Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 23 Nov, 2021

By Joe Mantone and Gaurang Dholakia

Highlights

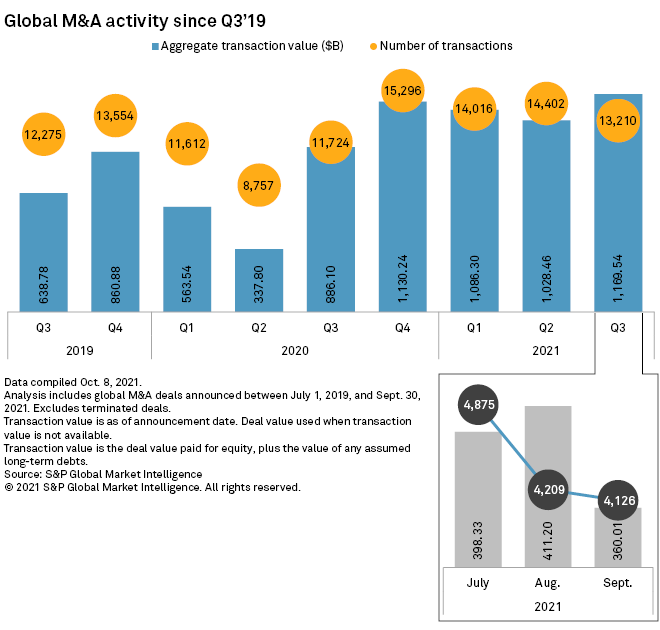

M&A activity continued its unprecedented run during the third quarter as total global announced transaction value increased 13.7% sequentially and 32.0% year over year to $1.170 trillion, according to S&P Global Market Intelligence's latest M&A and Equity Offerings Market Report.

The Take

The third quarter marked the fourth straight period in which the total announced value of global M&A activity topped $1 trillion. Before this streak, deal announcements had not crossed the $1 trillion threshold for three consecutive quarters, according to S&P Global Market Intelligence data that dates back to the 1990s. Accommodative financing markets have helped fuel large M&A transactions with low interest rates on debt financing and open capital markets giving buyers the wherewithal to execute large deals. Looking ahead, more transactions are on the horizon. Initial public offering activity from special purpose acquisition companies has rebounded, and companies continue considering their strategic options as they adjust to the post-pandemic environment.

The deal-making has helped a number of investment banks post record-setting marks with their advisory business, and catalysts for more transactions are giving them reason to make rosy revenue projections.

Some sectors such as real estate that had experienced more muted M&A activity coming out of the pandemic are seeing an acceleration in transactions as valuations steady. In the third quarter, U.S. real estate deals generated a total value of $105.87 billion, which was higher than any other sector in the country.

During recent earnings calls, investment banking executives noted that technological disruption along with economic growth will remain drivers to M&A. Several also noted how financial sponsors are becoming active, and they expect investors to continue allocating funds to private equity strategies.

"The money is going to keep going in," Evercore Inc. co-Chairman and co-CEO John Weinberg said during his company's third-quarter earnings call.

The economic backdrop is not without its headwinds. Supply chain disruptions and inflation are two factors "driving a new set of discussions with CEOs, boards and institutional investors," Lazard Ltd. Chairman and CEO Kenneth Jacobs said during his company's third-quarter earnings call.

The increased focus on the issues is leading to companies adjusting their internal forecasts and can increase uncertainty, which often slows deal-making because buyers and sellers have a more challenging time agreeing on price. But investment banking executives said the concerns are not derailing strategic discussions.

"The M&A environment continues to be as good as we've seen," Jacobs said.

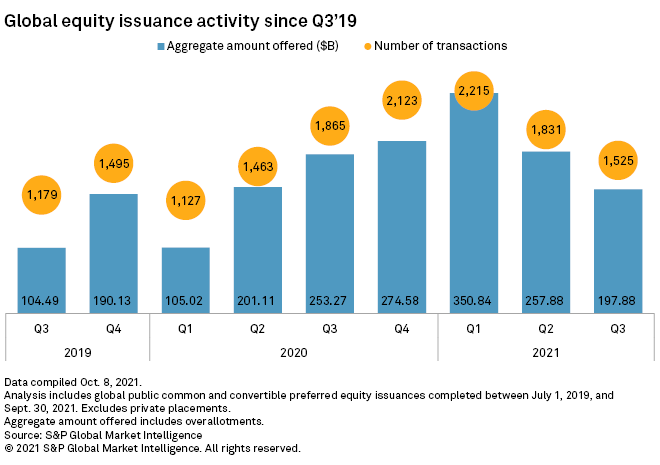

Equity underwriting activity has slowed when compared to the year-ago levels. In 2020, issuers boosted capital levels during the height of the COVID-19 pandemic, and markets saw special purpose acquisition company issuance skyrocket.

In 2021, equity issuance has reached a leveling point that is lower year over year but higher than historical totals. This is especially the case with SPACs.

The formation of new blank-check companies came to a near halt earlier in 2021 after the vehicles faced regulatory scrutiny, including the SEC raising questions about the accounting warrants as equity on their balance sheets. However, SPAC IPOs started picking up during the end of the second quarter and the momentum carried into the third quarter, when the number of global SPAC IPOs increase 2.8% sequentially and 16.7% year over year to 112.

The SPAC deals helped boost the number of global IPOs to 654, which was 9.0% higher year over year but down 10.5% sequentially.

The increased capital chasing M&A deals should help enhance valuations of sellers. Increasing stock market prices along with a lack of volatility in the equity markets are also conducive backdrops for IPOs and M&A.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Download the full report

Theme

Location