Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Feb, 2023

Introduction

Even though tech M&A dropped sharply in late 2022, dealmakers see business picking back up this year. Almost half of respondents to 451 Research's annual Tech M&A Outlook survey predict an acceleration in activity in 2023. To pull that off, however, they are going to need acquisition prices to come back down and industry growth to go back up.

Overall, our annual survey of some of the industry's busiest bankers and buyers yields a significantly more bullish forecast for tech M&A this year than the previous edition. More respondents anticipate an uptick (46% in this survey versus 28% in the previous one), while slightly fewer expect a downturn (29% versus 31%). As always, though, what you see depends a lot on where you are.

The two recent editions of our Tech M&A Outlook surveys — which are always in the field in mid-December, asking about the year ahead — come at very different points in the M&A cycle.

Essentially, respondents to our previous survey were being asked if 2021's record acquisition pace would continue, while our just-completed survey is coming off a six-month slide that, if annualized, would have been the lowest yearly total in a decade, according to 451 Research's M&A KnowledgeBase. Given those choices, dealmakers told us that, for 2023, they are looking to get back to dealing in a market that has recently been clipping along at a rate of about a half-trillion dollars of spending each year.

Shopping markets

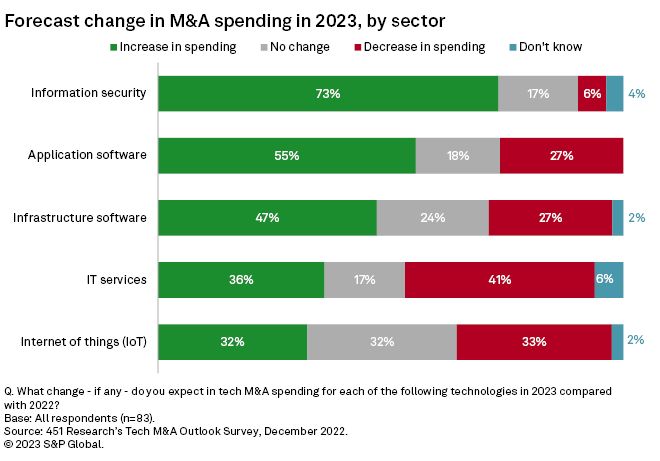

As to where they expect to be busiest with dealmaking in the coming year, a familiar segment topped their list: information security. The infosec sector, which tends to see the biggest IT budget increases in any given year, has headed the forecast in every survey since we introduced the question more than a decade ago.

Infosec has lived up to its decade-long top billing. The M&A KnowledgeBase indicates that infosec deal volume has more than tripled during that time. Further, the bets are getting more strategic. The total tab for infosec purchases in just the past two years in the M&A KnowledgeBase has soared above $100 billion — as much as the previous seven years combined. Seven of the 10 largest infosec prints in the 20 years of our data have come since Jan. 1, 2021.

Even after that record-shattering run, three-quarters of respondents to the Tech M&A Outlook survey forecast that there will be more infosec acquisitions in 2023 compared with 2022. (For the record, last year saw the second-highest totals for both number of deals and spending in the M&A KnowledgeBase.) One indicator of the continued strength of the sector is the following: In a 451 Research survey of IT decision-makers, 94% of respondents project that their organization will have more money to spend on infosec this year than last year, even amid a rough forecast for tech overall.

Rounding out the podium, application software and infrastructure software (in that order) were expected to be the next busiest markets for tech M&A, which is identical to the outlook from our previous survey. In particular, acquisitions of application vendors have surged in the current "software is eating the world" era, emerging as the single largest category of deals in the M&A KnowledgeBase.

One of the main reasons the number of application software purchases doubled over the past half-decade has been the relentless shopping in the space by private equity firms. Once they were able to borrow against the software business model, our data shows that buyout shops started snapping up application providers at a faster rate than other tech markets. Their share of app deals is about 10 percentage points higher than their share of the broad tech M&A market over the past decade.

Looking ahead, those numbers are likely to tick even higher, according to the prevailing view in the Tech M&A Outlook. When asked about market participants, some 57% of respondents (including a significant number that work at companies) anticipated that private equity acquirers would be "more competitive" than strategic or corporate acquirers in deals across all of tech in the coming year, compared with just 43% that predicted the other way around.

A growing problem

After years of relatively easy expansion, tech struggled to find growth in 2022. The slowdown hit pretty much every organization across the industry, indiscriminately wiping out trillions of dollars of value from a sector that has pretty much only known increasing valuations.

Growth-at-all-costs startups that boasted about doubling or even tripling bookings every year were suddenly hunkered down in cost-cutting mode, focused on preserving their capital. Mature tech giants, which had benefited from a spike in demand coming out of the pandemic, saw sales tick down from 20% back into the more typical teens percentages. Some of them even shrank in 2022, an almost unimaginable comedown for the former highfliers.

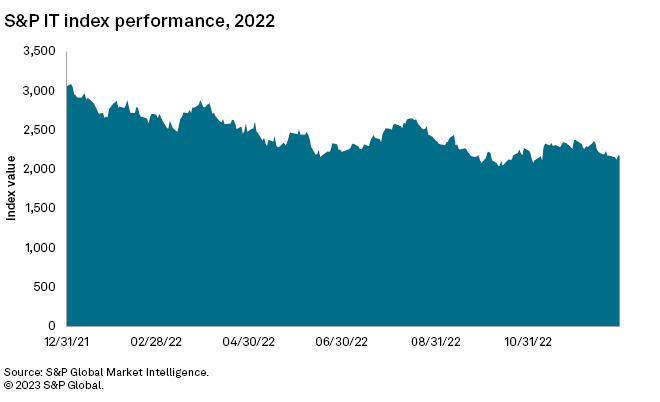

As sales declined, valuations followed suit. Tech stocks, as measured by the S&P 500 IT index, lost about 30% of their value in 2022 — twice as steep as the decline in the broad market. Last year marked the most bearish year for tech in a decade and a half.

With all of that working against tech, no one really wanted to go shopping, and certainly not for any big-ticket items. For instance, the M&A KnowledgeBase shows that tech acquirers announced only slightly more than half as many deals valued at more than $1 billion in 2022 versus 2021. A heightened awareness of risk and uncertainty tabled a lot of transactions last year.

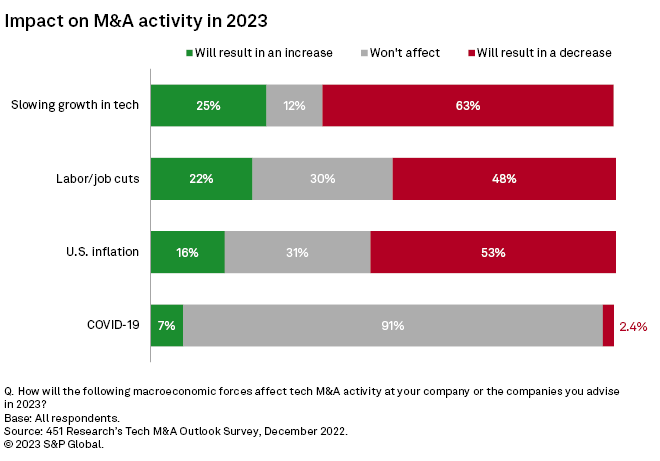

Those concerns will linger into this year and will complicate dealmaking, according to the M&A Outlook. Nearly two-thirds of survey respondents (63%) said the slowing growth across the tech industry will result in fewer acquisitions in 2023. Worries about the continued deceleration topped the three other macroeconomic concerns we asked about.

Discounts to get deals done

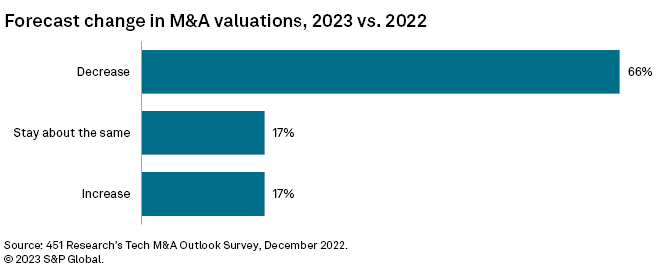

Respondents' overriding concern about tech's prospects for growth also figured into their calculations around pricing. In a word, 2023 will be a year for discounts. Fully two-thirds of respondents to the Tech M&A Outlook predicted that acquisition valuations across the market will come down this year compared with last year. That was almost twice the level that gave a bearish outlook in our previous survey.

Looking a bit deeper into the all-important matter of money, when it comes to M&A, corporates are more likely than advisers to see bargains. (We have more on the demographics at the end of the survey, but four of 10 responses came from dealmakers at companies, with the remainder from investment bankers.) Different groups, understandably, have differing perspectives.

Responses from corporates represent the view from the buy side. Assuming economic self-interest, we would expect them to want to get more for less in the deals they do. At the very least, buyers would be more likely to want to pass along to targets some amount of the crushing discount their own companies have undoubtedly received in the current bear market.

On the other hand, investment bankers most often sit on the other side of the table from acquirers. Although they do some buy-side work, they more often represent sellers that, assuming economic self-interest, want to maximize their gains when they divest.

Inevitably, given the conflicting motivations, a gulf emerges between the two sides, which has been true since Babylonians first traded grain and textiles along the Euphrates. Over the previous decade — and especially coming out of the COVID-19 recession — the way to bridge the inevitable bid-ask spread was pretty simple: Bump up the bid.

Buyers gave in on pricing, and valuations soared. (Incidentally, the same dynamic played out in venture capital, which resulted in a rather frothy funding environment that the industry still has not sorted out.) Acquirers paid an average of almost 4.5 trailing sales for the companies they bought in 2021, according to the M&A KnowledgeBase. That is basically twice as much as they had ever paid.

But largess goes away in lean times, and the munificent multiples are no more. Our data indicate that acquirers paid almost one turn lower in 2022 than they did in 2021. While the current market is still relatively pricey, the prevailing forecast calls for deal valuations in 2023 to drop back closer to what they were than what they have been.

And the Golden Tombstone goes to…

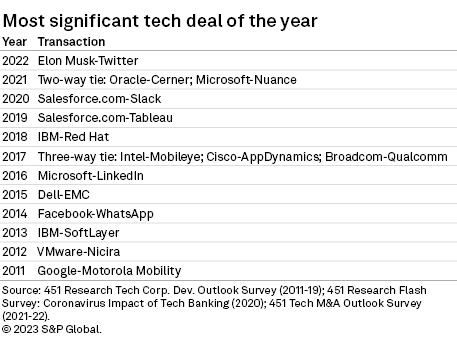

Finally, as we always do in our Tech M&A Outlook surveys, we asked the tech M&A community to look over the handiwork of their peers and rivals to pick the single deal of the past year that stood out above the thousands of transactions announced. For 2022, there could really only be one winner: Elon Musk's buyout of Twitter Inc.

The deal had it all. An eccentric as a main character, who also just happened to be (at the time, but no longer) the world's richest man. A highly visible — and highly flawed — target that was nonetheless capable of instigating and amplifying the vast and varied drama that came with the contested bid. And all of that playing out in a $44 billion process that defied convention, if not logic.

Somewhat surprisingly, Musk's always-in-the-news purchase only slightly edged Adobe Inc.'s planned $20 billion pickup of Figma Inc. The largest software-as-a-service acquisition announced in 2022 collected about one-third fewer votes than the Twitter take-private, which was twice the size.

On the other hand, the voting between the two deals was not particularly close when it came to respondents picking which transaction would likely generate the lowest returns for the acquirer. Elon Musk took that in a walk. The deal's heavy debt load, along with evaporating revenue and general corporate turmoil, raised concerns. As is often the case, our Golden Tombstone award seems to come a little tarnished.

A note about the 451 Research Tech M&A Outlook: The survey, which was open from Dec. 6 to Dec. 16, 2022, attracted 83 responses. Senior investment bankers accounted for 60% of responses, with the remaining 40% coming from people in M&A-focused corporate roles. Roughly nine of 10 responses came from North America — with about half of those coming from California and the broader western U.S., and another one-third coming from the eastern U.S., including New York City and Boston.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.