Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Aug, 2022

By Seth Shafer

Cheaper ad-supported plans from Netflix Inc. and Walt Disney Co. are coming soon to the U.S. market, with plans to eventually roll them out in international markets as well. Disney and Netflix executives have touted the introduction of ad-supported tiers as a way to cast a wider net for new subscribers that otherwise cannot afford a subscription, but Kagan's Consumer Insights survey data shows only a faint correlation for some services between consumers that choose ad-supported tiers and income.

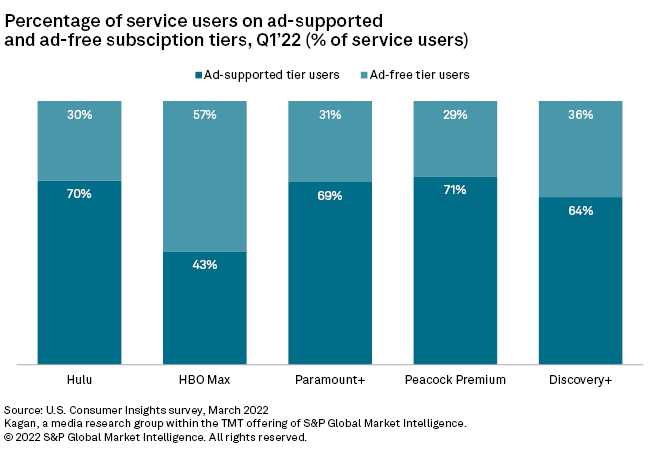

* About 65% to 70% of users at Hulu, Peacock Premium, Paramount+ and Discovery+ reported using ad-supported plans in the U.S. Consumer Insights survey of 2,519 internet adults fielded in March 2022.

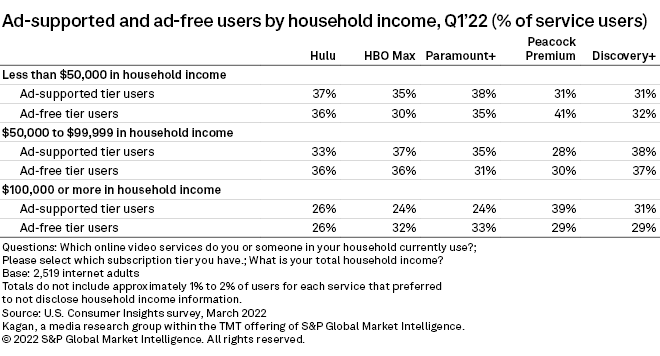

* While roughly one-third of ad-supported users at most services did live in households making less than $50,000 in income, another 25% to 40% lived in homes with $100,000 or more in annual income.

* Given the popularity of ad-supported plans, operators such as Disney and Netflix that are launching ad-supported plans may not see a mass influx of new subscribers and could instead see a sizable number of existing subs switch to ad-supported offerings.

Among major U.S. streaming services that offer the option of ad-supported and ad-free plans, most consumers have opted for the ad-supported tier. Warner Bros. Discovery Inc.'s HBO Max was the lone exception with 43% of users on the ad-supported package but that option was only rolled out in the U.S. in June 2021 and could see more users migrate to it over time. The choice between packages offered by these services typically revolves around ads/no ads although Paramount Global Paramount+'s ad-free tier also includes access to local CBS station feeds, additional live sports content and the ability to download content for offline viewing.

Ad-supported tiers did not appear to be resonating solely with lower-income households as most services saw a relatively even distribution across income brackets. HBO Max was the highest priced service at $9.99/month for its ad-supported tier and $14.99/month for its ad-free tier and it did see a small tilt at either end of the income spectrum, with lower-income households slightly more likely to select ad-supported plans and higher-income homes leaning toward ad-free subscriptions.

Paramount+ saw a similar distribution to HBO Max while Peacock was the reverse – more lower-income homes choosing the ad-free plan and higher-income homes opting for ad-supported. Hulu and Discovery+ saw little differences across plans and income brackets. Ad-supported tiers for Paramount+, Peacock Premium and Discovery+ are each priced at $4.99/month and ad-free plans at $9.99/month while Hulu costs $6.99/month with ads and $12.99/month for its ad-free offering.

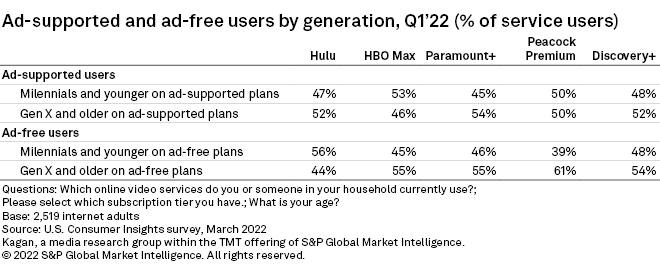

Examining age of users across tiers also showed no clear trends when it came to selecting a plan. Gen X and older users at HBO Max, Paramount+, Peacock Premium and Discovery+ did somewhat gravitate to ad-free packages but Hulu's ad-free users tended to come from younger generations. Hulu, Paramount+ and Discovery+ ad-supported users were slightly more likely to come from Gen X and older generations while HBO Max users viewing ads skewed a bit towards millennial and younger viewers.

Gen X and older respondents closer to peak earning capacity are typically more likely to live in higher income households although the user bases and demographics of individual SVOD services can vary significantly from service to service. Please see the following article for detailed SVOD user demographic data in Excel format: US SVOD user trends and demographics, Q1'22.

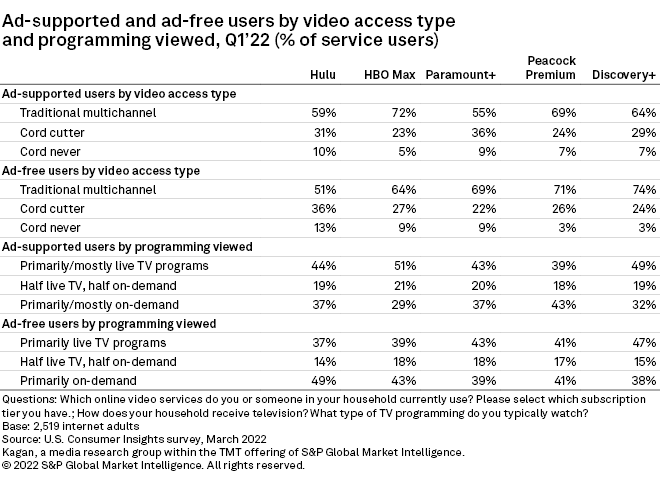

Video access type varied by service but revealed no clear connection between cord-cutting (often viewed as a cost-saving measure that can stretch household SVOD budgets) and the choice between ad-supported and ad-free SVOD tiers. Cord cutters represented roughly 25% to 35% of both ad-supported and ad-free viewers for most services, with only Paramount+ seeing a sizable difference for cord cutting at 36% of ad-supported viewers versus 22% of ad-free viewers. Traditional multichannel homes were dominant across both groups.

Ad-supported users at Hulu and HBO Max were more likely to primarily watch live TV as compared to their ad-free counterparts but levels were generally similar across subscription tiers and services. Most SVOD services with ads keep streaming ad loads at about three minutes to five minutes of ads per hour of viewing — far lighter than linear TV ad loads that can exceed 10 minutes per hour at some networks. Consumers accustomed to heavier linear ad loads may not be that bothered by comparatively light streaming ad loads and are simply shrugging and choosing ad-supported plans to save a few bucks each month.

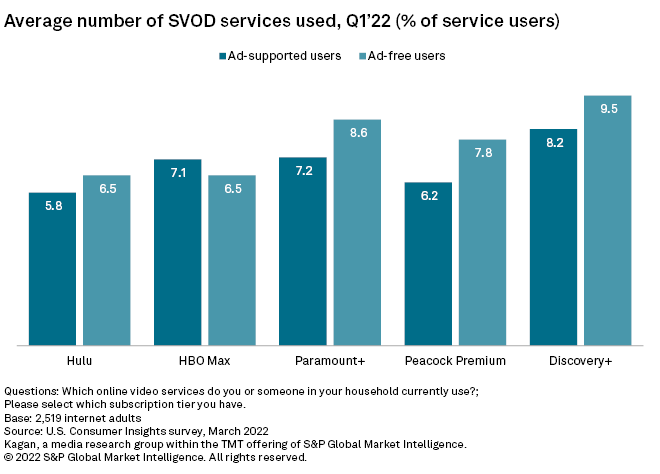

Users on ad-free tiers tended to subscribe to a higher number of SVOD services than their ad-supported counterparts, with just HBO Max bucking that trend. An abundance of ad-supported tiers may be enabling some households to squeeze in an extra service they otherwise might not pay for but SVOD adoption levels among users of major offerings remain high at about six to nine services across tiers and services.

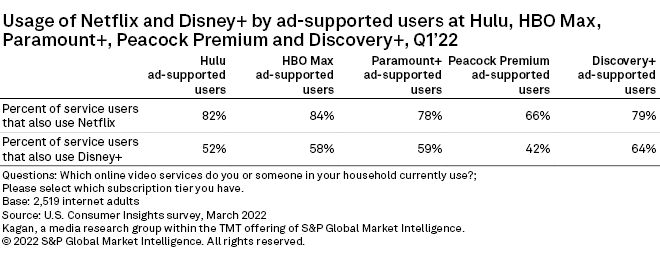

Ad-supported users at major services are also already using Netflix and Disney+ at high rates. About four-fifths or more of ad-supported users at Hulu, HBO Max, Paramount+ and Discovery+ also used Netflix while a solid majority at most services also used Disney+. Most SVOD households did not appear to be ditching Netflix and Disney+ en masse and instead were likely to include them along with numerous other services in their regular rotation of services.

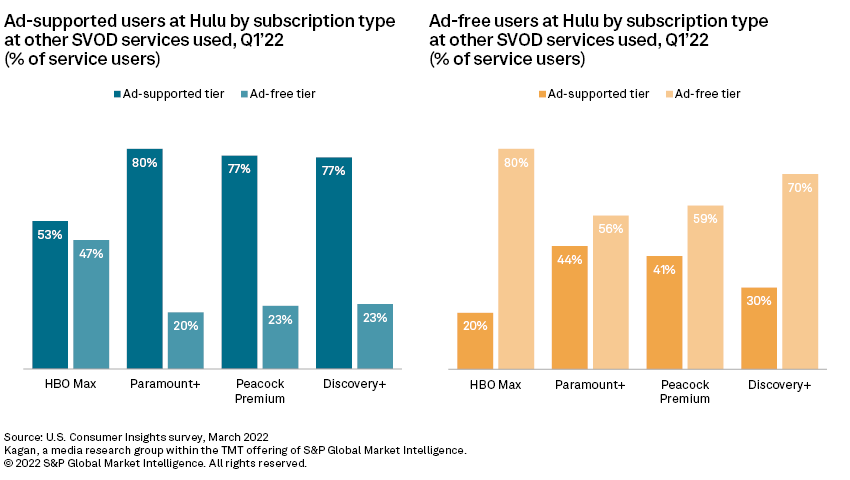

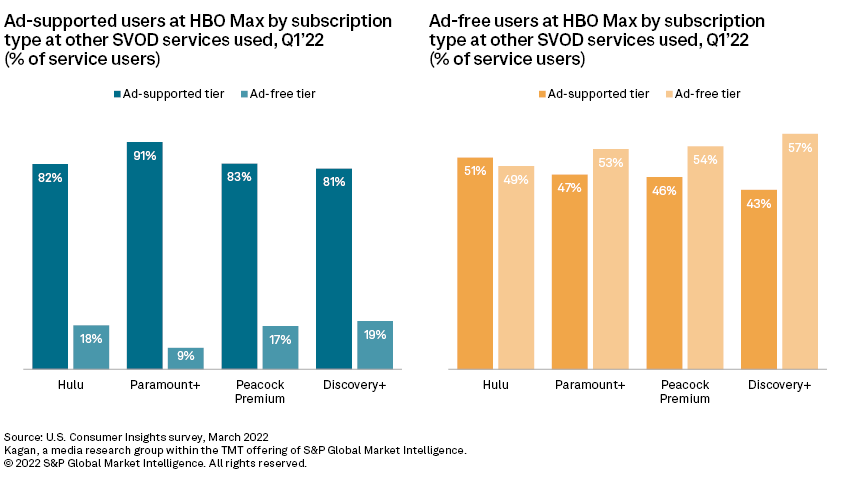

There was also relatively little "cross-over" behavior between ad-supported and ad-free users. Using Hulu and HBO Max as examples due to their larger respondent base sizes across multiple services, ad-supported viewers at those two services tended to select ad-supported tiers when they used other services. Ad-free viewers were also generally more likely to select ad-free tiers at other services but the tendency was less apparent when compared to ad-supported users opting for other ad-supported offerings.

A case could be made that both Netflix and Disney+ are simply "different" when it comes to ad viewing preferences and subscription tier choices — Netflix, due to the fact that it has been an ad-free haven for its entire existence and Disney+, due to some parents seeking to keep children from being exposed to ads on the service. While those and other factors could see slightly reduced levels of ad-supported subscribers for Netflix and Disney+ relative to Hulu and others, survey data suggests that a sizable number of new and existing subs for both Netflix and Disney+ will opt for ad-supported tiers.

Data presented in this article was collected from Kagan’s Q1’22 U.S. Consumer Insights survey conducted in March 2022. The survey totaled 2,519 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Gen Z adults are ages 18-24, millennials are aqes 25-41, Gen X are ages 42-56 and baby boomers/seniors are adults aged 57+.

Consumer Insights is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.