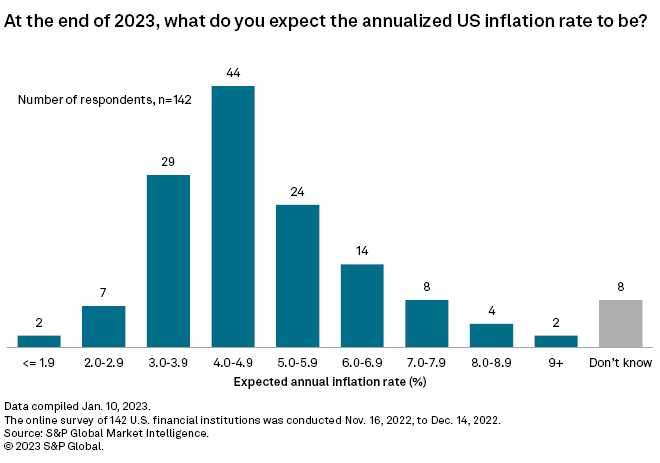

Most survey respondents expect U.S. inflation to trend lower in 2023 but remain well above the Fed's 2% target.

Roughly 72% of respondents, excluding those that responded "don't know," expect the annual inflation rate at the end of 2023 will be between 3% and 5.9%. The mean inflation estimate among all respondents that indicated a specific inflation range was 4.85%, while the median estimate was 4.45%.

This would be an improvement from December 2022's non-seasonally adjusted 6.5% increase in the consumer price index year over year, which was the lowest 12-month rate since October 2021.

Federal Funds rate to remain at elevated levels at end of 2023

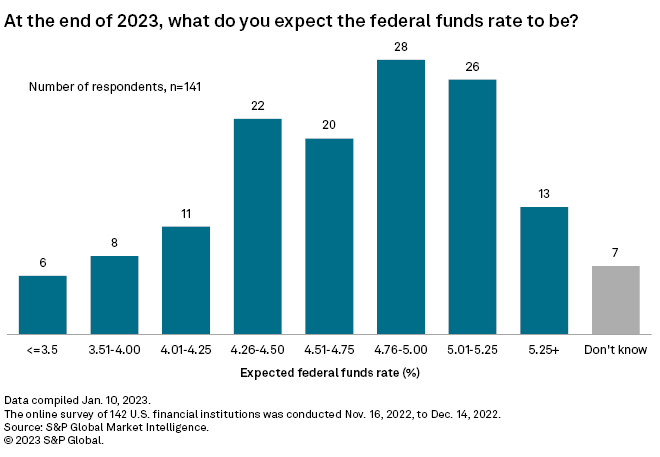

Almost two-thirds of respondents — 87 of the 134 that indicated a specific range — believe the federal funds rate will end 2023 higher than its current target range of 4.25% to 4.50%. Collectively, the group predicted a mean federal funds rate of 4.64% and a median rate of 4.76% at the end of the year.

After lifting rates off pandemic-era lows in March 2022, the Federal Reserve's Federal Open Market Committee raised interest rates another six times last year, including four consecutive 75-basis point increases between June and November.

Most recently, the FOMC announced a 50-basis-point hike in the federal funds target range Dec. 14, the day the survey closed, and released projections for a median 5.1% federal funds rate in 2023, up from the 4.6% rate projected in its September release.

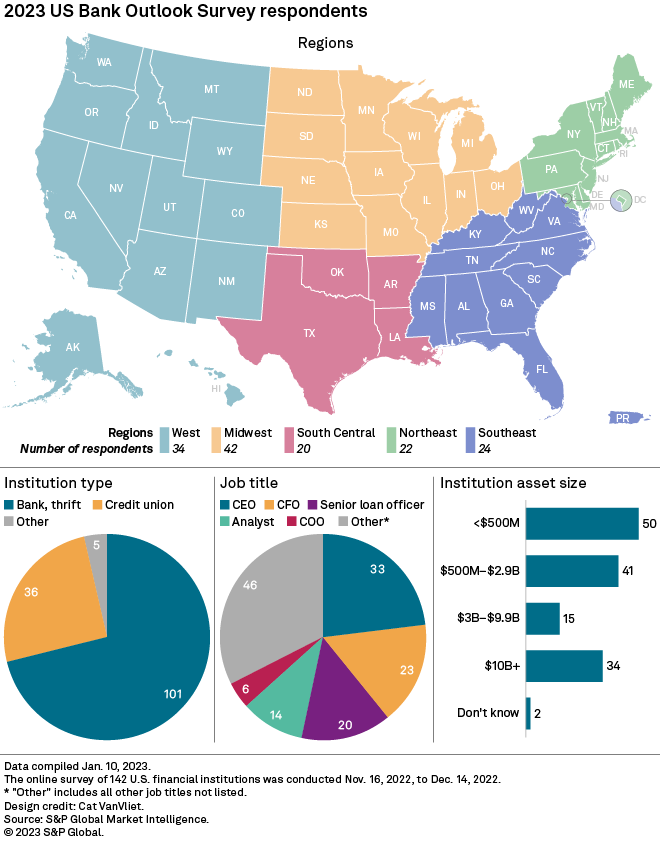

S&P Global Market Intelligence surveyed 142 U.S. financial institution clients on various topics including economic expectations, projected interest rates and the outlook for bank M&A in 2023. Of the 142 participants, 101 worked for commercial banks or thrifts, 36 for credit unions and five for other U.S. institutions.

The online survey was conducted between Nov. 16, 2022, and Dec. 14, 2022.

If you would like to participate in future U.S. banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.