Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 Jul, 2024

By Iuri Struta

| The UK Labour Party has promised to remove bureaucratic hurdles around building datacenters like this one in London's Canary Wharf. Source: Construction Photography/Avalon via Getty Images. |

A key component of the UK Labour Party's tech agenda involves making it easier to build datacenters, but analysts and experts say the problem goes far beyond building permits.

The Labour Party, which various polls say will be the likely winner in the upcoming July 4 UK election, has outlined an industrial strategy that both "supports the development of the artificial intelligence sector" and "removes planning barriers" for new datacenters. The Conservative Party, meanwhile, has doubled down on its support for UK equities by unlocking capital for high-growth companies and investing in computing and advanced manufacturing. However, the ruling party has not said anything about the importance of building new datacenters.

Labour's focus comes as datacenter construction in the country has become more difficult.

The UK's datacenter infrastructure is largely in London, where open real estate is in short supply. As such, developers have been trying to move out into other places around London, especially the so-called greenbelt, a large area around London where urbanization and industrialization are being resisted. For instance, a proposed £2.5 billion datacenter slated to be built in a former landfill near the M25 motorway was recently rejected by the local council over concerns it would spoil views.

While easing the permitting process could open the door to more development, it is by no means a cure-all.

"Planning permission is an issue, but not the biggest," John Booth, managing director at sustainable IT consultancy Carbon3IT, said in an interview with S&P Global Market Intelligence.

London calling

London boasts one of the most technologically advanced communities in Europe in terms of adoption of cloud and new technologies, which has helped drive demand across its datacenter industry. This demand is not slowing down, with the city having one of the largest startup communities in Europe. It has long been a center for software development, while the skills that congregate in the city have also made it a leading hub for internet of things and AI development.

Given this, hyperscalers such as Alphabet Inc., Microsoft Corp. and Meta Platforms Inc. are ramping up their datacenter capacity to support the growing demands of AI applications. Alphabet announced at the start of this year that it would build a $1 billion datacenter in the UK. Microsoft said in late 2023 that it would invest $3.2 billion in UK datacenters over the next three years, which the company touted as its largest investment in the country.

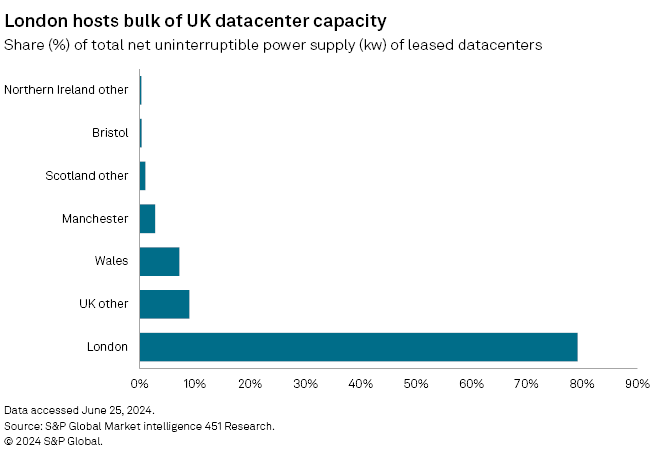

The UK is one of the largest datacenter markets in the world in terms of capacity and is No. 1 in Europe. But the vast majority of the UK's datacenters are concentrated in or near London, with clusters in Slough, the City and the Docklands. London hosts around 79% of UK datacenter power, according to S&P Global Market Intelligence 451 Research's DataCenter KnowledgeBase.

Datacenters were traditionally built near cities to be as close as possible to customers and airports. Proximity to customers and enterprises reduced latency, or the amount of time it takes for data to travel from one place to another.

"Ultimately, customers drive decisions where datacenters are built," said Matthew Grant, EMEA development director at Colt Data Centre Services UK Ltd. (Colt DCS). "For latency and other reasons, they still prefer locations near their existing [datacenters] around London."

But London is running out of room and energy for sprawling, power-hungry new datacenters.

"Due to lack of land, some London-based operators have retrofitted floors and have been building in car parks," said Mai Barakat, a research analyst at 451 Research.

Grant said Colt DCS did not have major permitting hurdles around datacenters; energy availability is a much bigger issue.

"If there's a site planned for development in a greenbelt area and within an availability zone, it doesn't necessarily mean it already has power," Spencer Lamb, chief commercial officer at datacenter operator Kao Data, told Market Intelligence.

Moreover, homebuilding in West London was halted two years ago because the grid ran out of capacity, with the blame pinned on datacenters nearby.

Looking north

A potential solution to these challenges might be to start building more datacenters in northern England, which has an abundance in power resources as it was once an industrial powerhouse. A datacenter in the north would also cost less to build — thanks to inexpensive land, staff and infrastructure — and cheaper to maintain given cooler temperatures.

Cheap and available power combined with cooler temperatures are key reasons why so many datacenters are being built in the Nordic countries. Finland is expected to grow datacenter net square feet at a compound annual growth rate of 20% in the next five years, versus 11% for Europe as a whole, according to 451 Research.

"This could be a mechanism to help UK's north, which has suffered from deindustrialization," Booth of Carbon3IT said. "The greenbelt has never been well-provisioned for energy anyway."

Kao Data's Lamb said there are further benefits to building outside the greenbelt. "With better planning zones, not only are we able to develop datacenters quickly and efficiently with available renewable power already there, but the rest of the country can benefit from the tens of billions of pounds of private investment," Lamb said.

What the northern part of the country lacks now is demand. Stellium Datacenters Ltd., a provider of colocation services based in Newcastle, boasts solid performance at a fraction of the London cost. However, it has failed to attract a core tenant. Meanwhile, Colt DCS has pre-sold all capacity for the 30-MW datacenter under construction on its West London campus, and will soon start construction on a second, 27-MW building.

But being close to a large metropolitan area may not be as important as it once was. Carbon3IT's Booth called it an "old factor" that will eventually fade away, especially with more encouragement from the government.

451's Barakat agreed. "If your workload is not latency sensitive, you don't need to be in London," she said. "It's more like an industry bias."

In particular, AI training workloads can be conducted from anywhere, allowing for the construction of datacenters outside major cities.

"When it comes to training models ... they don't necessarily have to be near people because people aren't using the training model; people are using the output of the training model," 451 Research analyst Dan Thompson said in a recent Market Intelligence webinar on powering AI datacenters. "From that, we've been seeing datacenters kind of pop up in new and interesting places."

Mai Barakat contributed to this article.This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.