Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 May, 2024

By Tony Lenoir and Kristin Larson, PhD

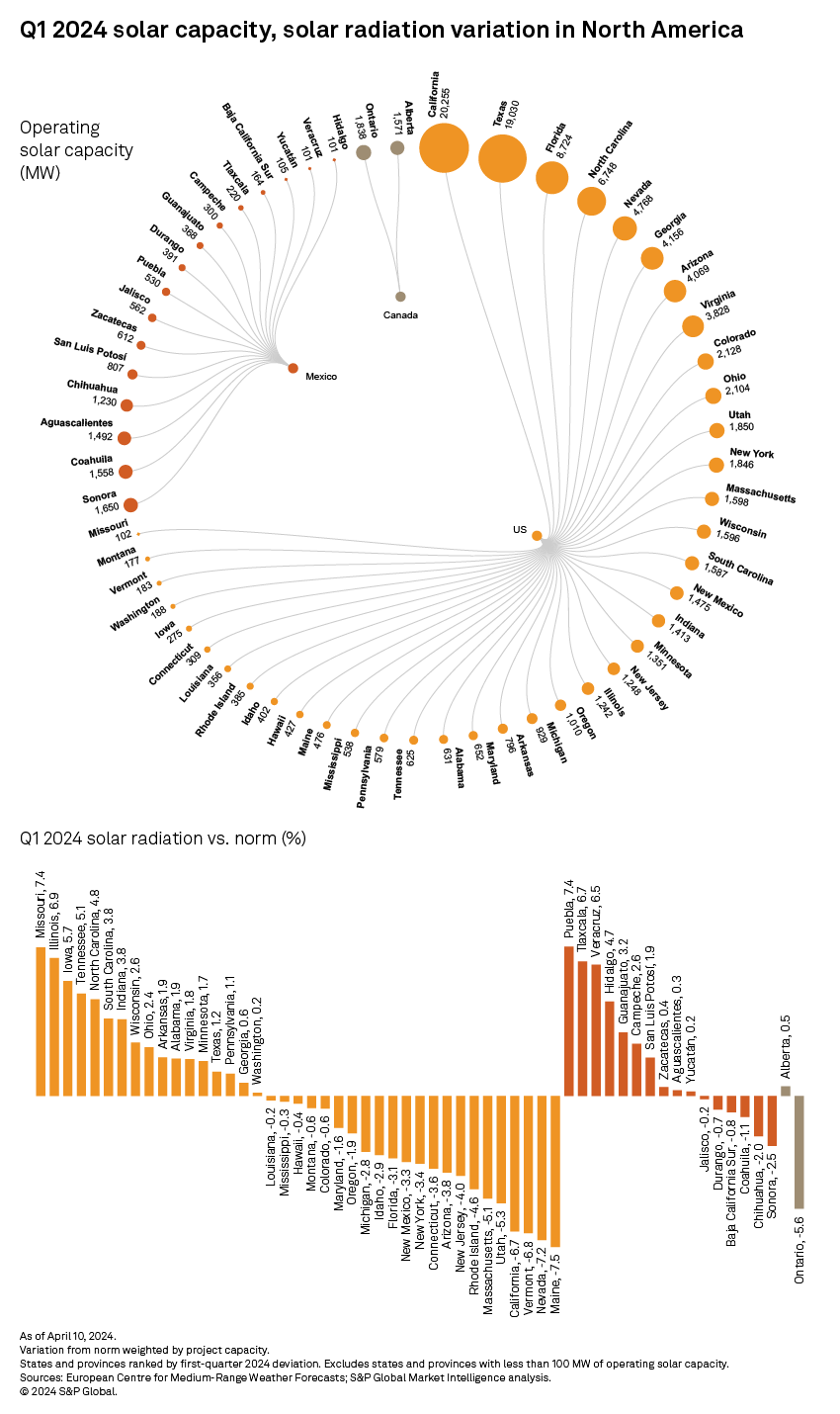

Cloudier-than-usual skies overhung solar projects in North America during the first quarter of 2024. US insolation levels, dragged by considerable negative deviations in the West, the Northeast and along the Pacific Coast, logged a 1.9% retreat from the norm — a departure that likely limited the impact of the US solar generation fleet's 33% year-over-year expansion on overall photovoltaic energy generation.

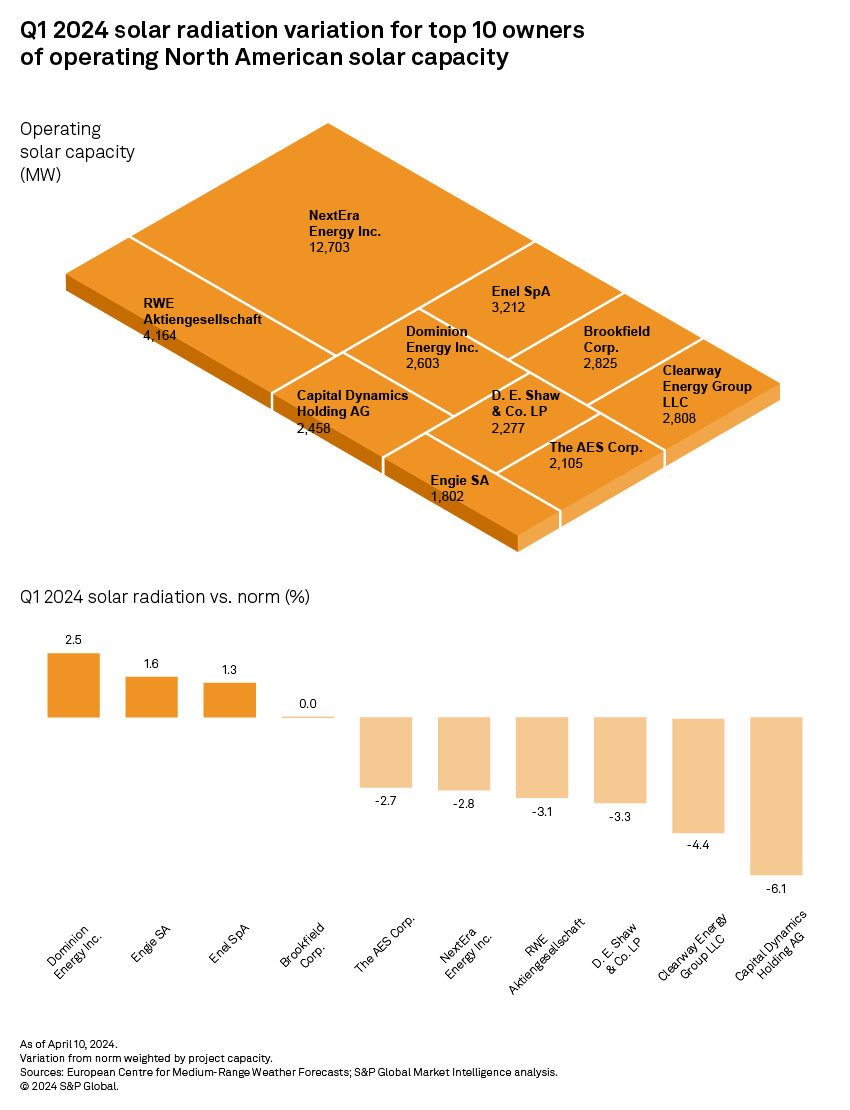

With about 60% of the US — where the bulk of utility-scale solar capacity in North America is located — experiencing below-normal radiation levels in the first quarter of 2024, 11 of the top 20 photovoltaic-portfolio owners in the region logged insolation deficits during the period.

States popularly associated with sunshine were particularly impacted, notably California and Florida. Among other things, this affected portfolio-average irradiation levels for capacity leader NextEra Energy Inc., which were down nearly 3%.

To the north of the continent, the solar generation space in Canada contended with radiation on average 2.9% below normal. Ontario, where more than half of the country's solar capacity operates, notably experienced a 5.6% sunshine deficit during the same period. High-single-digit declines were recorded in Prince Edward Island and Manitoba, but the weight of these provinces in Canada's overall solar footprint is negligible.

To the south, 14 of the 21 Mexican states hosting utility-scale solar projects ended the quarter in positive territory, helping the country eke out a positive 0.2% average deviation from the 20-year average. That said, photovoltaic projects in the US-bordering states of Sonora, Chihuahua and Coahuila — which account for nearly 43% of Mexico's utility-scale solar generation fleet — averaged below-the-norm irradiation in the three months to March 31.

In the US, solar capacity leader California, which accounts for over 20% of the US operational total, experienced the fourth largest insolation pullback from the norm. Drenched by atmospheric riversfor weeks — conditions that boosted wind speeds and rainfall — sunshine in the state negatively deviated 6.7% from its 20-year average in the first quarter, including a nadir of negative 10.1% in February. Drilling into the data shows no silver lining, with all California-based projected experiencing suboptimal solar conditions, including retreats in double-digit territory across 40% of the state's solar farms.

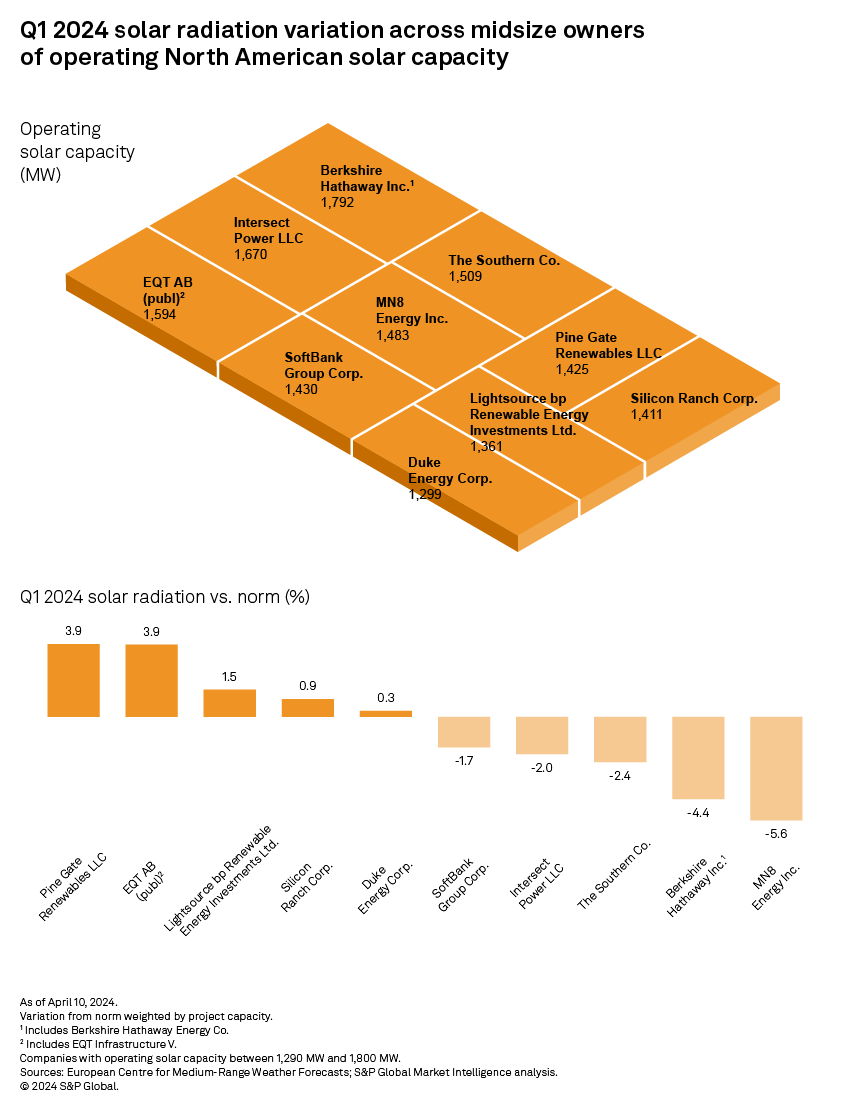

Insolation at the San Luis Obispo County-located 586-MW Topaz Solar Farm — the largest solar project in California and the second-largest in the US — dipped 6.8% below normal, weighing on parent company Berkshire Hathaway Inc.'s portfolio average. Of note, Berkshire Hathaway, long a fixture in the top 10 leaderboard of owners of operating solar capacity in North America, dropped from the list in the first quarter.

France-headquartered Engie SA supplanted Berkshire Hathaway in the ranking, thanks to its photovoltaic capacity in North America jumping 492 MW quarter over quarter. Engie's sequential solar portfolio expansion reflects the beginning of operations at the company's Texas-based 342-MW Five Wells Solar Center and at its Illinois-sited 150-MW River Ferry Solar Project, both of which came online in December 2023.

The sites of Engie's two newest solar projects in North America benefited from extra sunlight during the period under analysis, brightening the company's portfolio average. Among the top 10 owners of solar capacity in the region, Engie was one of the four companies in the ranking that experienced above-average insolation in the first three months of 2024, up 1.6%.

Of Engie's 62 solar projects in North America as of the first quarter of 2024, only 18% experienced radiation levels below the norm. For perspective, average insolation across portfolio leader NextEra Energy Inc., which accounted for more than 34% of the group's overall capacity in the first quarter, dipped 2.8% below the norm.

Of note, Engie's foray into the club of top 10 owners of solar capacity in North America could prove short-lived. Bloomberg News said in a March 4, 2024, report that the company was looking into divesting some of its US-based renewable assets, to the tune of about $1 billion.

Solar radiation is the mean surface downward shortwave radiation flux measured from the fifth-generation European Centre for Medium-Range Weather Forecasts reanalysis. This variable includes direct and diffuse solar radiation and is the model equivalent of global horizontal irradiance, the value measured by a pyranometer, a solar radiation measuring instrument. The data is available at quarter-degree latitudes and longitudes, with a spacing of slightly over 27.5 km. This analysis compares first-quarter 2024 radiation values with the 20-year solar radiation average for the corresponding period.

Data visualization by Joseph Reyes.For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast. Regulatory Research Associates is a group within S&P Global Commodity Insights.S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.Kristin Larson contributed to this article.This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.